Bitcoin may return to the bottom of its current range; stuck for months, BTC may not be able to push higher. Driven by macroeconomic forces and uncertainty, sideways price action has reduced the volatility of global financial assets.

At the time of writing, Bitcoin (BTC) is trading at $19,400 with sideways movement across all time frames. Earlier today, the cryptocurrency hinted at more gains, but bulls failed to maintain momentum, forcing back BTC’s gains from last week.

Bitcoin goes quiet, macro forces take over

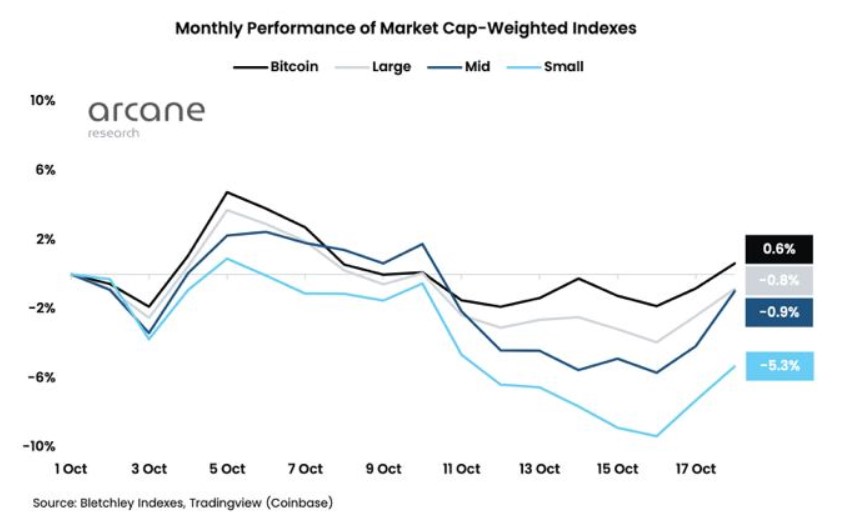

According to Arcane Research, Bitcoin has not seen a clear direction in October. The cryptocurrency was the best performing asset in terms of assets moving sideways during this period.

The chart below shows that the benchmark cryptocurrency posted a 0.6% gain in the past 30 days, while other crypto assets tended to decline slightly. Smaller tokens underperformed, losing 5% in October.

Smaller cryptocurrencies often suffer the most in a choppy and uncertain market; investors usually hide in Bitcoin and stablecoins as measured by the BTC dominance and the USDT dominance. These statistics show an upward trend after a huge drop in mid-October.

The spike in stablecoin and BTC dominance signals more sideways price action as the crypto market enters a new phase of uncertainty until the ensuing macroeconomic event triggers an explosion of volatility. Arcane Research noted the following about BTC’s current price action:

Still no clear trend in October as the crypto market remains flat. Bitcoin and ether are gaining market share against the other large caps this week, while small caps are struggling (…). The crypto market is still very much aligned with the stock market this month. Both Bitcoin and Nasdaq are up 1% in October, with the correlation remaining at record highs.

What happens when BTC goes quiet?

Additional data from research firm Santiment indicates that Bitcoin whales can accumulate BTC at current levels. The cryptocurrency is moving near its all-time high in 2017. Historically, these levels have provided long-term investors with the best opportunity to increase their positions.

As BTC’s price trends went sideways, Bitcoin addresses with between 10,000 and 100,000 BTC hit their highest level since February 2021. At that point, the cryptocurrency was preparing to re-enter price discovery mode after a major bull run that left it off. less than $20,000 to the low $30,000.

the research bureau noted:

(…) addresses with 10 to 100$ BTC have reached their highest number of respective addresses since February 2021. As the number of addresses on a network increases, the tool should follow suit.

Despite this data, current macroeconomic conditions could be unfavorable for a Bitcoin rally that leads the cryptocurrency into long periods of accumulation and consolidation around the 2017 ATH and the annual low of $17,600.