Ethereum on the largest smart contract platform continues to gain strength against the US Dollar, especially with a recent move above $1,600. The recovery is expected to continue after the Federal Open Market Committee (FOMC) meeting and its decision to hike interest rates in two days.

Experts say that cryptos may generally retrace before this, thus shaking off weak hangs before making a bullish move to higher targets above $2,000. Ethereum price had pulled back to $1,594 to trade near $1,594 with the $1,500 support expected to absorb the increasing selling pressure.

Ethereum Price Poised for a Major Breakout – Here Are the Levels to Watch

Investors are eagerly awaiting the Federal Reserve’s decision on raising interest rates and expect the regulator to continue with its tough measures to curb economic growth. However, market watchers are eyeing a rise of 25 basis points, which is relatively lower than the 50 basis points increase in December.

This positive sentiment follows a decline in general inflation for December from 7.1% recorded for November to 6.5%. While the decline isn’t large enough to completely take the Fed off the gas pedal, it does signal that the economy is headed in the right direction.

The CPI is an indicator for the Fed to either tighten its monetary measures used to combat inflation or loosen its grip – allowing markets to recover, especially high volatility indices such as digital assets. The ones.

Meanwhile, Ethereum price remains in a position to significantly break above the $1,680 resistance. Since the temporary support at $1,600 has already been penetrated, ETH price may be forced to look down towards $1,500 before resuming its upward move. Based on the daily time-frame chart, the 200-day exponential moving average (EMA) (in purple) is strengthening support in that area.

Adding credibility to the short-term bearish outlook in Ethereum price is a buy signal from the Moving Average Convergence Divergence (MACD) indicator. The MACD line in blue confirmed the call for traders to unload their bags, locking in profits by flipping below the signal line in blue (shaking weak hands).

Doc Profit, analyst and trader on Twitter shared with his large following on Twitter that “weak hands are shaking, market awaits FOMC in 2 days.” Analysts refer to the pullback as “fake dumb” meaning “shaking of weak hands” ahead of the next breakout in a few days.

The same daily chart reveals the formation of a falling wedge, the breakout of which helped Ethereum price sustain its upward move to $1,680 in January. It is noteworthy that ETH price is currently trading about halfway through the 46.55% breakout target.

For such a huge jump to $1,947, a retracement would be expected before another bullish move. That said, the support at the 200-day EMA remains crucial for a resumption of the uptrend. However, the bulls could accelerate the recovery process by reclaiming the lost ground above $1,600.

With this support level, investor confidence in the uptrend could increase, thus flipping the odds in favor of a quick move to close the gap near $1,947 and subsequently opening the door for further gains above $2,000.

Renowned trader and crypto analyst, Rekt Capital informed his 334k followers on Twitter that Ethereum remains in a position to breakout above the monthly downtrend resistance. According to his chart, such a move would take Ethereum to $2,275. On the other hand, a failure to successfully hold this move could see Ethereum retest support at $1,068.

Key Fundamentals to Watch for Ethereum Price

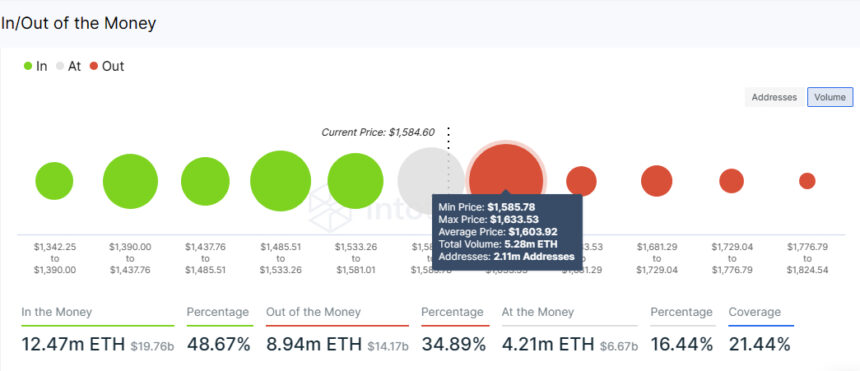

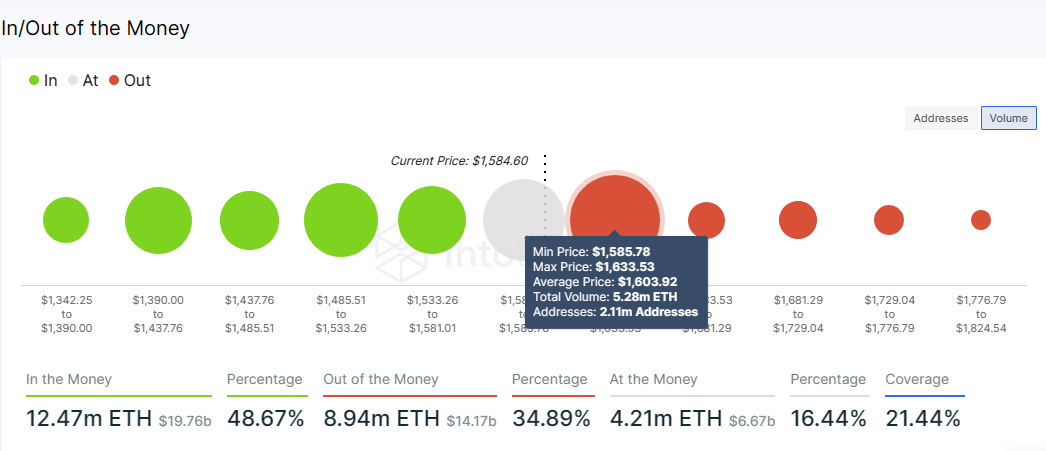

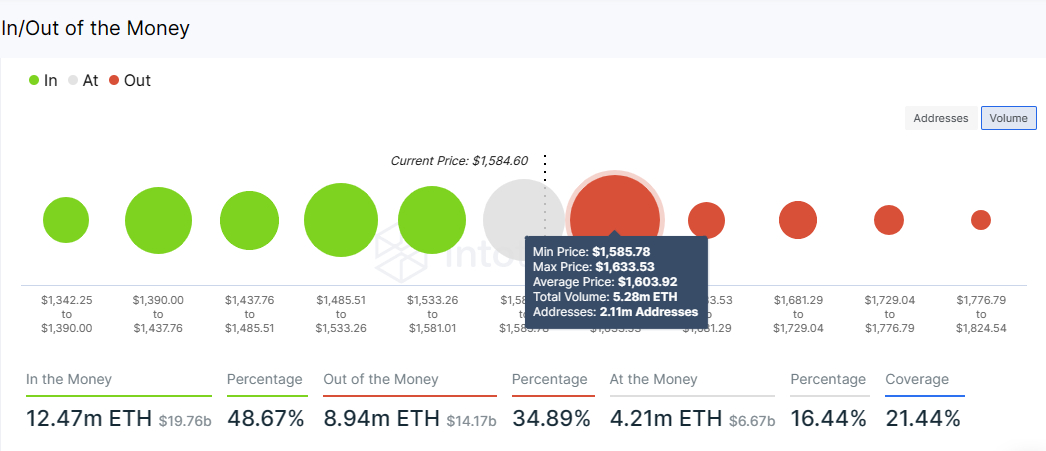

The area between $1,585 and $1,633 is home to at least 2.11 million addresses that bought 5.28 million ETH in the past. These addresses are currently out of the money (facing an unrealized loss) according to on-chain data presented by IntoTheBlock (ITB).

The sheer presence of sellers in this area means that as Ethereum price corrects, some investors may sell at its various break-even points, resulting in increased overhead pressure. Bulls need to be prepared for such events as they tend to push ETH price higher.

A clear break above this broad seller congestion could be the only boost needed to propel Ethereum to the wedge breakout target at $1,947 and possibly guide ETH above $2,000.

On the other hand, Ethereum support sits atop a cluster of medium-to-strong support areas – illustrated by the green circles. Therefore, the continued pullback may not go below $1,500. Furthermore, it validates the above price analysis.

The bullish outlook for Ethereum price will largely depend on the Fed’s decision on interest rates. A break above $2,000 is needed to confirm a long-term bullish trend in ETH, but a decline to $1,500 and the 100-day EMA (in blue) at $1,400 cannot be ruled out, at least for now. not for.

That said, a breakout of $10,000 in 2023 could be a tall order for Ethereum price. However, the coin could close at its all-time high of $4,878, especially if the bulls take support of another recovery phase above $2,000 in the coming days, possibly in a few weeks.

Should You Buy Ethereum Today?

before you invest in ethereumYou may want to consider ETH as well as other high potential crypto projects.

We Review the Top 15 Cryptocurrencies for 2023, as Analyzed by crypto news Industry Talk Team.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

Related Articles:

Bitcoin Crypto Related Post