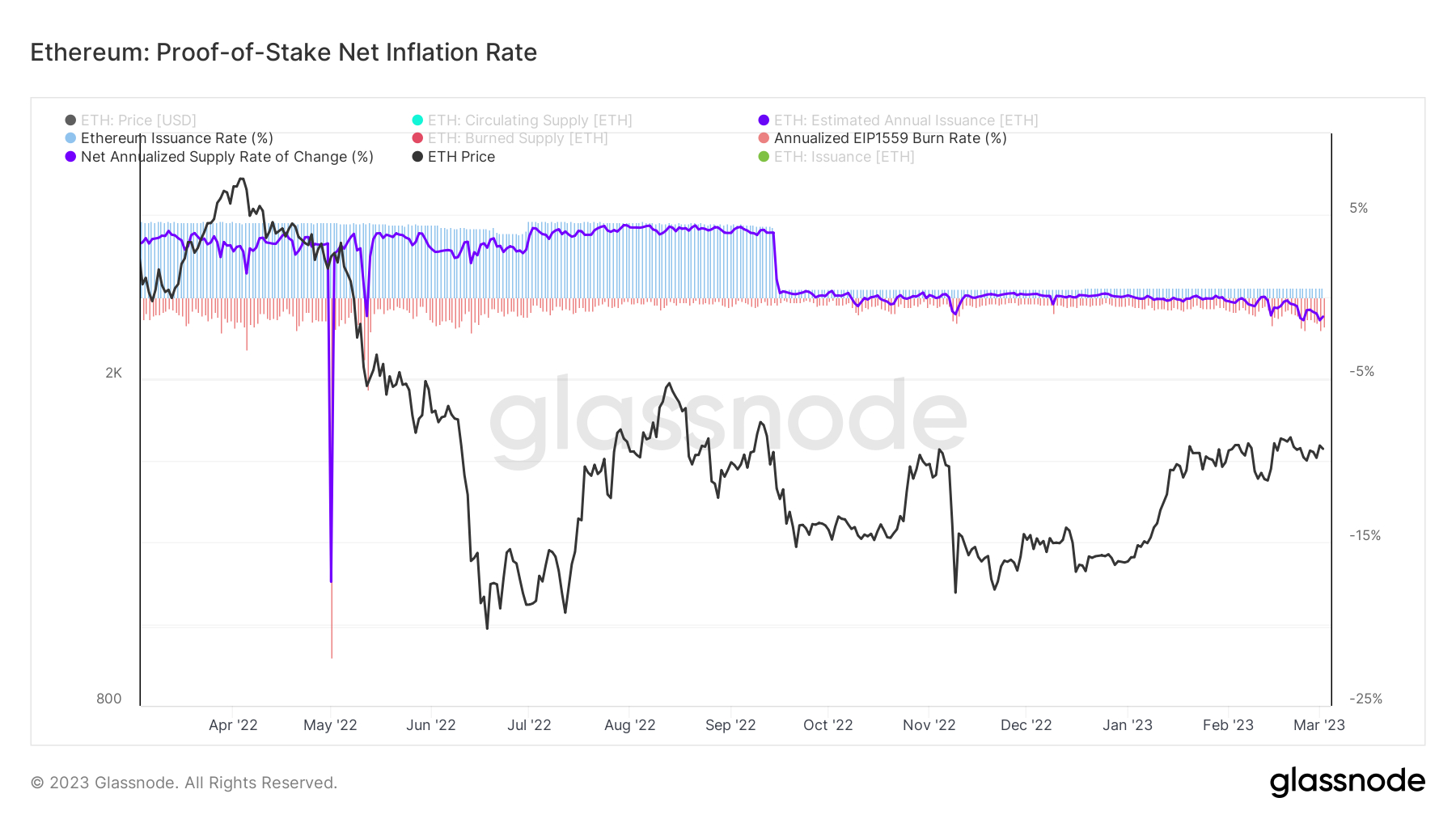

the rate at which ether Supply is shrinking, having recently reached its highest level in years. On Wednesday, the annual EIP-1559 burn rate was exceeded ETH The 1.425% increase in the issue rate is the highest since a bizarre incident last May where the deflation rate rose above 17% for just one day.

When the deflation rate goes up, it means that people ETH Tokens are becoming increasingly scarce. Most analysts believe it should promote cryptocurrency price in the long run.

ETH/USD declined by about 5.0% on Friday as crypto markets rattled on concerns about crypto banks silvergate and reports that tether scammed To maintain access to the global banking system, suggests that traders are not paying much attention to recent developments in the ETH deflation rate.

Indeed, currently changing hands around $1,570, ETH/USD is now down about 10% from its recent highs in the mid-$1,700s. While ETH may be down since early February, its deflation rate certainly is not. In fact, it seems to be trending more.

Traders should keep deflation in mind as a potential talking point/narrative that could boost ETH later this year. Other topics that can also boost like ethereum network upgradeIncluding the launch of staking ETH withdrawals next month, a possibility DeFi resurgence And a possible correction in the broader backdrop, if a US recession can be avoided and falling inflation gives the US Federal Reserve room to cut rates.

Explainer – What is bullish ETH deflation?

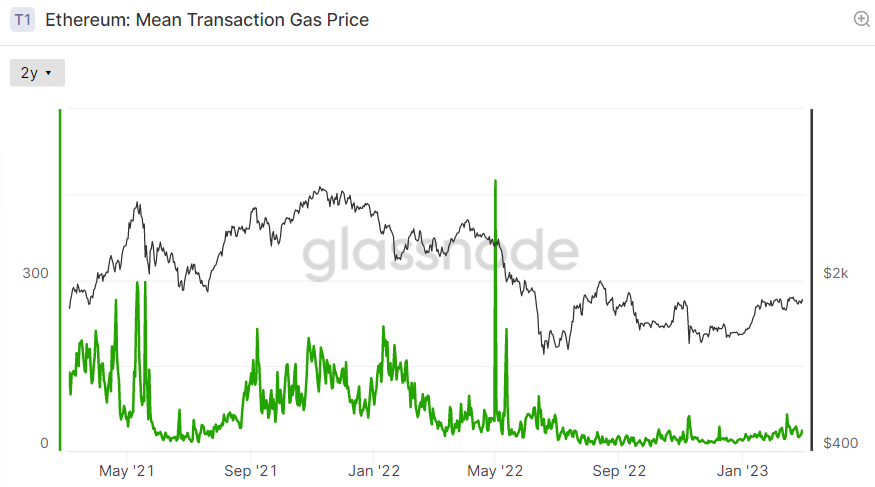

Before answering the question why ETH deflation rate is increasing, we need to understand why ETH deflation occurs and for this we need to understand how ethereum network fee the structure works. Network charges are divided into two components. The first is the base fee that all users must pay to ensure that their transactions are accepted and processed on the blockchain.

Then there is an optional trick that users can pay to process their transactions more quickly. The Ethereum network automatically calculates a base fee, which increases during times of heavy network traffic. Ethereum Improvement Proposal (EIP) 1559, which was implemented into the Ethereum code in the August 2021 London hardfork, requires that all of these base fees paid by users are then burned, permanently removing the token from circulation. be removed

As a result, when the base gas charge increases, the ether burning rate also increases. When this burn rate exceeds the ETH issuance rate, which is around 0.55%, the ETH supply will decline. ETH is issued to the nodes and stakers that secure the Ethereum network. The chart below shows how the Ethereum network (Base) gas fee has been slowly increasing in recent months.

ETH deflation rate could accelerate further

Persistent high network congestion pushed the daily annual ETH (EIP 1559) burn rate up to 6.0% in early 2022. At the time, the Ethereum blockchain was still powered by a very energy-intensive proof-of-work consensus mechanism and, as a result of the very high energy fees and miner rig costs incurred by miners operating the network, Ethereum’s issuance rate was limited. was higher at around 4.4-4.6% per annum.

This means that the deflation rate of Ether only reached its maximum level of around 1.5%. If a resurgence in the broader crypto and DeFi market can send the EIP 1559 burn rate back to its early 2022 high, the new very low ETH issuance rate means that Ether’s deflation rate could reach 5.5%.

Where next for ETH price?

While the ETH deflation may sound very exciting, bulls may need to be patient as the near-term outlook for the world’s second-largest cryptocurrency by market capitalization approaches. ETH’s latest drop has sent it below an uptrend it has sustained since the beginning of 2023.

The odds could potentially be bad for ether’s near-term price outlook, with a test of the February low in the mid-$1,400s potentially on the cards. Of course, Friday’s aggressive rally in US stock markets, if built into next week, could prevent further downside in crypto markets. Whatever the case, ETH is likely to continue to bounce around the mid-$1,400 to mid-$1,700 range in February.