On-chain data shows that the Bitcoin taker buy-sell ratio has been the highest since February. Here’s what this may mean for the market.

Bitcoin Taker Buy Sell Ratio Has Registered A Spike Recently

An analyst in a CryptoQuant post pointed out that the current taker buy-sell ratio values may suggest a bullish sentiment in the market. The “taker buy sell ratio” is an indicator that measures the ratio between the taker buy and the taker sell volumes in the Bitcoin market.

When the value of this metric is less than 1, it means the taker sell volume is currently greater than the taker buy volume, which implies that the selling pressure is higher in the market. Such a trend suggests that most investors currently share a bearish sentiment.

On the other hand, values of the ratio above this threshold indicate the long volume is overwhelming the short volume right now, meaning that the investors are willing to buy the coin at a higher price. Naturally, this trend can hint at a bullish mentality being the dominant sector.

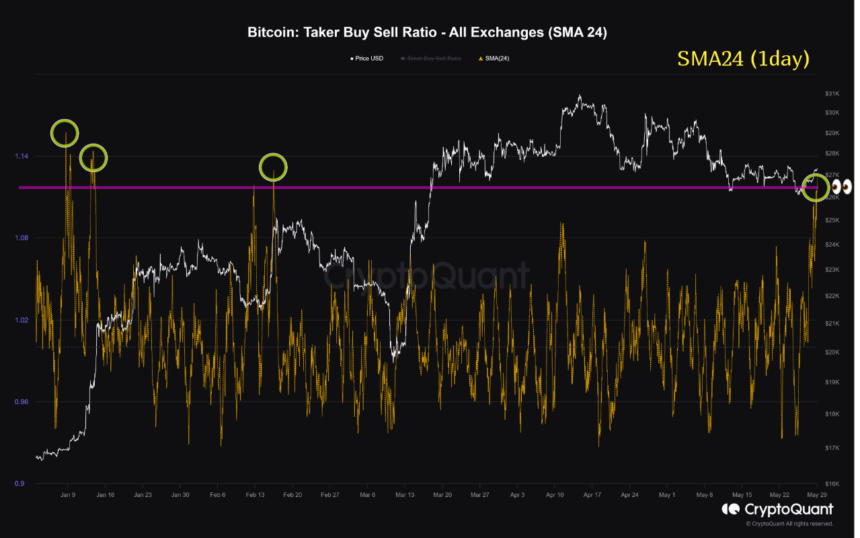

Now, here is a chart that shows the trend in the 24-day simple moving average (SMA) Bitcoin taker buy-sell ratio over the last few months:

The 24-day SMA value of the metric seems to have been quite high in recent days | Source: CryptoQuant

As displayed in the above graph, the 24-day SMA Bitcoin taker buy-sell ratio has observed a sharp rise recently and has hit some pretty high levels above the 1 mark. This means the taker buy volume has significantly outpaced the taker sell volume.

The current values of the metric are the highest seen since back in the middle of February. The only other times this year that similar values were observed were just two instances in January when the rally took off.

The quant believes that these current high values may suggest the presence of bullish sentiment in the market. Still, they remain skeptical, citing that the spike is “largely due to the recent sharp increase in open interest.”

The “open interest” metric tells us about the total amount of Bitcoin futures market contracts currently open on the derivative exchange platforms. The below chart shows the recent trend in this indicator.

Looks like the value of the metric has surged to relatively high values recently | Source: CryptoQuant

As the analyst mentioned, the Bitcoin open interest has increased rapidly in the last few days, which may explain why the taker buy-sell ratio has also increased.

“In other words, while the derivatives market may seem bullish, any position taken will invariably result in a counter-trade through a settlement (or liquidation),” explains the quant.

How the market responds to this surge in the taker buy volume that has emerged alongside the latest rebound in the cryptocurrency price remains to be seen.

BTC Price

At the time of writing, Bitcoin is trading around $27,800, up 4% in the last week.

The asset has enjoyed some rise in the past day | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com