The BTC/USD pair is trading sideways on December 8, maintaining a narrow range from $16,750 to $16,900, but bitcoin price prediction Remains bearish after breakout of the upward channel.

Bitcoin has fallen 75% this year from its previous high of $69,000. However, the reason for these drastic declines can be attributed to various factors.

Lately, everything has negatively affected the cryptocurrency market, contributing to losses in the world’s largest cryptocurrency, Bitcoin, whether it was the dramatic collapse of FTX or the increasing selling pressure as whales cut their flows. reduces the quantity.

Other than this ftx collapseThe decline in BTC can be attributed to the minor capitulation risk which has been continuously troubling traders looking to enter long positions.

Furthermore, according to Daniel Batten, Vice Chairman of ClimateTech, approximately 29 mining companies account for 16.48% of the entire bitcoin (BTC) network and use 90% to 100% renewable energy. Therefore, BTC price has not yet been affected by this news.

on the plus side, paypalA major financial services provider is planning to launch cryptocurrency services in Luxembourg in what appears to be an attempt to expand the use of cryptocurrencies across the European Union.

This news is considered to be one of the most important factors that could help BTC price limit further losses.

Meanwhile, Binance CEO Changpeng Zhao said that there is no outstanding debt on the exchange and urged anyone to verify this claim. This could be good news for cryptocurrency investors and the industry as a whole.

Miner capitulation poses serious risk to bitcoin price

Bitcoin’s downtrend can be linked to the increased risk of miner capitulation, which scares away traders attempting to open long positions and puts pressure on the BTC price.

According to on-chain data, miners are selling their bitcoin holdings due to tight budgets. The result of this is visible in the form of fall in the share prices of mining companies.

NASDAQ-listed cryptocurrency mining firms such as Marathon Digital, Core Scientific, Riot Blockchain, Hut 8 Mining, HIVE Blockchain Technologies have all lost 46%, 20% and 38% in one month over the past six months. Months, respectively, and this month the problem has gotten worse.

This month saw a decrease in mining activity, resulting in a decrease in hash rate and mining difficulty. The mining industry is under pressure due to low coin prices, rising energy costs and heavy debt loads.

As a result of financial hardship and falling stock prices, companies would eventually go bankrupt, dumping bitcoin as a last resort. It is also worth noting that the BTC reserves of miners have decreased by 13K BTC. According to Glassnode, it is currently at a 14-month low of 1,818,280.032 BTC.

CZ confirms about zero outstanding debt on the exchange

Binance CEO Changpeng Zhao said the exchange has no outstanding debt and urged anyone to verify the claim. Binance released the first Bitcoin Proof of Reserves on November 25 to show that on-chain reserves of 582,485.9302 BTC were 1% more than total customer deposits of 575,742 BTC.

According to a report released on December 7 by renowned financial auditing firm Mazar, Binance’s bitcoin reserves were pledged to more than 100% of its total liabilities. As a result, it was considered as one of the key factors that could boost investor confidence.

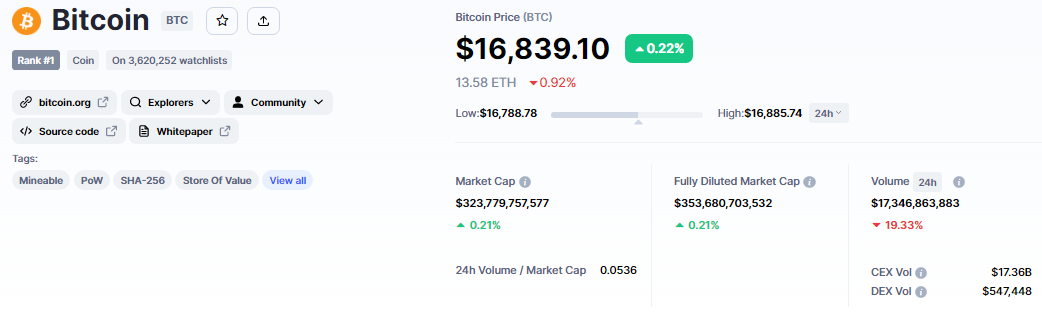

bitcoin price

current price of bitcoin is $16,844, and the 24-hour trading volume is $17 billion. BTC price is mostly flat today, up only 0.20%, while the other leading cryptocurrency, Ethereum, has gained almost 1%.

If bitcoin prices Stay below $16,900, an important technical resistance, with more losses likely. On the 4-hour time frame, the $16,900 level acts as a support and is extended by an upward trend line; However, the presence of Doji candles indicates that a downtrend is forming.

Looking to the downside, the next level of support for bitcoin is $16,500. If there is a breakdown of this level, BTC price could decline towards $16,000 or even $15,450.

If bitcoin fails to sustain its recent selling trend and instead displays a bullish break above $17,000, a healthy rally to at least $17,350 can be expected. If the bullish trend continues, bitcoin price could reach $17,650 or even $18,000.

massive upside potential coins

Despite the bearish price action, the coins below are going from strength to strength, attracting the attention of crypto whales.

IMPT – Pre sale ends in 4 days

IMPT The pre-sale has now raised nearly $15 million as early investors rush to buy altcoins ahead of their listing on exchanges in seven days. The sale is set to end in less than four days, followed by confirmed listings on Uniswap, LBANK Exchange and Changelly Pro.

As these listings have already been confirmed, the IMPT sale has gathered momentum in its final phase.

At the same time, the fundamentals of the Ethereum-based carbon credits marketplace place it in a strong position to secure long-term growth, with the platform already proving popular with ESG-focused cryptocurrency investors.

IMPT has raised over $15 million So far in its pre-sale, 1 IMPT is currently selling for $0.023.

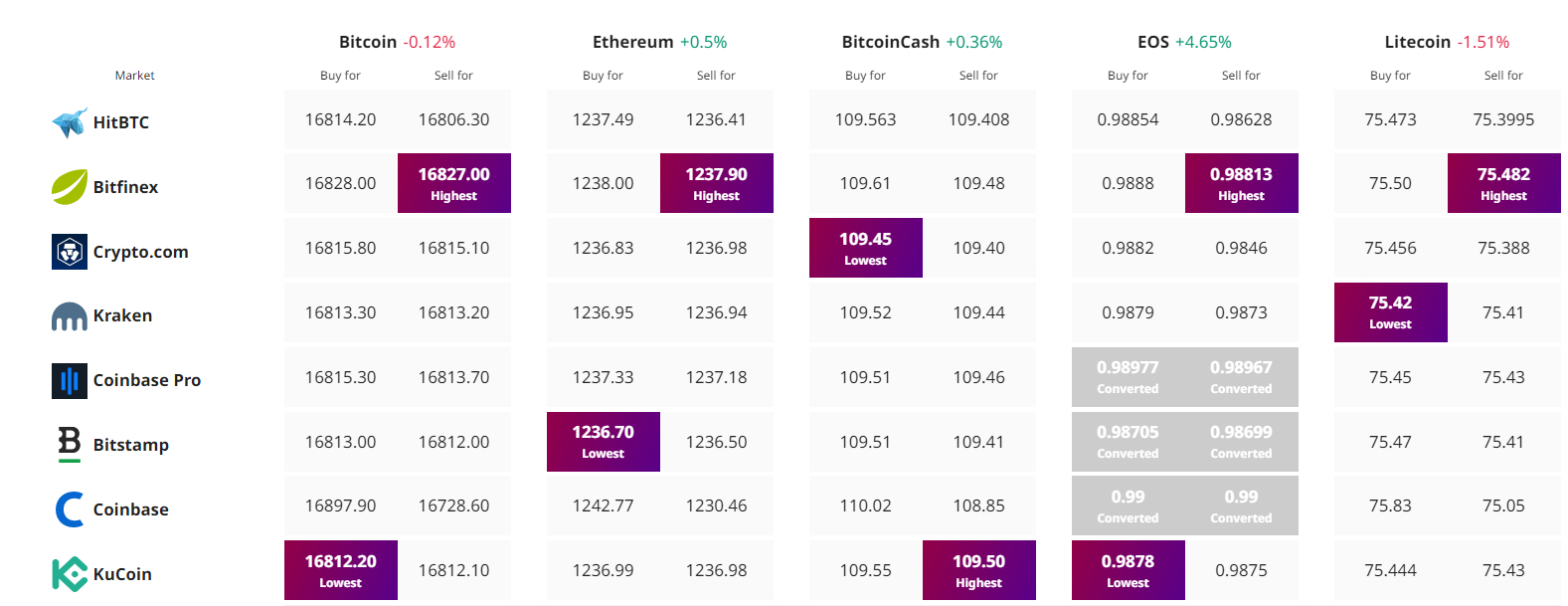

Find the best price to buy/sell cryptocurrency

Bitcoin Crypto Related Post