The crypto market has turned green again with Bitcoin’s price pushing north of $20,000 after a severe push from those levels in August. The market is heading into the weekend and with two major events in the coming days, there could be a spike in volatility.

At the time of writing, Bitcoin price is trading at $21,000 with gains of 10% and 4% respectively in the last 24 hours and 7 days. Data from Coingecko shows that BTC is doing better in the crypto top 10 in terms of market capitalization, as other assets are lagging and showing small losses.

Bitcoin Price Near Overhead Resistance, Can Bulls Continue?

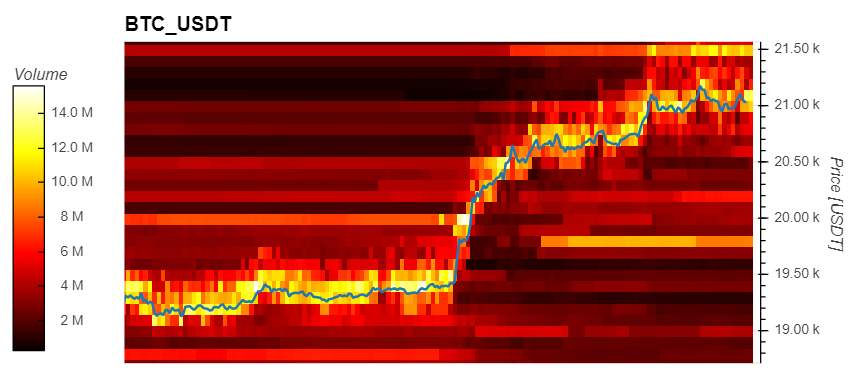

As Bitcoin flirts with its current levels, Material Indicators (MI) data is beginning to show liquidity in flux. The benchmark crypto was able to fill more than $15 million in demand orders as it broke past critical resistance at $20,000.Now the key resistance level is at $21,500 for the short term. At those levels, Bitcoin price sees sell orders stacking from $7 million to about $12 million in the past 12 hours. These orders can act as resistance and delay any attempts by the bulls to regain higher levels.

Material indicators show that the current price action is being bought by retail investors and by large investors with buy orders over $100,000. If Bitcoin price shows a bullish continuation, the latter should continue to bid and support the cryptocurrency. However, investors with $100,000 bid orders have remained steady as BTC’s price trends have been positive. This points to a possible retest of the support with $19,500 to $19,800 as potential targets to avoid further losses and maintain near-term bullish bias.

Bitcoin Price Critical Levels On Higher Time Frames

Additional data from Caleb Franzen, Senior Market Analysis for Cubic Analytics, shows that Bitcoin has shown similar price action in 2022. In previous months, the cryptocurrency’s downward trend has been followed by periods of consolidation.

As can be seen below, these periods pointed to more downside effects. So it is critical that Bitcoin price recovers north of $25,000, $28,000 and $32,000 or else the market risks a slow bleed to new lows. Franzen said while sharing the following chart

Bitcoin consolidated for 107 days starting in the early first quarter of 2022 before breaking down for the next leg lower. The current consolidation scope is 83 days. I don’t expect the current market to match the 107-day range, but it’s worth noting that they could take a while.