ethereum native token ETH Deflation is occurring once again, as more tokens have been burned than newly issued coins, prompting some supporters to point to ETH as the good money of the future.

The latest deflationary turn for ETH occurred during the crypto market crash over the past few days, as transaction fees on ETH soared as traders rushed to send more tokens to and from exchanges. And as Ethereum users know by now, the network just introduced its new token burn mechanism. EIP-1559 Upgrade in August 2021. The upgrade created a system where a portion of the transaction fee is burned, causing the issuance of ETH to be – sometimes – deflated.

As a result of this new burn mechanism, more tokens are burned when trading with more ETH and paying transaction fees.

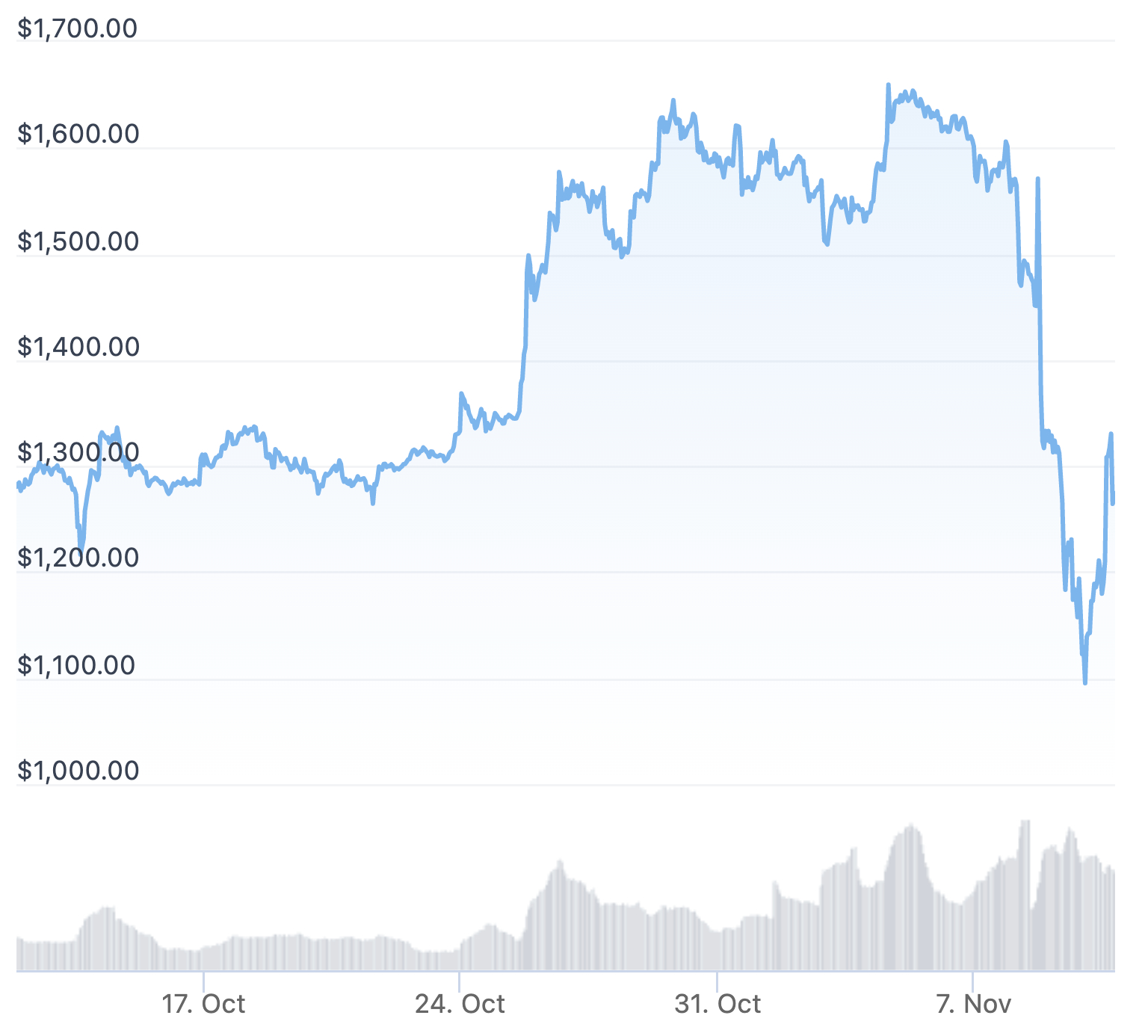

According to data from the ETH tracking website ultrasound.moneyThere has been a steady decline in ETH supply since 8 October, and turned negative on 9 November. Since then, supply has been declining at a rapid rate, reaching an annualized -1% supply increase at the time of writing.

One thing to note, however, is that the ETH supply has decreased as the token prices declined along with the broader crypto market. In the past 7 days, the price of ETH is down by more than 16% over the past 7 days, although it remains almost unchanged when looking at the month as a whole.

no new ideas

ETH as Ultra Sound Money was brought to you by Ethereum Foundation researcher Justin Drake in an interview on the Bankless podcast in early March 2021:

However, others are of very different perspectives, for example bitcoin (btc) Proponents often argue that the predictable and irreversible issuance of BTC makes good money, and the same cannot be said of ETH.

Among those who argued for this is early bitcoiner Kyle Torpy, who wrote in an op-ed for cryptonews.com He ETH is far from ultra sound money,

In other words, the issue of whether ETH is – or could ever be – is still up for debate, and will probably remain so for the foreseeable future.

Bitcoin Crypto Related Post