Are NFT prices indicative of a sinking ship for the market? The year 2023 hasn’t been kind to some of the biggest NFTs that dominated the market in 2022. Several notable projects have experienced significant declines in their token values, painting a challenging picture for NFT investors.

Data provided by NFTGo reveals that the Blue Chip Index, a measure of the overall performance of top-tier NFTs, has also witnessed a downward trend. It has dropped to 7,446 ETH from its peak of 12,394 ETH recorded in July 2022. Let’s take a closer look at the performance of some prominent NFT projects.

TL;DR:

- NFT market sees significant price declines, raising concerns about the industry’s stability.

- Popular projects like Doodles and Invisible Friends experience substantial drops in token values.

- Despite the downturn, some investors remain optimistic, while others choose to hold or sell their assets.

NFT Price Market Movements: Going All The Way Down?

According to current trends, some of the highly popular NFT projects are experiencing massive downturns in their prices. Does this mark the beginning of a bubble burst? Or are founders simply not doing enough? Or is the community at large to blame, with scams and tomfoolery running abundant? Some of the most affected project are as under:

- Doodles, once highly sought-after, has seen a dramatic drop in value. Previously valued at 23 ETH, the token now sits at a mere 2.3 ETH—a substantial decrease that highlights the volatility of the NFT market.

- Invisible Friends, another notable project, has also suffered a significant decline. With its token previously valued at 8 ETH, it has now plummeted to 1.15 ETH, leaving investors grappling with losses.

- Moonbirds, which once commanded a hefty 32 ETH, has seen its value drop to a meager 2 ETH. This substantial decline has undoubtedly left investors disappointed and concerned about the future of the project.

- Goblintown, previously valued at 6 ETH, now stands at a mere 0.26 ETH. This is a staggering decrease that rattles the NFT community.

The decline doesn’t stop there, though. NFT giants Bored Ape Yacht Club (BAYC), has also experienced a significant decrease in its floor price. Once boasting a floor price of 550,000 USD, it has now dipped below 100,000 USD—a drastic plunge that has caught the attention of many market participants.

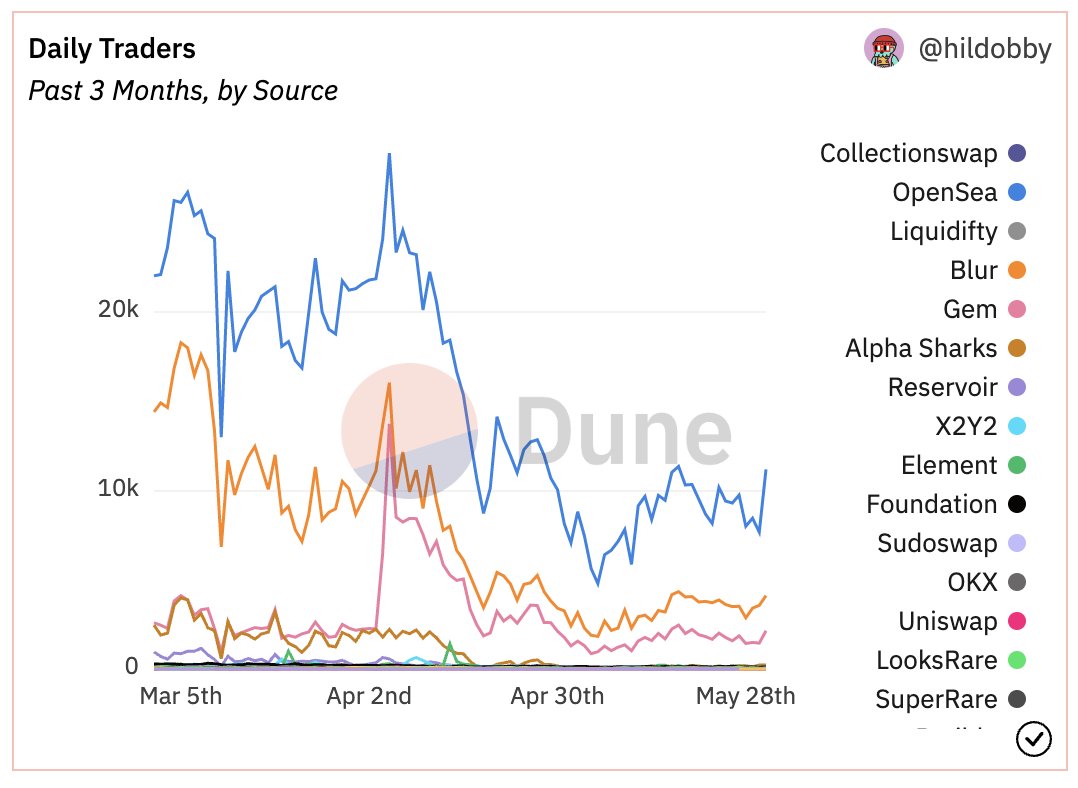

But worry not, it so happens that despite the price fall, unique NFT holders are steadily on the rise from the past three months.

Silver Linings In The Downturn

Despite these troubling numbers, some NFT investors remain surprisingly unaffected by the ongoing decline in value. In fact, a handful of investors view this as an opportune time to invest, believing in a potential market recovery.

Contrary to this optimistic view, there has also been a notable increase in the number of blue chip NFT holders over the past year, indicating a sustained interest in these projects. However, sellers have also increased by 32%, while the number of buyers has decreased by 30%. These statistics suggest a cautious sentiment among market participants, as some choose to hold onto their assets, while others opt to cash out.

As the NFT market continues to navigate these turbulent times, it remains to be seen whether these projects will regain their former glory or if the downward trend will persist. Investors and enthusiasts alike are keeping a watchful eye on the market, eagerly awaiting signs of a potential comeback or further depreciation in NFT prices.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.