On-chain data shows that the Bitcoin leverage ratio has risen to a new all-time high, suggesting the market is headed for high volatility.

Bitcoin All Exchanges Estimated Leverage Ratio Sets New ATH

As noted by a CryptoQuant afterthe funding ratio has remained neutral, while the leverage in the market has increased.

the “all exchanges estimated leverage ratio” is an indicator that measures the relationship between Bitcoin’s open interest and the derivative foreign exchange reserve.

What this stat tells us is the average amount of leverage currently used by investors in the BTC futures market.

When the value of this indicator is high, it means that users are currently exerting a lot of influence. Historically, such values have led to higher volatility in the price of the crypto.

On the other hand, the low value of the statistic suggests that investors are not currently taking high risk because they have not used much leverage.

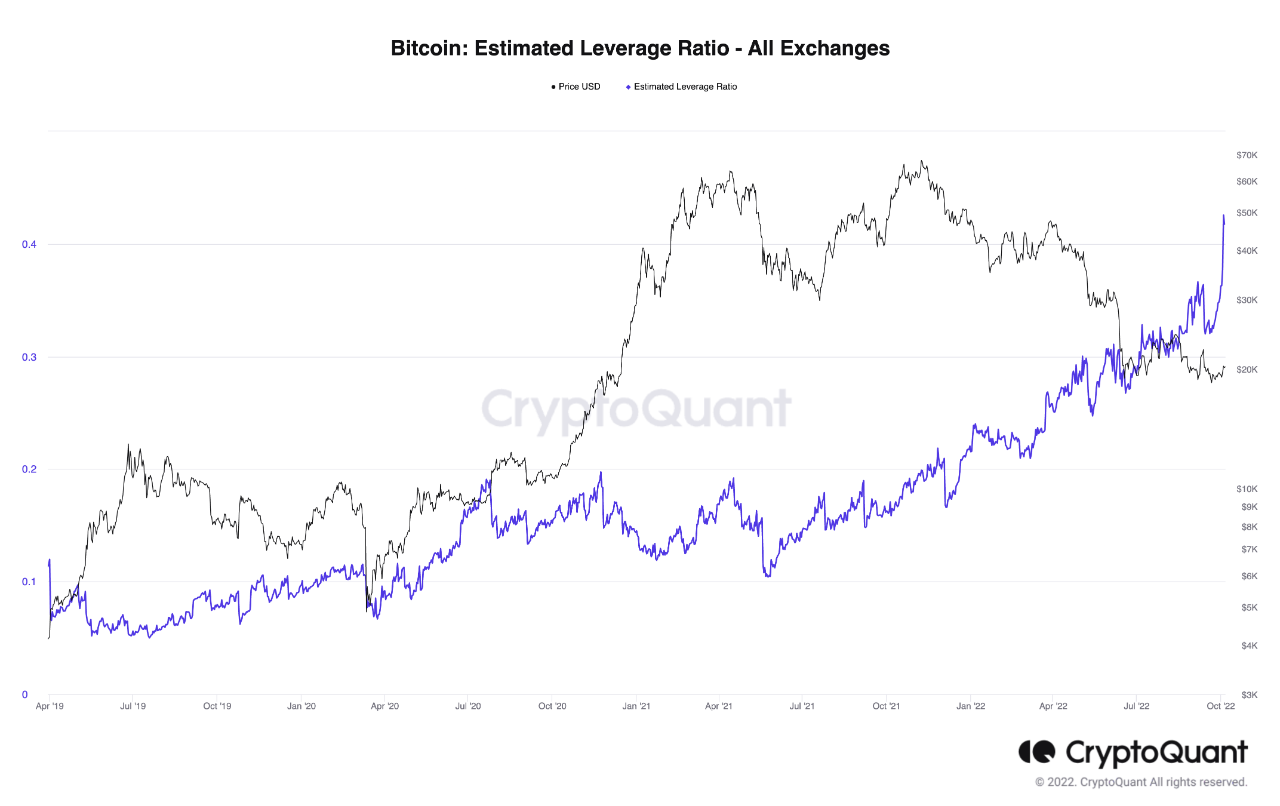

Here is a chart showing the trend in the Bitcoin leverage ratio over the past few years:

Looks like the value of the metric has been rising up during the last few months | Source: CryptoQuant

As you can see in the chart above, Bitcoin’s estimated leverage ratio has skyrocketed recently, reaching a new ATH. This means that investors take high leverage on average.

The reason why over-leveraged markets have typically become highly volatile in the past is because such conditions make massive liquidations more likely.

Sudden price swings during highly leveraged periods can cause many contracts to be liquidated at once. But it doesn’t stop there; these liquidations further amplify the price movement that caused them and thus cause even more liquidations.

Liquidations that overlap in such a way are called a “squeeze.” Such events can include both longs and shorts.

The Bitcoin funding rates (the periodic fee exchanged between long and short traders) can give us an idea of the direction a potential squeeze could go.

CryptoQuant notes that this metric is currently neutral, meaning the market is evenly split between shorts and longs. As such, it’s hard to say what direction a potential squeeze could head in the near future.

The Bitcoin volatility has in fact been very low for the past few weeks, but with such high leverage accumulation, it could be a matter of time before a volatile price takes over.

BTC price

At the time of writing, Bitcoin price is hovering around $19.6k, up 2% over the past week.

The BTC value continues to trend sideways | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com