The world’s second largest cryptocurrency, Ethereum is barely staying above water amid a fragile market situation. Investors are patiently awaiting every word from Federal Reserve Chairman Jerome Powell’s speech.

Some experts believe that the expected 0.25% increase in interest rates coincides with the possibility of the price of Ethereum and other cryptocurrencies remaining unchanged.

At the moment, Ethereum is priced at $1,575 while the bulls focus on tackling the $1,600 resistance. On the downside, the support at $1,520 should be defended at all costs to avoid a possible decline to $1,445 and $1,400, respectively.

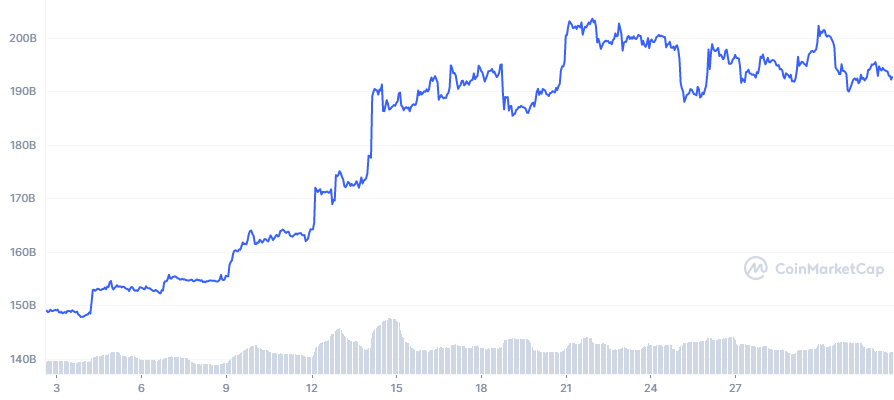

Over $7 billion in trading volume was recorded in the 24 hours analyzed, although the ETH price only changed +0.15%. The market cap of the token has dropped from $202 billion on January 29 to $192 billion as a result of the market selloff since the weekend.

Ethereum Price Shows Stability Ahead of FOMC

The largest smart contract token remained relatively stable at roughly $1,678, despite falling from January highs. Awaiting the Fed’s decision on a possible interest rate hike of 25 basis points, investors have held back. The first US FOMC meeting scheduled to conclude later today will either end the new year in crypto bullish, stalling the recovery, or end in a short term selloff.

According to an analysis by LookOnChain on how ETH reacts after eight FOMC meetings in 2022, investors can expect Ethereum price to jump up to 4.25%, with 0.25% being the lowest expected change.

Ethereum price sits comfortably at $1,517 with important support provided by the 200-day exponential moving average (EMA) (in purple). However, the Moving Average Convergence Divergence (MACD) indicator has recently shown a sell signal, indicating a correction in a longer trend in the coming days.

Traders should follow the MACD line in blue color as it diverges below the signal line in red color. The decline may intensify if the momentum indicator turns down the mean line and possibly moves to negative territory again. The red histograms in the same indicator reinforce the increasing bearish progress.

Assessment of Bullish Outlook in Ethereum Price – Short Analysis

The Money Flow Index (MFI) on the same daily time-frame chart shows that investors are ready to pump money into the Ethereum markets. We can see the MFI bouncing off the midline in the neutral zone after a big drop from the high range of the overbought zone. As long as there is more volume inflows than total outflows of ether, a trend rebound will be the most likely outcome.

Furthermore, the 50-day EMA (in red) recently moved above the 100-day EMA, for support provided by the 200-day EMA. Although not a golden cross pattern, the one formed with the 50-day EMA crossing above the 200-day EMA means that the bulls are in control and Ethereum price is likely to climb higher.

Short-term analysis based on the chart on the four-hour time frame shows that Ethereum is holding an uptrend between the 100-day EMA (in blue) and the 50-day EMA (in red). While the most popular smart contract token is trading below the dotted trend line, its support at the 100-day EMA has been reinforced by a lower rising trend line, meaning the odds still favor a bullish outcome.

After falling from January highs, Ethereum sank into oversold conditions based on the Stochastic Oscillator. However, the recovery is already underway with the bullish pressure gradually intensifying.

Therefore, with a minor push above the 50-day EMA and the dotted rising trendline, Ethereum price will resume its uptrend with targets at $1,800 and $2,000, respectively. As seen in the daily time frame analysis, the MFI indicator maintains a positive picture.

It would be prudent to assess the possibility of an extended trend correction, especially if support at the 100-day EMA on the four-hour chart weakens. From here, Ethereum will be forced to look towards the 200-day EMA (purple) at $1,486 for support. If push comes to shove, declines could reclaim the next buyer congestion zone at $1,400.

Can This Stable Upgrade Ethereum Price Surge?

The Ethereum merge upgrade sets the ball rolling for a number of features expected on the proof-of-stake (PoS) blockchain, including ZheJiang – the staking testnet going live today. Users will interact for the first time with a new staking protocol that allows the withdrawal of staked ETH.

According to the developers of the testnet, the Shanghai+Capella upgrade will go live in about six days from today. The testnet will allow developers to monitor the withdrawal process and other related services and resolve any potential issues that may arise.

The Ethereum community is waiting with bated breath for the Shanghai upgrade to be launched before the end of Q1 2023. This will be a notable hard fork as it will see investors withdraw ETH locked in the Beacon chain for the first time.

Experts believe the event will be a significant catalyst for the Ethereum price and liquid staking platforms that allow investors to lock digital assets in smart contracts and still give them access to their liquidity, such as That lidoDAO.

The Shanghai upgrade will also open up opportunities for organizations and crypto exchanges that can use the staking feature to generate more income. A recent report from JP Morgan states that companies like Coinbase could unlock a $500 million annual revenue opportunity with the launch of the Shanghai upgrade.

Overall, Zhejiang will mark a new beginning for the Ethereum ecosystem and trigger a potential increase in ETH price. The Shanghai upgrade could also drive prices up on liquid staking platforms such as Lidodao.

ethereum options to buy today

investors are waiting buy ethereumMight want to consider ETH as well as other high potential crypto projects.

We Review the Top 15 Cryptocurrencies for 2023, as Analyzed by crypto news Industry Talk Team.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

Related Articles:

Bitcoin Crypto Related Post