On December 5, Bitcoin, the leading cryptocurrency finally broke above the key $17,000 resistance, and it is now correcting north of $17,600. Similarly, EthereumThe second most valuable cryptocurrency broke the $1,300 resistance and headed towards $1,350.

Major cryptocurrencies trade mixed in early December 5 global crypto market capitalization 1.58% to $865.67 billion in the previous day. In the last 24 hours, the total crypto market volume increased by 5.91% to $32.24 billion.

The total DeFi volume was $2.42 billion, which was 7.49% of the total 24-hour volume in the crypto market. The total volume of all stable coins was $29.19 billion, which was 90.52% of the total 24-hour volume of the crypto market.

Let’s take a look at the top 24-hour altcoin gainers and losers.

Top Altcoin Pros and Cons

Here are three of the top 100 coins that gained price in the last 24 hours Cronos (CRO), cello (celo)And Litecoin (LTC), The price of CRO has increased by almost 12% to $0.071; The price of CELO is up more than 11% to $0.6955, and the price of LTC is up about 7.5%.

Monero (XMR), Neutrino USD (USDN)And Tron (TRX) There are three of the top 100 coins whose value has decreased in the last 24 hours. While XMR is trading down about 1.30% to $144.50, USDN is trading down about 1% to $0.8890. Meanwhile, TRX price is trading down more than 0.50% at $0.0535.

Bybit Will Cut 30% Workforce As Crypto Bear Market Deepens

Bybit, a centralized cryptocurrency exchange, has become the latest to lay off staff as the crypto winter continues. The company had laid off employees in June this year itself. Singapore-headquartered company Bybit has announced layoffs.

Furthermore, this is a part of the company’s ongoing restructuring effort. It is the latest crypto firm to shift priorities as the bear market worsens. Bybit co-founder and CEO Ben Zhou made a statement on December 4, saying the layoffs would affect all departments.

Kraken to lay off over 1,000 employees as crypto winter casualties mount

Kraken co-founder and CEO Jesse Powell announced that the company will lay off approximately 1,100 employees, or 30% of its workforce, in order to “adapt to current market conditions.”

Specifically, Powell pointed to “broad economic and geopolitical concerns” as the root cause of the disappointingly weak growth. He pointed out that the recent market downturn has reduced trading volumes, new registrations and customer demand.

Kraken claimed that it was forced to lay off many employees, despite previously having reduced personnel and marketing expenses. Kraken’s layoffs this month due to the bear market have been accompanied by staff reductions at other cryptocurrency companies.

Unchained Capital (which laid off 600 people) and Coinbase (which laid off 60 people) are among the companies that have recently reduced their workforce. In the wake of the collapse of FTX, the most publicized instance of market volatility this year, BlockFi filed for bankruptcy earlier this week.

The exchange rate of the most popular cryptocurrency against the US dollar, BTC/USD, has crashed to a two-year low.

This ultimately has a bearish effect on the cryptocurrency market, however, the technical outlook is driving a bullish trend in leading crypto coins.

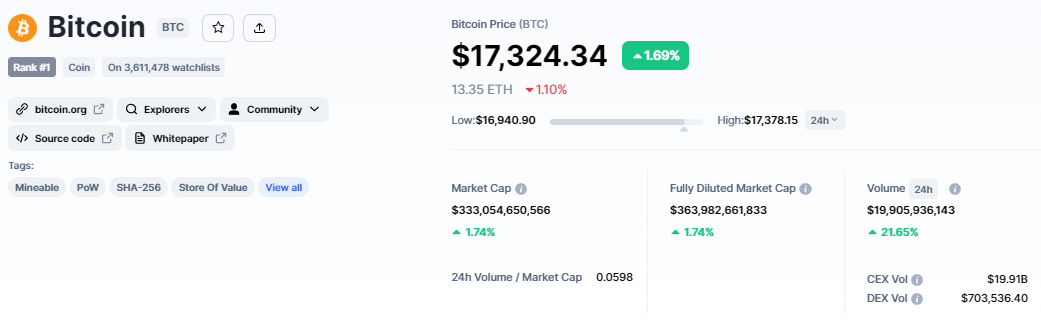

bitcoin price

the current bitcoin price $17,332, and a 24-hour trading volume of $19 billion. During the last 24 hours, the BTC/USD pair gained more than 1.5%, while coinmarket cap is currently in the first position with a live market cap of $363 billion, up from $357 billion yesterday.

It has a total supply of 21,000,000 BTC coins and a circulating supply of 19,224,668 BTC coins.

BTC/USD The pair broke the $17,250 barrier and broke out in a narrow trading range from $16,800 to $17,250. The RSI and MACD indicators are in a positive zone, and the 50-day EMA is supporting BTC at $16,800.

On the upside, bitcoin is approaching the next resistance at $17,650, above which it could expose BTC towards $18,000. BTC formed a bullish engulfing candle on the 4-hour time frame, well above an upside trendline level at $17,000.

On the downside, support for bitcoin remains at $17,200, and a break below this level could take BTC towards $17,000 or even as low as the $16,750 level.

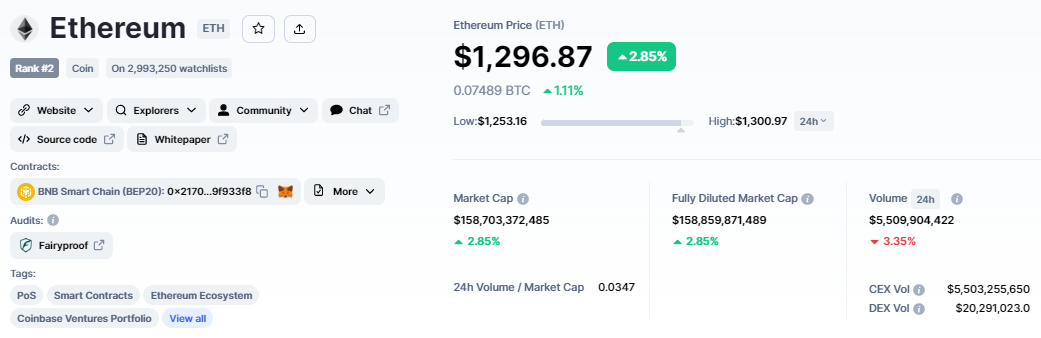

ethereum price

current price of Ethereum $1,296, with a 24-hour trading volume of $5.5 Billion. Ethereum is up almost 2% in the last 24 hours. CoinMarketCap is currently ranked #2 with a live market cap of $158 billion. It has a circulating supply of 122,373,866 ETH coins.

on the 4 hour chart, Ethereum It was trading bullish above the $1,250 psychological level, and it is now trading bearish above and below the $1,300 psychological level.

The bullish bias remains strong, as the 50-day moving average is near $1,250. The RSI and MACD have recently entered the buy zone, which indicates a good opportunity to go long.

The increased demand for ETH could push its price towards the $1,350 resistance. If ETH fails to close a candle above the $1,300 level, the price could decline towards the $1,250 or $1,220 support area.

Keep an eye on the $1,300 level, which could act as a pivot point today.

IMPT Pre-Sale Ending Soon: 1 Week To Buy

IMPT Another is an Ethereum-based network that will reward users for doing business with environmentally responsible firms. These benefits will be provided through the company’s IMPT token, which can be used to receive NFT-based carbon offsets that can be sold or retired.

IMPT has raised over $14 million Since its initial public offering in October, 1 IMPT is currently trading at $0.023.

IMPT.io will be a new platform for carbon offsetting and carbon credit trading End its token pre-sale on December 11th because of the phenomenal success

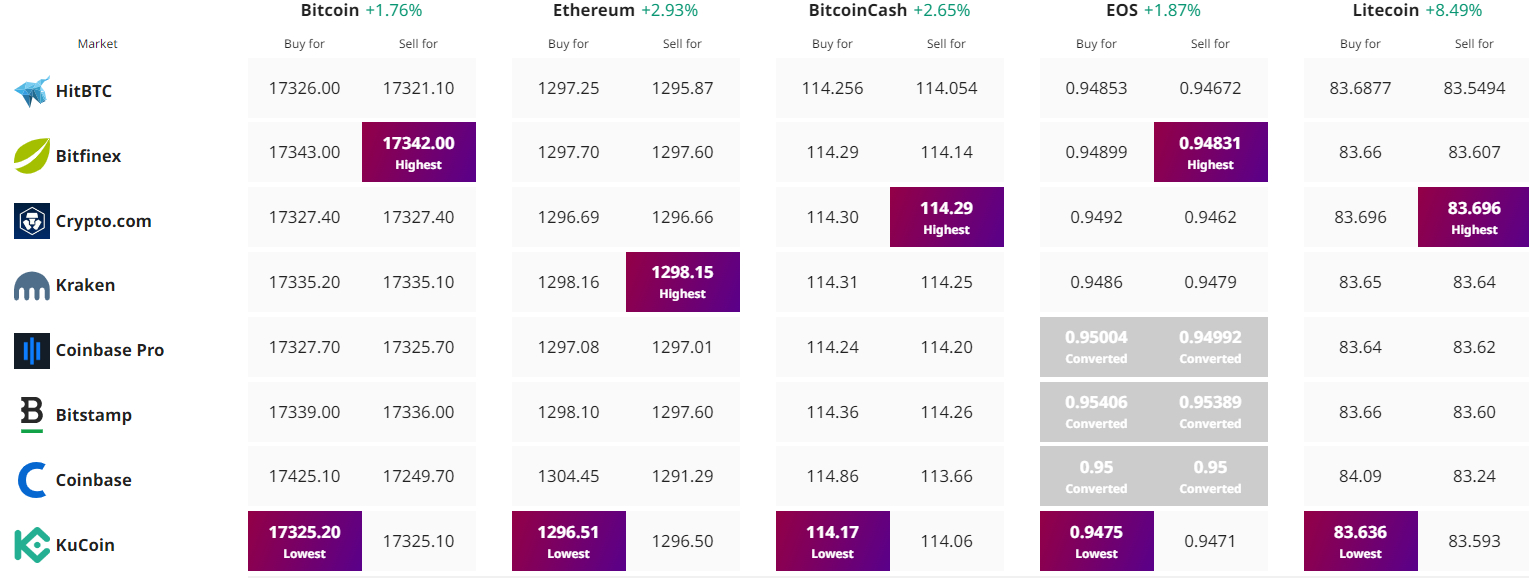

Find the best price to buy/sell cryptocurrency

Bitcoin Crypto Related Post