Bitcoin There has been a sharp fall in its value in the last few days, which has raised concerns among investors and traders. The market is currently trying to figure out the reasons behind this decline and determine where the following support for the cryptocurrency may lie.

In this article, we will examine the factors contributing to the recent decline in the price of bitcoin and explore potential support levels for the cryptocurrency.

UK Crypto Crackdown: Which Banks in the UK Allow Bitcoin Purchases?

Lately, there has been a growing trend of cracking down on cryptocurrency purchases in the UK. As the popularity of bitcoin and other digital assets continues to grow, many banks have taken steps to limit their customers’ ability to purchase these assets.

The biggest UK banks are Nationwide and HSBC. Daily Limits Enforced From making crypto purchases to buyers or restricted credit cards. The move follows the lead of other banks, which have taken a tougher stance on crypto over the past year, with some tightening regulations following the collapse of FTX, a major digital asset exchange, in November.

Despite this action, many banks in the UK still allow bitcoin purchases. These include Barclays, which allows customers to make crypto purchases through its banking app; Lloyds Bank, which allows credit card transactions for crypto purchases; and Santander, which supports crypto purchases through its mobile banking app.

Furthermore, some digital banks such as Revolut and Monzo have also made it easy for users to buy and sell cryptocurrencies through their mobile apps.

Overall, while the ban on crypto purchases by UK banks may affect demand for bitcoin, the extent of this effect is difficult to estimate. As with any regulatory changes in the crypto market, it is important for investors to stay informed and up to date on any potential effects on BTC and other digital assets.

ISM Service PMI

as per latest service ismThe country’s purchasing and supply officials reported that economic activity in the services sector expanded for the second month in a row in February.

The Services PMI recorded 55.1 per cent, indicating growth in the sector. The services sector has seen growth in 32 out of the last 33 months, with contraction only in December.

As the services sector continues to expand, this could have a positive effect on bitcoin and other cryptocurrencies. This is because increased economic activity usually translates to higher investor confidence and a greater willingness to invest in risky assets like bitcoin.

bitcoin price

This time, Bitcoin is trading at $22,396 with a trading volume of $26B in the last 24 hours. Technical analysis of the BTC/USD pair shows that the symmetrical triangle pattern at the $23,250 level was violated, and if the breakout continues, BTC price could decline towards the $22,046 support area. If the price declines further, it could reach $21,450.

Despite the bearish engulfing candle formation indicating a strong sell bias, if the candles close above this level, there is a potential for a bullish rally.

The bounce-off targets $22,800 or even higher, reaching the $23,750 mark.

bitcoin options

Investors looking to buy bitcoin may want to consider exploring other options that offer greater short-term growth potential. Cryptonews conducts an in-depth analysis of the top 15 cryptocurrencies investors should consider for 2023. To know more click on the link given below.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

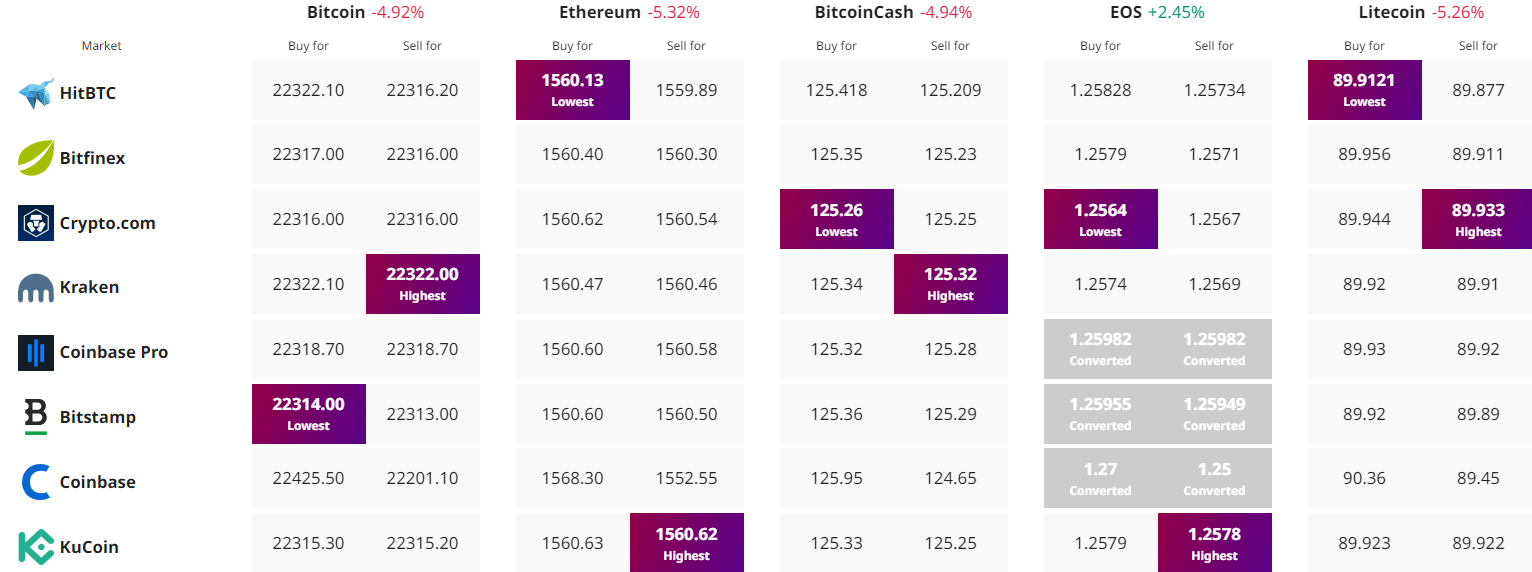

Find the best price to buy/sell cryptocurrency