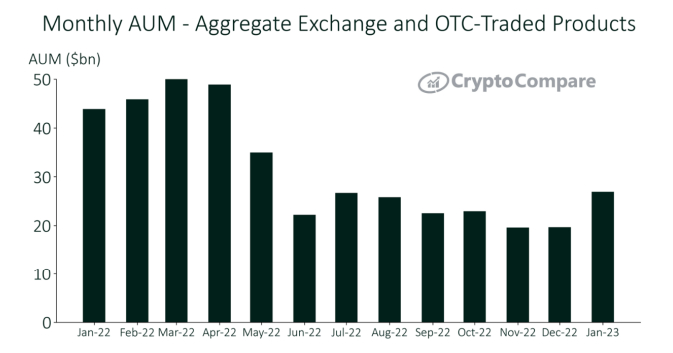

Total assets under management (AUM) for digital asset investment products grew by 36.8% in January to $19.7 billion, the highest level since May 2022, CryptoSwap said in its latest monthly Digital Asset Management Review report. According to the crypto intelligence firm, “The bullish sentiment was driven by liquid short positions and a favorable macro environment, which was reflected in the recent CPI announcement, which saw bitcoin price reach $23,000; Its highest level since August 2022”.

However, CryptoSwap noted that AUM is still down 38.7% from its January 2022 levels “due to a difficult year for bitcoin, the broader crypto market, and traditional assets”. It is widely agreed among analysts that the main trigger of 2022’s risk asset and crypto bear markets was a surprisingly aggressive change in the policy stance of the US Federal Reserve and other major central banks, in order to curb strong-expectations. Increase in global price pressures.

Grayscale is fragile despite market revival

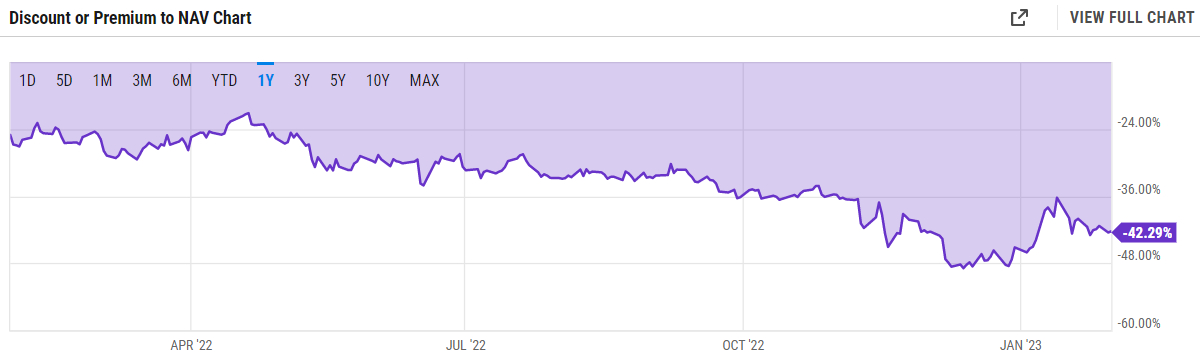

Despite the January revival in crypto market sentiment, there has also been a rebound on crypto investment product AUM, with CryptoCompare noting that the situation relating to Grayscale’s Bitcoin Trust (GBTC) remains fragile. While GBTC remains the dominant bitcoin investment trust product with a market share of 69.3% in terms of AUM, Cryptocurrencies noted that “the discount associated with Grayscale’s GBTC trust has only shrunk slightly” in January.

GBTC discount refers to the percentage that GBTC shares are trading below their net asset value. as 31scheduled tribe In January, GBTC discount was an astonishing 42.29%, only slightly higher than the record low hit last December in the region of 48%. CryptoSpy states that “the situation remains fragile” with Grayscale facing challenges, including “the bankruptcy declaration of its sister company Genesis in January due to its exposure to FTX, and the SEC filing its bitcoin trust into an ETF.” Ongoing lawsuits to change”.

Will the Fed scare investors away from crypto again?

Latest Crypto Report Chimes With Latest Weekly Fund Flows CoinShares Report, Digital asset investment products saw their biggest inflows since July 2022 last week, according to CoinShares Bitcoin dominated and accounting for inflows of $116 million. January clearly saw a resurgence of appetite among institutional investors for crypto investments.

But that resurgence is set for a firm test this Wednesday. The Fed is about to release its latest monetary policy decision at 1900GMT and is expected to raise interest rates by another 25 bps to 4.50-4.75% target range. This would mark another slowdown in the pace of rate hikes, after the Fed raised rates by 50 bps at its last meeting and 75 bps at each of the last four meetings before that.

Optimism about a less aggressive Fed as inflation shows significant signs of cooling and forward-looking economic indicators point to a possible US recession later this year was a key pillar of the January rally. but Macro strategists are warning Market optimism may have gone too far. Markets are expecting just another 25 bps rate hike after today’s move and a rate cut later this year, but Fed Chair Jerome Powell could signal further hikes, and later this year may back down against the idea of cutting rates.

Traders should be prepared to risk an aggressive short-term pullback in crypto prices – for long-term bulls this could present a new opportunity to buy the dip, given that rising sign that 2022 the bear market is over,

Bitcoin Crypto Related Post