in view of of bitcoin The latest slide below the $21,000 level on Thursday came as traders considered a growing liquidity crunch and ongoing issues among major crypto-friendly banks. macro headwind In form of US Federal Reserve signal exposure, Bitcoin Options has taken its most pessimistic stance on the near-term price outlook for cryptocurrencies this year.

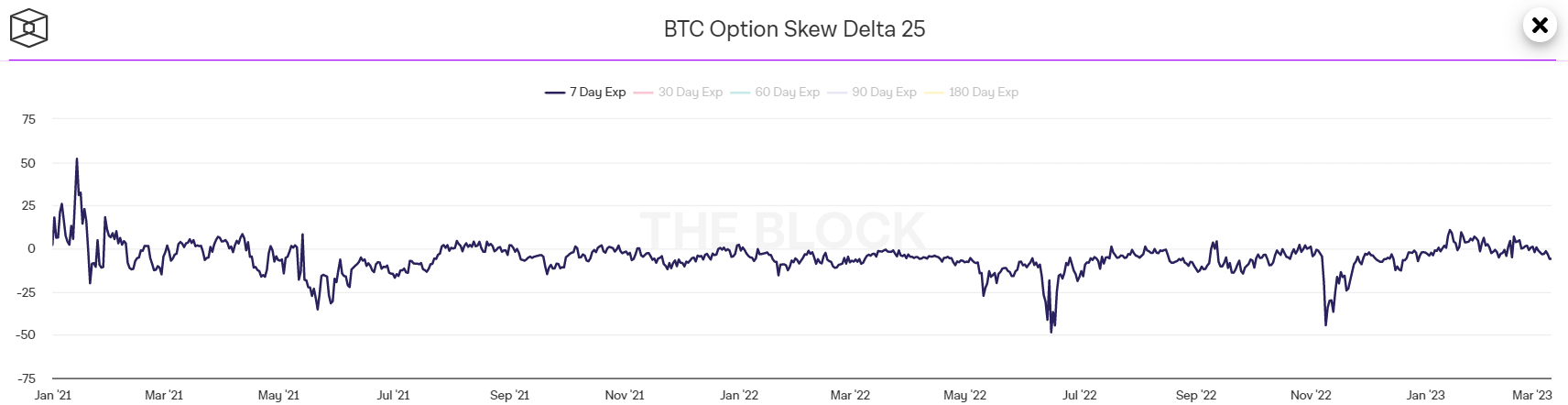

B T c/USD was last trading at $20,700, down less than 5.0% over the past 24-hours according to CoinMarketCap and is now down about 18% from the previous yearly high in the low $25,000s. At the same time, the skew of the 25% delta Bitcoin Options expiring 7 days from Thursday fell to around -6, the lowest since December 2022.

The 25% delta option skew is a popular monitored proxy of the extent to which trading desks are charging investors more or less for the upside or downside protection through put and call options being sold. A put option gives an investor the right but not the obligation to sell an asset at a predetermined price, while a call option gives an investor the right but not the obligation to buy an asset at a predetermined price.

A 25% delta option skew above 0 suggests that desks are charging more for equivalent call options versus puts. This implies that demand for calls versus puts is higher, which can be interpreted as a bullish sign as investors are more eager to hedge (or bet) a security against a rise in prices.

For now look at the long term price of the holding firm

While the 25% delta skew of 30-day and 60-day options fell to their lowest levels of the year at -3 and -2, respectively, the 25% delta skew of 90- and 180-day options Has gone. held, both balance close to zero. This suggests that investors are of the view that the current headwinds faced by the market (the collapse of crypto banks, scrutiny from US regulators and the Fed’s continued tightening efforts) are unlikely to send bitcoin off current levels on a sustained basis. .

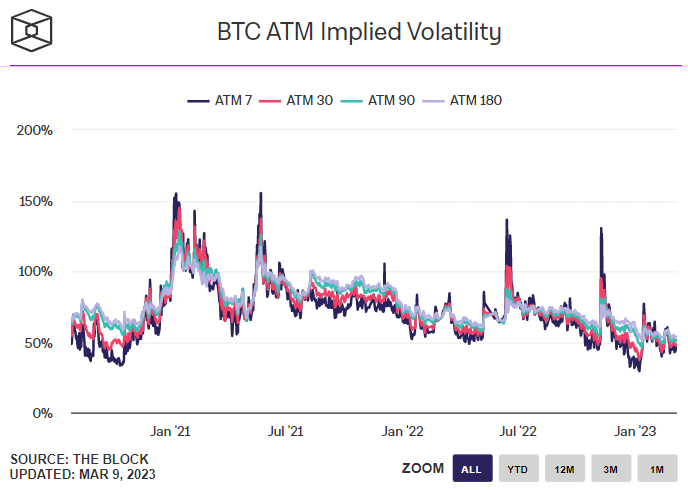

Options markets are also sending the message that bitcoin investors remain overly bullish on price volatility risks. Implied volatility for at-the-money (ATM) options expiring in 7, 30, 90 and 180-days is broadly unchanged over the past month.

Meanwhile, Deribit’s Bitcoin Volatility Index (DVOL) is also largely unchanged in recent weeks at 49, and is still not above its record low of 42 earlier this year.

Where’s Next for Bitcoin (BTC)?

The latest drop in bitcoin price has opened the door for a possible decline below the $20,000 level. But traders will be eyeing near-term support in the form of the 200-day moving average and realized price in the $19,700-800 area, which level, if retested, could attract significant downside-buying interest .

Looking at bitcoin over a wider time horizon, bitcoin’s latest decline still leaves it well within its range of the last eight months. While there could be downside ahead, bitcoin has just erased a 50% rally from its November 2022 low, prompting it to bet on new bear-market cycle lows soon for the world’s largest cryptocurrency by market capitalization. It is made up.

In the near term, US jobs data for February is set for release on Friday and next week’s US CPI report will be crucial in determining near term momentum. The bulls will be hoping for a negative surprise that could ease concerns about Fed tightening and give BTC price some room to recover.