The Block said it is working with the SEC to “explore legal action against Hindenburg Research for its factually incorrect and misleading reports”.

American multinational financial technology giant block inc (NYSE: SQ) is currently under intense pressure following a loss reports Short Seller, from Hindenburg Research. According to the report, Hindenburg Research accused Block of running a fraudulent operation that took advantage of the demographics it claimed to serve, the unbanked.

Hindenburg, known for such reports, said its investigation into Block Inc. was conducted over a two-year period and included interviews with both current and former employees. The report states that the block is in the habit of increasing its user metrics, which is a key indicator of growth, and that it benefits from doing so.

“Our 2-year investigation concluded that The Block systematically took advantage of the very demographics it claimed to help. The “magic” behind The Block’s business is not disruptive innovation, but fraud against consumers and the government. The company aspires to facilitate, avoid regulation, make predatory loans and fees framed as revolutionary technology, and mislead investors with inflated metrics,” the report reads.

Hindenburg also alleged that Block maintained weak compliance with respect to its know-your-customer (KYC) provisions. To prove this, the research firm said that it had opened a fake account on Cash App in the name of the former president. Donald Trump and Tesla CEO Elon Musk,

The firm said the accounts were not only opened, but associated payment cards were requested and delivered via mail from a fake Donald Trump account. according to the report,

“Former employees estimated that 40%-75% of the accounts they reviewed were fake, involved in fraud, or had additional accounts linked to the same person.”

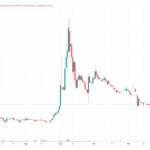

Following the damaging findings, Hindenburg Research said it took short positions on Block’s shares. Since the report broke, the company’s stock fell 14.82% to close at $61.88 at the end of trading on Thursday.

Block Inc’s Response to Hindenburg Research

The revelations made by Hindenburg Research have received a very strong rebuttal from the company worth noting That it is a highly regulated company that takes its compliance obligations so seriously.

“We are a highly regulated public company with regular disclosures, and are confident in our products, reporting, compliance programs and controls. We will not deviate from typical short-seller tactics,” Block added.

The company said it is working with the United States Securities and Exchange Commission (seconds“Today we’re going to explore legal action against Hindenburg Research for sharing a factually incorrect and misleading report about our Cash App business,” the company said in a press release.

While Hindenburg Research’s actions and approach may be detrimental to investors, it has a high probability of coming under intense scrutiny from regulators in the near future.

Benjamin Godfrey is a blockchain enthusiast and journalist who loves to write about real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desire to educate people about cryptocurrencies drives his contributions to well-known blockchain-based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Bitcoin Crypto Related Post