As US inflation data is released, Bitcoin Investors and traders are eagerly awaiting its effect on the price of cryptocurrencies. Since last Friday, bitcoin has been on a remarkable run, rallying nearly 30% from recent lows and setting a new 2023 record above $26,000. The cryptocurrency boom comes amid a banking sector crisis and widespread bank runs.

In addition to bitcoin (BTC), Ethereum (ETH) has also seen an increase in its value, which is currently trading above the $1,600 mark. This upward trend in the value of both BTC and ETH has contributed to an overall increase in the value of most cryptocurrencies.

Therefore, the future of cryptocurrencies seems optimistic, especially given the readiness of the US authorities to support banks that accept cryptocurrencies.

The move has instilled investor confidence and restored confidence in the financial sector, leading to a surge in demand for cryptocurrencies. As a result, major cryptocurrencies such as Bitcoin and Ethereum have increased their values, thereby increasing the overall market capitalization.

This article will examine the latest bitcoin price predictions and trends as investors navigate the effects of inflation on the cryptocurrency market.

Support from US regulators boosts BTC price

The crypto market climbed above $1.08 trillion for the first time in weeks, despite the recent closure of banks that were crypto-friendly. The surge was mainly driven by bitcoin (BTC), which surged nearly 10% to cross the $24,000 mark, reaching a two-week high. Ethereum (ETH) also saw bullish momentum above $1,600.

The recent surge in BTC’s value was ignited by US regulators’ support for Silicon Valley Bank and Signature Bank, which is seen by many investors and traders as a positive sign for the overall banking sector. As a result, market sentiment improved and investors rushed to BTC, causing its value to skyrocket.

However, the latest increase in the value of BTC highlights the increasing mainstream adoption of cryptocurrencies. This suggests that the cryptocurrency market may continue to experience rapid growth and volatility as more investors and institutions adopt digital assets.

EU proposes new blockchain for personal identification

On another note, the European Union has proposed a specialized blockchain that contains personal identity and data information relevant to the region. This blockchain protects user privacy while complying with MiCA, the upcoming cryptocurrency regulatory framework of the European Union.

The move is expected to increase investor confidence in the cryptocurrency sector, indicating that governments and regulatory bodies are willing to support the industry.

US Dollar Falls, Boosts Bitcoin Amid Systemic Concerns

The US dollar struggled to gain momentum on Tuesday and hit a multi-week low on concerns about a possible systemic crisis following the collapse of a US technology-focused lender.

The current crisis in the banking sector has fueled speculation that the Federal Reserve may halt its aggressive rate-hike cycle.

As a result, market expectations suggest there is a 31% chance of a rate cut in June and for the rest of the year.

It is important to remember that the Federal Reserve’s rate hikes have played a significant role in driving the strength of the US dollar, but have moderated expectations of how higher rates may move.

Looking ahead, the crucial US inflation report is due for release later on Tuesday, adding to the Fed’s dilemma of whether to continue on its path of rate hikes or to further tighten monetary policy to combat persistent price pressures. to allow. Some relief to the banking system

bitcoin price

On Tuesday, the BTC/USD pair traded with a bullish trend near the level of $25,750. On the upside, bitcoin faces immediate resistance at the $26,700 level. Further higher, a break of the $26,700 level could open more room for buying towards $27,400.

On the lower side, bitcoin has an immediate support at $25,125, and a break below this level could open more room for selling towards the $23,750 level. If the price surpasses the $25,225 level today, it might be worthwhile to consider a buy trade.

Top 15 Cryptocurrencies to Watch in 2023

Check out Industry Talk’s thoughtfully curated list of the top 15 altcoins to watch in 2023, as selected by Cryptonews. The list is constantly updated with new ICO projects and altcoins, so be sure to check back often for the latest updates.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

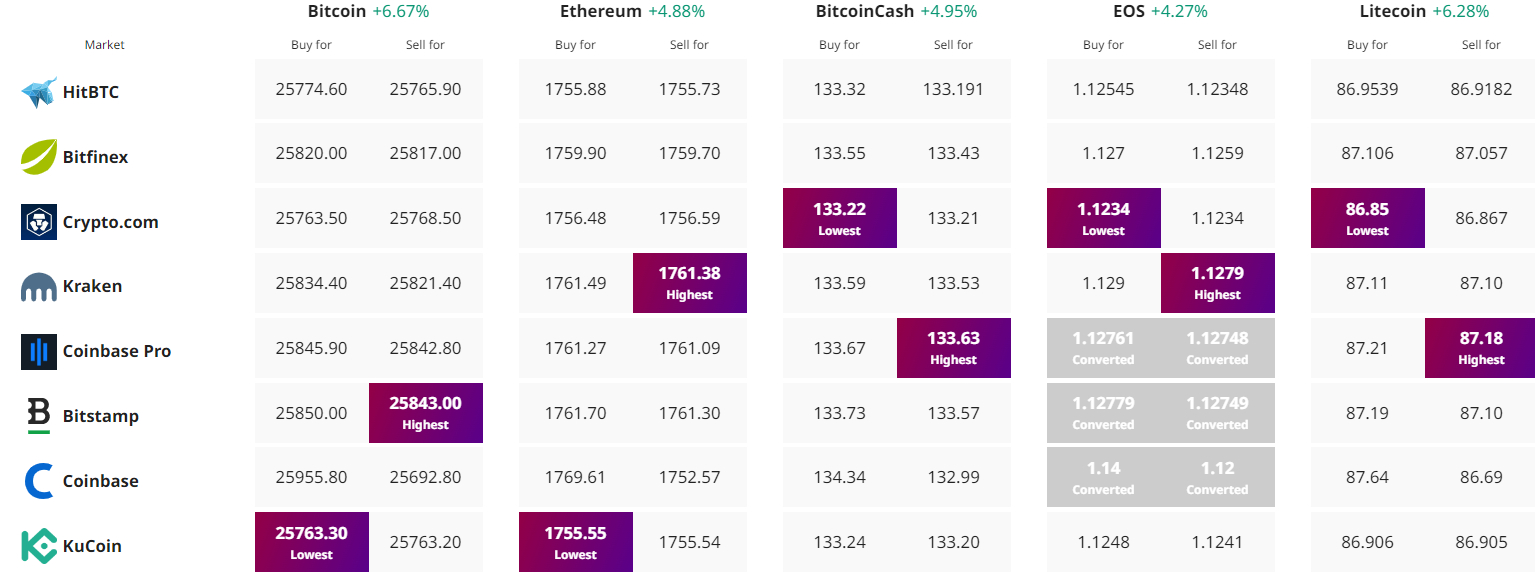

Find the best price to buy/sell cryptocurrency