Bitcoin price is hanging by a thread as it pulls back its gains from yesterday’s trading session. Again, macroeconomic forces seem to be taking over price action as the number one cryptocurrency by market cap looks down the abyss of a potentially fresh leg.

At the time of writing, Bitcoin price is trading at $19,077 with a 5% loss and a 1% gain in the past 7 days and 24 hours, respectively. BTC is looking at two possible support levels in short time frames to avoid further downturns.

Bitcoin price reacts bearish to ECB rate hikes

Today was about to be a volatile day as the chairmen of two of the world’s largest central banks, the European Central Bank (ECB) led by Cristine Lagarde and the US Federal Reserve (Fed) led by Jerome Powell, made important announcements.

the ECB announced a 75 basis point rate hike, the largest in its history. In the coming months, the financial institution will continue to rise as it aims to “dampen demand and guard against the risk of a continued upward shift in inflation expectations”.

In addition to stopping inflation, the same goal as the US Fed, the ECB is trying to slow the euro’s crash against the US dollar. In light of the current macroeconomic uncertainty and the spike in global energy, people have been rushing to the dollar.

This has led to a crash in the European currency, legacy financial markets, the Bitcoin price and crypto markets. as Lagarde announced Due to their measures, the euro saw a small spike that could indicate a positive perception of the market.

via Twitter

Sell Liquidity Boosts, Can Bitcoin Overcome?

Both Lagarde and Powell agreed that the near term indicates more pain for the financial world. Initially, Bitcoin price reacted on the downside but is still sitting at critical support and could potentially bounce from $19,000.

This level and $18,600 act as an important support and bulls should hold them to avoid further downturns. As NewsBTC reported yesterday, it is critical that bulls regain higher levels at $19,000 and north of $20,500.

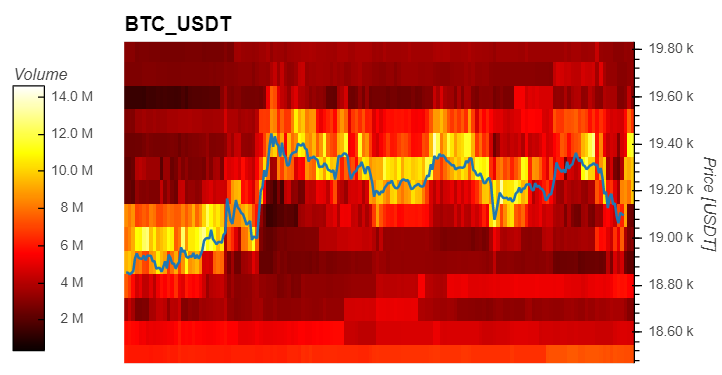

However, data from Material Indicators points to near-term headwinds as the Bitcoin order book sees a spike in demand (sell) liquidity. $19,400 appears to be a critical low time frame overhead resistance with about $10 million in demand orders.