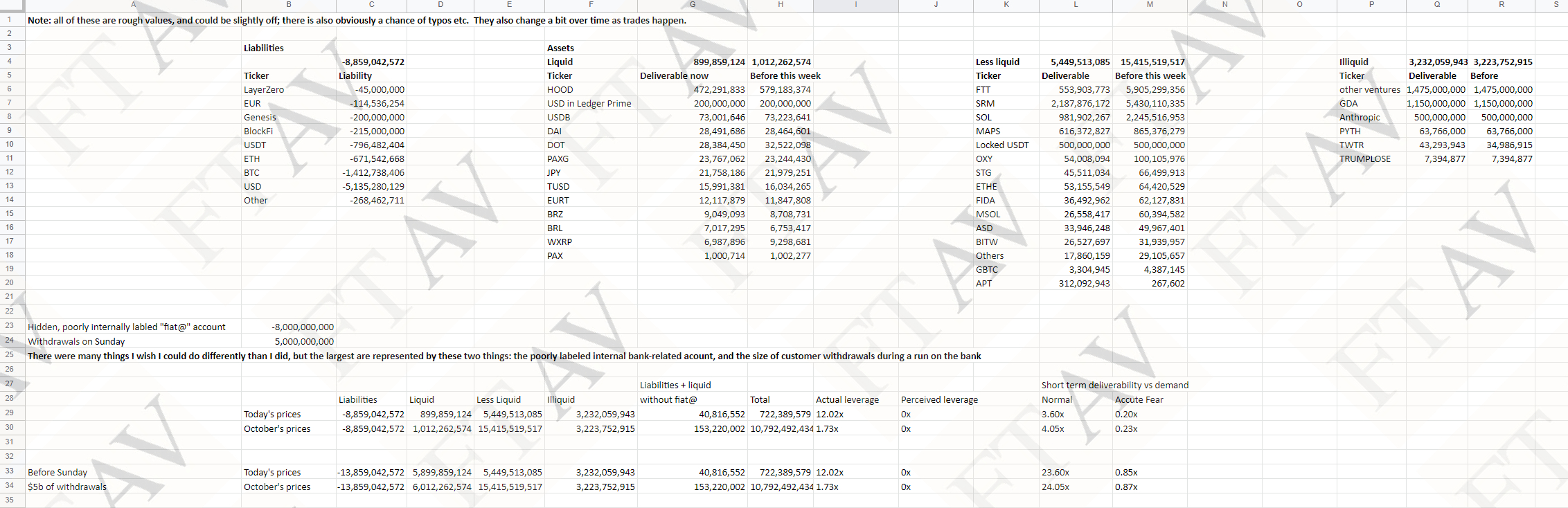

Apart from the damage caused by ftx The hacked, bankrupt exchange is apparently unable to account for $1 billion to $2 billion of client funds, people familiar with the matter say, and its The balance sheet reflects liabilities of $8,859 million Against a net worth of just $899 million.

In addition, $10 billion was transferred to affiliate Alameda Research, and perhaps most damagingly from a legal standpoint, FTX insiders created a “back door” to its accounting systems. reuters Report.

A backdoor to circumvent inspection requirements opened the FTX leadership to accusations that they were trying to shield their nefarious activities from the rest of the group’s employees.

These latest explosive findings follow the exchange’s admission that There was an “unauthorized transaction”,

At least $600 billion lost in hack – and what balance sheet itemization is TRUMPLOSE and other anomalies

So far it has been estimated that $600 million may have been withdrawn from the wallet which was either a . was rented or nefarious behavior by insiders.

The sketchy balance sheet shown above includes several large “less liquid” and illiquid entries, such as $2.1 billion worth of Serum (SRM) tokens, which would be worth much less than the book entry if marked to market.

There are other odd entries, such as “Anthropic” at $500 million; “TWTR” $43.2 million and “TRUMPLOSE” $7.3 million.

TWTR is certainly the ticker for Twitter, but it’s sitting in the illiquid part of the ledger, which is odd, even though Twitter is now a private company, as a shareholder when it was public than if an FTX entity was a shareholder. , FTX should have received $54.20 per share for its stock holdings.

Crypto prices remain weak as the FTX disaster unfolds. Bitcoin is down 2% today at $16,565.

FTX crypto operation “run by a gang of kids in the Bahamas”

but as report appears Regarding how the close executive team lived and worked together—some of them off and on relationships—there are growing a variety of fears about the way FTX is run.

A nexus of former Jane Street traders is at the heart of the company’s operations out of a Bahamas mansion where several executives live, according to a story on Fortune citing its own and Coindesk reporting.

Damn it, one person said of FTX: “The whole operation was run by a gang of kids in the Bahamas”.

However, there are nine people who live together in luxury housing, including Sam Bankman-Fried, the former CEO of FTX.

are among them Alameda Research CEO Carolyn Ellison, FTX Co-Founder and Chief Technology Officer Gary Wang and FTX Engineering Director Nishad Singh. The other six are all FTX employees, according to Fortune.

“Gary, Nishad and Sam control the code, the exchange’s matching engine and funds,” said the first person familiar with the matter. “If they move them around or input their own numbers, I’m not sure who will notice.”

Another person claiming to be familiar with the company’s operations said: “They would do anything for each other.”

In addition, Wang, Nishad and bankman-fried The giant was the sole board member of the FTX Empire, the philanthropic arm of the FTX Foundation.

Bankman-Fried, like Gary Wang, is a graduate of MIT.

The FTX and Alameda offices are located next to each other on a campus they share with various crypto incubator projects.

These internal ties made FTX a nest of allegedly conflicting interests and oversight nightmares.

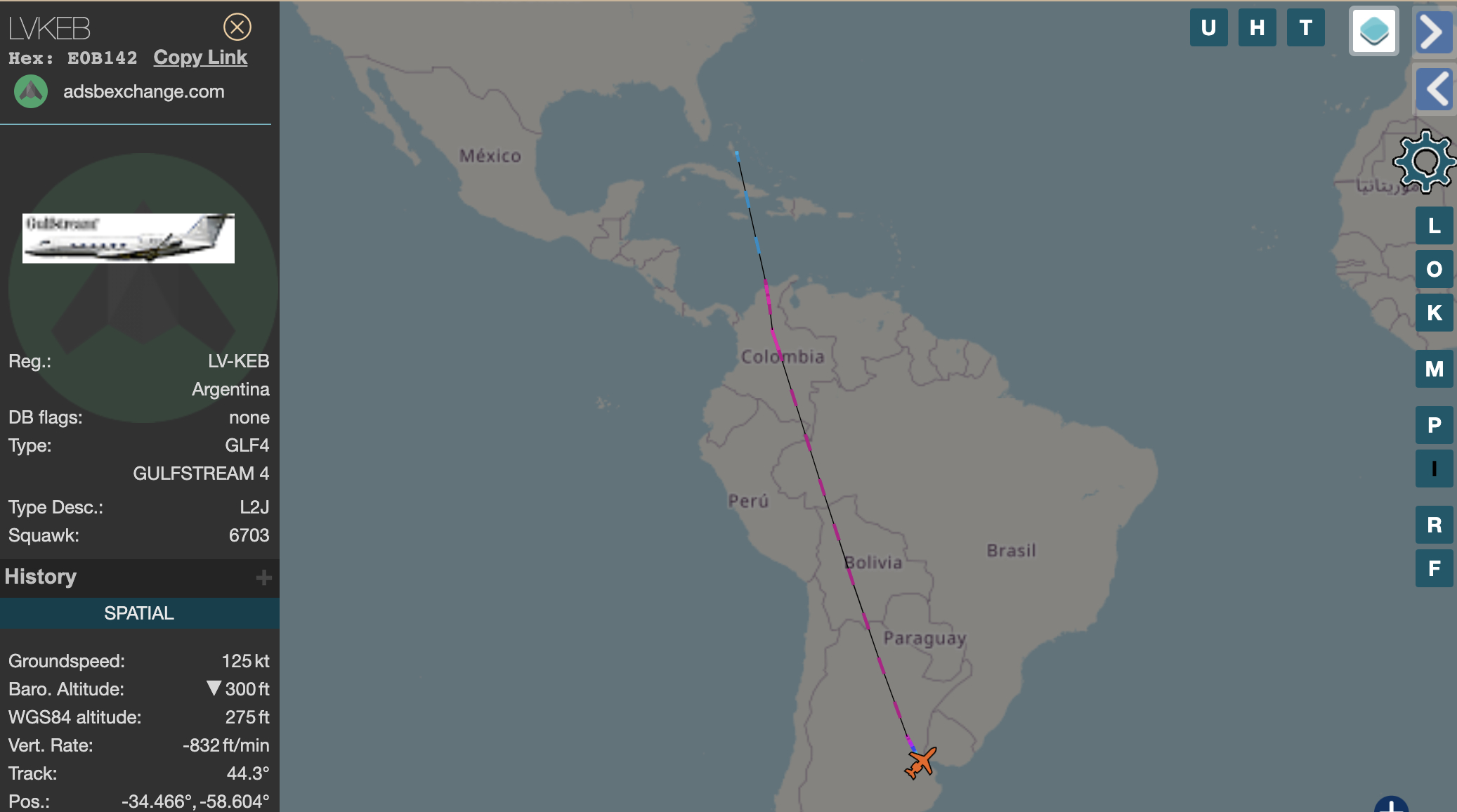

Where in the world is Sam Bankman-Fried?

Rumors are now circulating on social media that Sam Bankman-Fried and other members of the top team were on a private jet flight from the Bahamas to Argentina at 01:45 EST on Saturday morning.

The Gulfstream private jet registration is LVKEB and is considered an FTX asset.

https://globe.adsbexchange.com/?icao=e0b142

Yesterday, Gulfstream’s journey was the most tracked flight in the world.

However, the SBF has since communicated Reuters via text And he is said to have replied “no” when asked if he was in Argentina, apparently confirming that he is still in the Bahamas.

Cryptonews has also reached out to SBF on Telegram, but had not received a reply by press time.

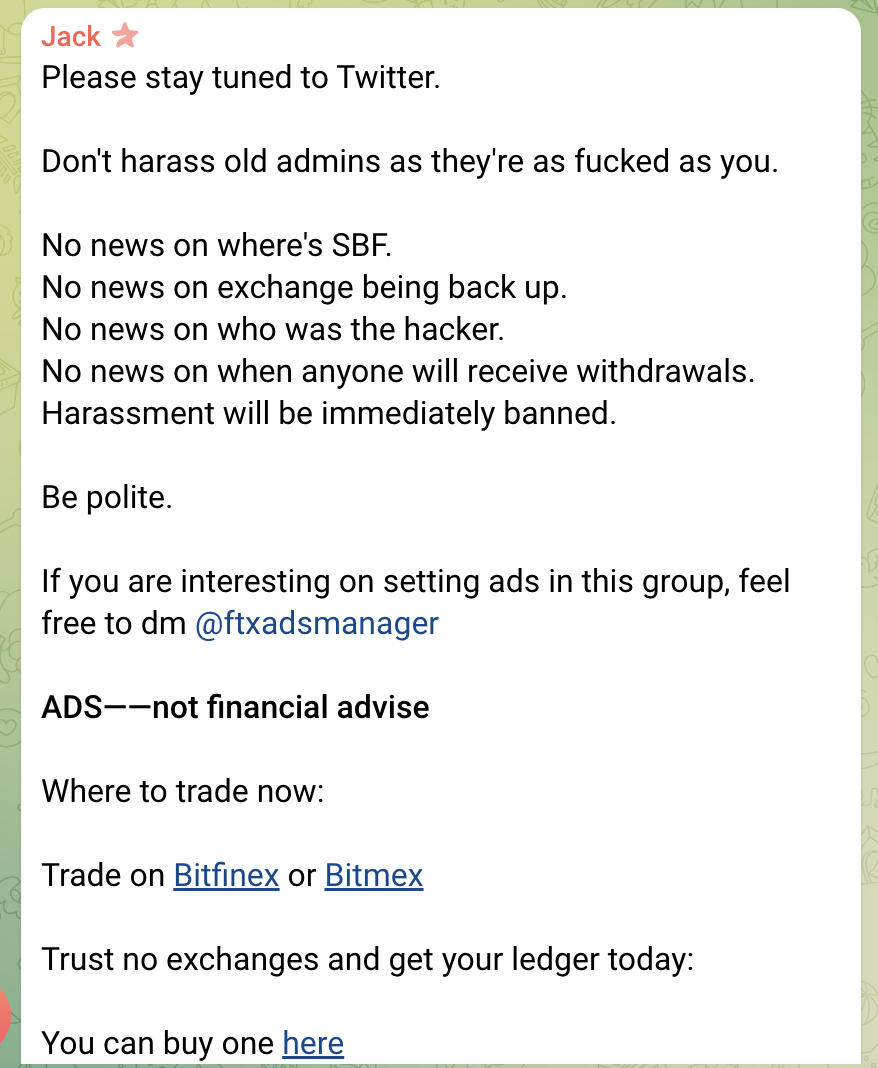

But on the official FTX Telegram a pinned message An administrator named Jack says he does not know where the SBF is – in other words, he is not corroborating the former CEO’s statement to Reuters that he is still on the Caribbean island of the Bahamas. .

speaking in conference in indonesia On Saturday, Binance CEO Changpeng Zhao (CZ) believes that the collapse of FTX has seriously damaged the crypto space, setting it back years.

CZ’s critics may argue that they should have thought of this before the bank run on FTX went into effect.

“I think basically we’ve been set back a few years now. Regulators are going to scrutinize this industry really, really hard, which is probably a good thing to be honest.” CZ .said

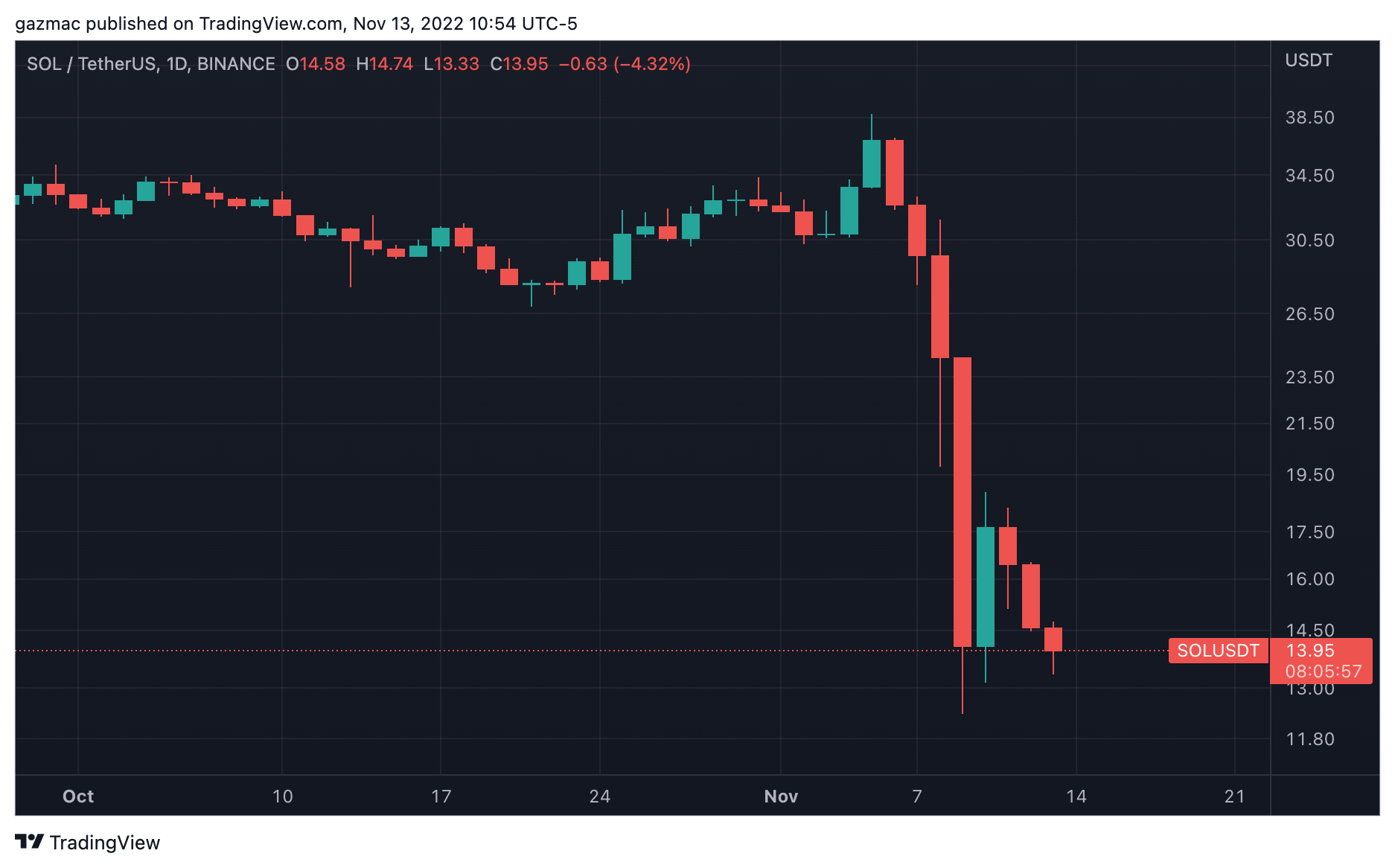

Solana, which has so far had a close relationship with FTX, is seeing selling pressure in its SOL token, which is down 7% today to $13.98.

The extreme downturn has extended to BTC wrapped on the Solana chain, which is down 76% in an ominous sign for those involved in the coin ecosystem.

FTX victims have begun to take proactive action by preparing for legal proceedings.

group is called FTX Class Action Lawsuit (chat) Already exists with over 50 members and is growing rapidly, as some worry that the official Telegram may be shut down and therefore wish to settle independently from the outlets of the exchanges that have been filled.

The group’s founder, AJ, told Cryptonews that they haven’t hired a lawyer yet, but “should do so in a few days”.

The group has set up a Google Form titled “Users Affected by FTX Bankruptcy”To collect information from creditors.

Crypto Exchanges Should Clean Up Their Deeds Fast

In yet another example of the shoddy practices taking place on some exchanges, it has just emerged that crypto.com Accidentally sent 320k ETH in customer funds to Gate.io, which get.io returned promptly – as shown in get.io Proof of stock.

And doubts are also being raised about the veracity of some Proof of Reserves (PoR) reports being published by centralized exchanges in some quarters. Mario Naufal, CEO OR IBCGroup.io Not affected by PoR from Gate and Huobi

In other news, Binance has passed on FTT deposits after noticing “suspicious movement of large amounts of FTT”.

The price of FXT token (FTT) continues its seemingly unstoppable descent of $0:

Providing some advice for crypto market participants, CZ tweeted “@TrustWallet your keys, your coins” over the past hour in reference to the Binance self-custody wallet and the mantra of crypto security.

The lessons of self-custody seem to have been ignored by many in recent times, as exchanges seem to have become a safer place to trade and the custody of assets can be trusted.

Trust Wallet Token (TWT) is up 63% today at $2.02:

Crypto Isn’t Totally Gloomy, Provided You Know Where To Look – Check Out These 2 New Tokens

One such area is in pre-sale tokens, which can provide a haven at times like these – provided you pick the right ones.

Two presale tokens attract attention today – dash 2 trade (D2T) and robot era (Torah).

dash 2 trade is building an analytics and signals trading platform with a state-of-the-art dashboard, unique presale scoring system, social sentiment analysis and social trading, auto-trading and backtesting.

in the vote of confidence in the project, elbank and, recently, bitmart Both have signed deals to list the tokens after their pre-sales end.

robot age Could be the next hot Metaverse gaming project and it’s very similar to Sandbox. Watch the video for more details about this 30x opportunity. Robotera is supported by KuCoin Exchange and Polygon Studio.

Bitcoin Crypto Related Post