A market strategist has warned that a “bloodbath” in risk assets, including the crypto market, could become a reality as Wednesday’s crucial Federal Reserve (Fed) meeting draws closer.

According to the strategist, who goes by the Twitter username TheCarter, Fed Chair Jerome Powell will emerge on Wednesday in a more forceful and flamboyant manner than the market expected. They believe that this will lead to a sharp selloff in all risk assets, which include bitcoin (btc) and most other digital assets.

In a Twitter thread posted on Friday, he wrote, “There will be blood on February 1st. Powell will reinvigorate financial conditions by forcefully addressing rate cuts.”

The strategist defended his view, describing Powell as “probably the most transparent Fed chair in history”:

“He plays with a wide open hand. Let’s look at his ‘hand’…”

The popular analyst cited Powell’s earlier statements, where he indicated that there is less risk to the economy than not doing enough to reduce inflation to its target.

“If that happens, we can strongly support economic activity,” Powell was quoted as saying in relation to the risk of overtightening.

The Fed watcher and market strategist added in the thread that both the Fed’s written statement as well as Powell’s press conference are likely to be “very aggressive” on Wednesday.

“It’s all about the Powell hammers on Feb 1st, not the IF,” he wrote, before adding some advice on what traders should watch at Powell’s press conference.

“Look for him to forcefully shift the conversation toward how long the Fed needs to hold terminal rates, and why. Look for him to expand on the lessons of the 1970s.

Carter further stated that it was “beyond me” how the market could continue to punch Powell in the face and not expect a retaliatory punch. […],

He went on repeating:

“There will be blood on February 1st.”

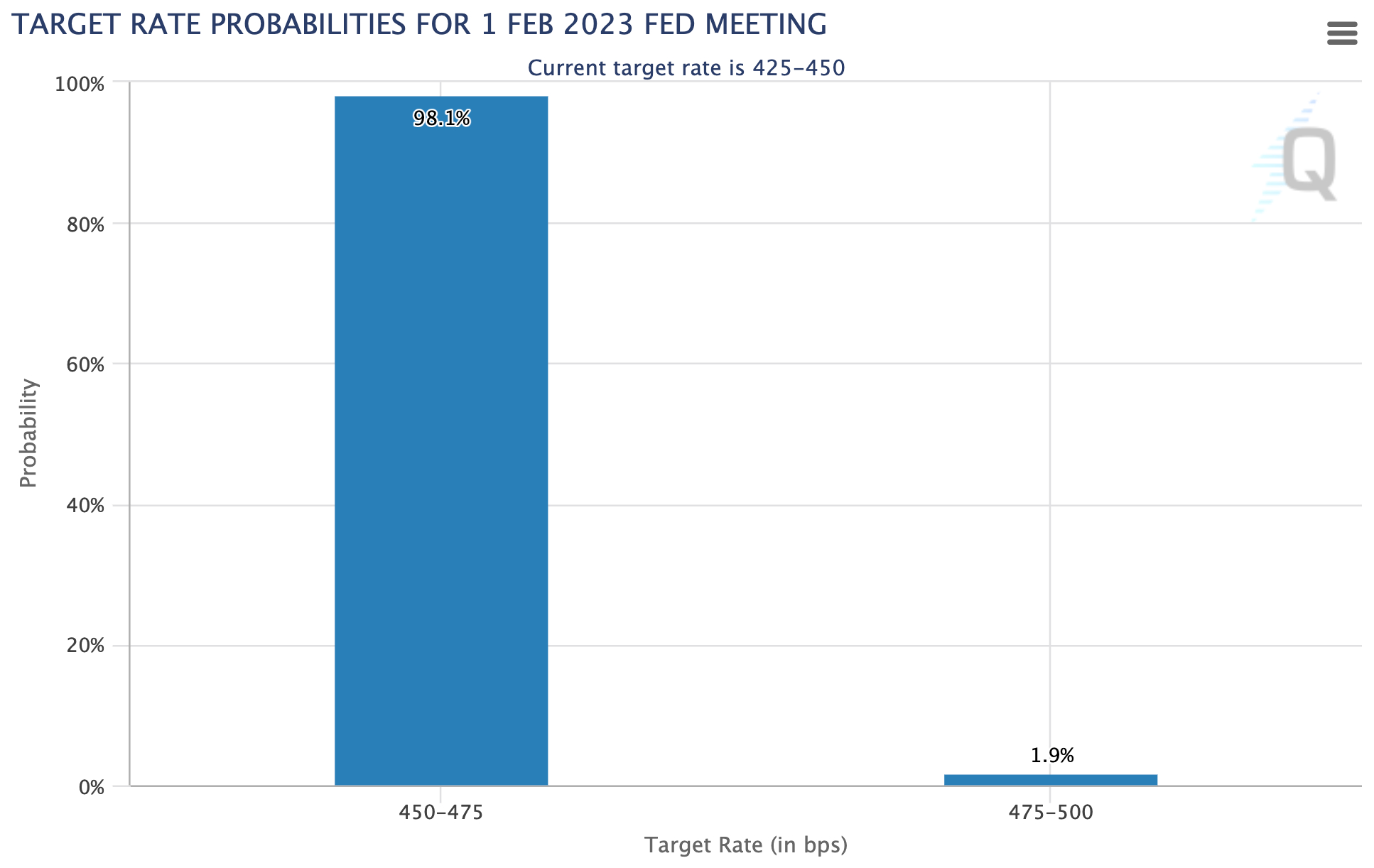

The Fed is set to announce its latest interest rate decision this Wednesday at 2 p.m. ET (7 p.m. UTC), with most analysts expecting a 25-basis point hike. This is also what the market has currently settled on, with the CME’s FedWatch tool for example projecting a 98.1% probability for a 25-basis point hike.

Fed Chair Jerome Powell has indicated in the past that he needs to see inflation coming down in a meaningful way before the Fed will consider halting its rate hikes. The latest inflation report for December showed that US inflation eases to 6.5% annual.

The Fed’s long-term inflation target is 2% annually.

Bitcoin Crypto Related Post