Bitcoin It has been unable to break its declining streak and is set to end the week on a bearish note as investors shied away from riskier investments amid rising macroeconomic uncertainty from higher-than-expected inflation data.

The significant losses come in the wake of personal consumption expenditure (PCE) data showing a more significant than expected price increase over the previous month.

Additionally, approximately $1.8 billion worth of bitcoin options contracts are due to expire today, which could trigger volatility in BTC’s short-term price movement.

As of now, the bitcoin price is at $23,070.20 with a trading volume of $25,828,731,350 in the last 24-hours. Bitcoin is down by 3.57% in the last 24 hours.

The current price of Ethereum is $1,598.62, with a trading volume of $8,619,530,362 in the last 24 hours. Ethereum It has lost 2.85% in the last 24 hours.

Crypto markets bearish as inflation concerns rise

The global cryptocurrency market is currently showing a bearish trend and is expected to end the week on a negative note as investors avoid risk-taking due to macroeconomic uncertainties, exacerbated by the higher-anticipated inflation data.

According to the PCE price index of the US Bureau of Economic Analysis, the annual inflation rate in the country rose to 5.4% in January from 5.3% in December.

As a result, the core rate of PCE inflation rose, reaching 4.7% for the first time in the last four months.

These data support the notion that the Fed may have to maintain higher interest rates for an extended period of time to combat inflationary pressures.

Both core and overall PCE inflation increased by 0.6% from one month to the next. Markets consider a 75% chance that interest rates will exceed 5.25% by the end of the Fed’s June meeting.

Bitcoin Options Contracts Worth $1.8 Billion Expires: What Could Affect the Price of Bitcoin?

More than $1.8 billion worth of bitcoin options contracts expired yesterday. However, the expiration of a large number of bitcoin options has a detrimental effect on the short-term price movement of BTC.

This is because the bitcoin market can be more volatile as traders rush to execute their transactions if they have established a position that requires them to buy or sell bitcoin. This can result in a brief change in price, either up or down.

It is important to note that the impact on the overall market can vary depending on a number of factors, such as the number of contracts held, positions taken by traders, and general market sentiment. Option expiration is a frequent occurrence in the financial markets.

Bitcoin mining difficulty increase reported by BTC.com

As of Friday’s update, BTC.com reports that bitcoin’s mining difficulty has increased by 9.95% after the latest adjustment. However, the increase in BTC mining difficulty suggests that it is becoming more challenging to mine new bitcoins, which can have both positive and negative effects on the price of bitcoin.

On the other hand, an increase in mining difficulty may indicate an increase in demand for bitcoin. As more people attempt to mine bitcoin, the network adjusts the mining difficulty to maintain a steady block generation rate.

This could create a feeling of scarcity and increase demand for bitcoin, which could lead to an increase in price.

Regulatory Action on Binance: SEC and NYDFS Oppose Binance.US’ Proposed Acquisition of Voyager Digital Assets

The US Securities and Exchange Commission (SEC) and the New York Financial Regulatory Authority have Binance.US opposed plans to buy the assets of bankrupt Voyager Digital for $1 billion, citing possible violations of several laws.

This is seen as another negative factor affecting the cryptocurrency industry, as the SEC’s regulatory action can have a significant impact on the cryptocurrency market.

Essentially, the SEC is responsible for overseeing the securities markets in the United States and has been closely scrutinizing the cryptocurrency industry in recent years.

bitcoin price

the current Bitcoin The price is at $23,150, having declined from the $23,400 mark. From a technical perspective, bitcoin is expected to find immediate support around the $22,700 level, and a breakdown below this level could potentially expose BTC price towards the $22,400 level.

On the upside, a breakout above the $23,400 level could propel BTC price towards the $24,100 or $24,600 marks.

However, the RSI and MACD indicators are still in the sell zone, so it is important to closely monitor the $23,000 to $23,400 range. A close above this range could provide a potential buying opportunity.

ethereum price

current live price of Ethereum stands at $1,600 with a 24-hour trading volume of $8.3 billion. Ethereum is down almost 3% in the last 24 hours. According to Coinmarketcap, Ethereum is ranked #2 with a live market capitalization of $196 billion.

The ETH/USD pair is currently facing an important resistance at $1,620, which is reinforced by the 50-day EMA on the technical front. If the pair closes below this level, it could trigger a selling trend in ETH.

On the downside, an immediate support for Ethereum is located at the $1,570 level. A break below this level could expose Ethereum price to the next support at $1,515.

On the other hand, a break above the $1,625 resistance could propel Ethereum price towards the next $1,674 resistance. Above this, the next resistance is held at the $1,740 level.

Top 15 Cryptocurrencies to Watch in 2023

Investors have many options in the cryptocurrency market besides Bitcoin (BTC) and Ethereum (ETH). The Cryptonews Industry Talk team has compiled a list of the top 15 altcoins to watch in 2023.

The list is updated regularly with new ICO projects and altcoins, so be sure to check back frequently for the latest additions.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

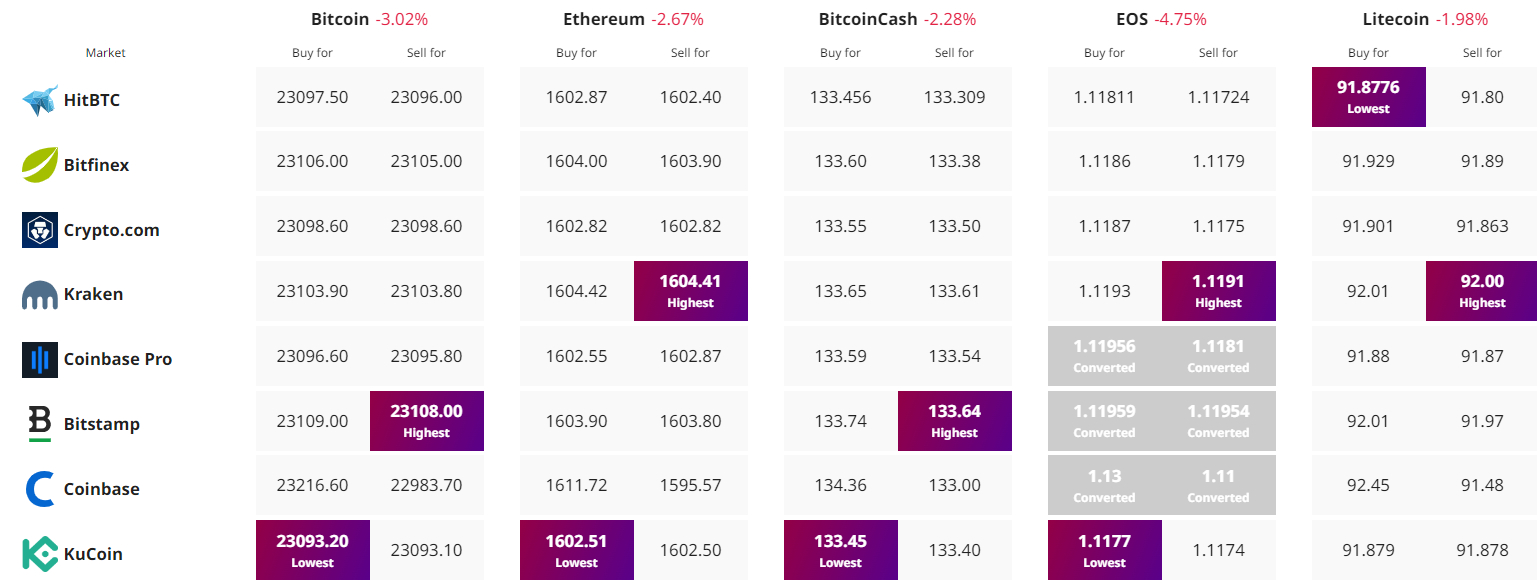

Find the best price to buy/sell cryptocurrency

Bitcoin Crypto Related Post