The first exchange-traded fund focused on NFTs and metaverse assets has announced closure as the crypto winter continues to take more victims.

The Defiance Digital Revolution ETF, listed on the NYSE under the ticker NFTZ, will close by the end of February. Press release, The fund will begin liquidating its portfolio assets on February 16, and will not accept orders for new construction units after that day.

“Prior to the liquidation date, shareholders may only be able to sell their shares to certain broker-dealers, and there is no assurance that there will be a market for the Fund’s shares during that time period,” the announcement said. Is.

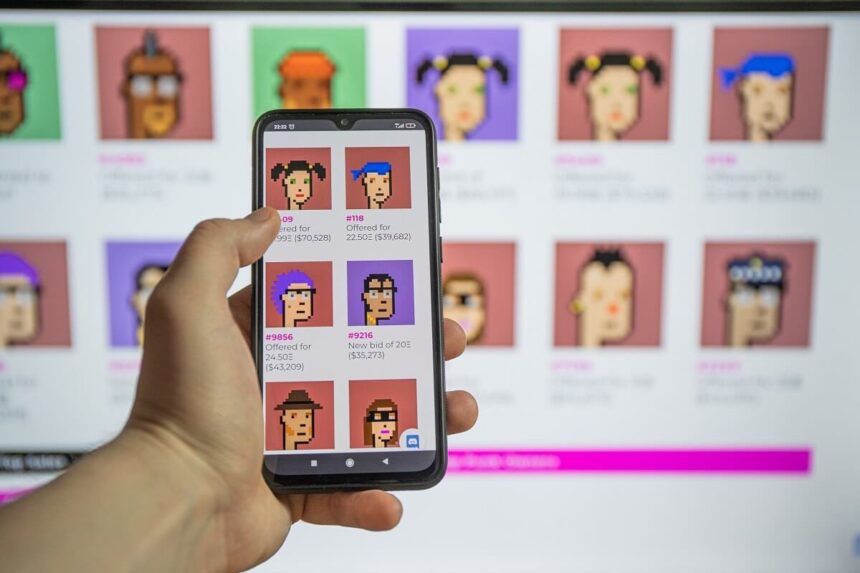

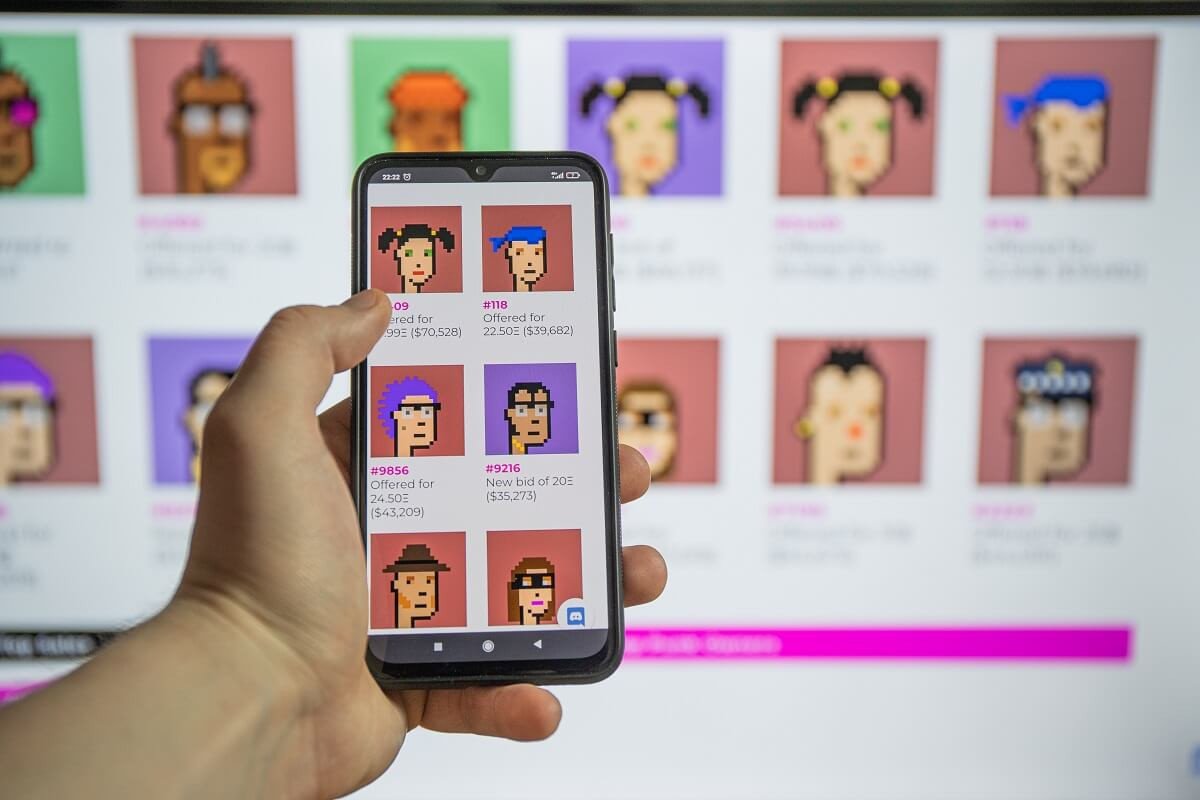

Launching in December 2021, the fund is offered by Defense ETFs and is built to track the BITA NFT and Blockchain Select Index, an index that tracks blockchain-related companies and non-fungible tokens. Fund shares fall more than 72% since its inception.

The fund’s closure comes as the hype on NFTs has cooled dramatically over the past year amid broader market downturns that have seen major cryptocurrencies such as bitcoin and ethereum hit all-time highs. lose about 70% of their value.

According to NFT experts from Casino en Ligne, the sale of non-fungible tokens saw A decline of 83 percent year-on-year in 2022. In addition, across all markets, including art, gaming and collectibles, NFT transaction volumes declined by at least 83 percent.

The NFT space reached an all-time high in January 2022, with monthly sales reaching $2.8 billion. However, this number saw a sharp drop earlier this year after bankruptcies and nearly $2 trillion were wiped off the crypto market.

Despite the bloodshed in the NFT market, several high-profile companies have announced plans to expand into NFTs. More recently, Amazon revealed It plans to launch a “digital asset venture” this spring focused on non-fungible tokens and Web3 gaming.

In November, a patent filing revealed Sony’s vision for a system that can be used to track the creation, use and transfer of digital assets created within games. The patent envisions a system for “creating, modifying, tracking, authenticating and/or transferring unique digital assets” associated with video games.

Furthermore, investment giant Fidelity also signaled its intention to delve deeper into cryptocurrencies and Web3 with three new trademarks it filed last December. The filing focuses on NFTs and virtual worlds such as the metaverse.

Bitcoin Crypto Related Post