New FTX CEO John Ray Revealed Today in a court declaration “Complete failure of corporate control” on bankrupt crypto exchange FTX.

FTX CEO John Ray highlights the enormity of the task facing them in finding and securing debtors’ assets as liquidators seek to uncover the administration and management nightmare that is FTX.

Despite the latest grim news, crypto prices are holding relatively well, with bitcoin holding firm at around $16,696, and a few bright spots like litecoin up 8% to $62 and XRP Ticking at $0.38, up 2.7%.

Good FTX News: $740m in Crypto and $560m in Cash Found and Safe

$740 million in crypto has been secured in cold wallets and $560 million in cash so far.

It also turns out that some parts of the group may be solvent, such as FTX Capital Markets and LedgerX, both regulated entities, so this is some good news for creditors.

Wholly owned equity entities Embed Financial Technologies and Embed Clearing are also considered solvent.

Custodian FTX Value Trust Company is also solvent, with the proviso Re uses throughout its document – “based on the information I have reviewed at this time”.

…but the rest of FTX is a horror show of amateurism and possibly criminal behavior

Additionally, in his announcement, Ray says that $372 million in unauthorized transfers were made after the petition date, in addition to the “minting” of approximately $300 million in FTT tokens by an unauthorized source.

Other numbers left out of the announcement include $1 billion that was loaned to Alameda Research, the hedge-fund-turned-trading-desk of FTX Group, to Sam Bankman-Fried and $500 to Nishad Singh, former director of engineering. million were given. FTX and Alameda Research.

At the top of Ray’s announcement he clarifies his initial assessment:

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of reliable financial information as has occurred here. Inexperienced, unsophisticated and potentially compromised by compromised system integrity and faulty regulatory oversight overseas For the concentration of control in the hands of a very small group of individuals, this situation is unprecedented.

And here are some really glaring examples of the lack of control systems and oversight that seem to be the norm at FTX Group:

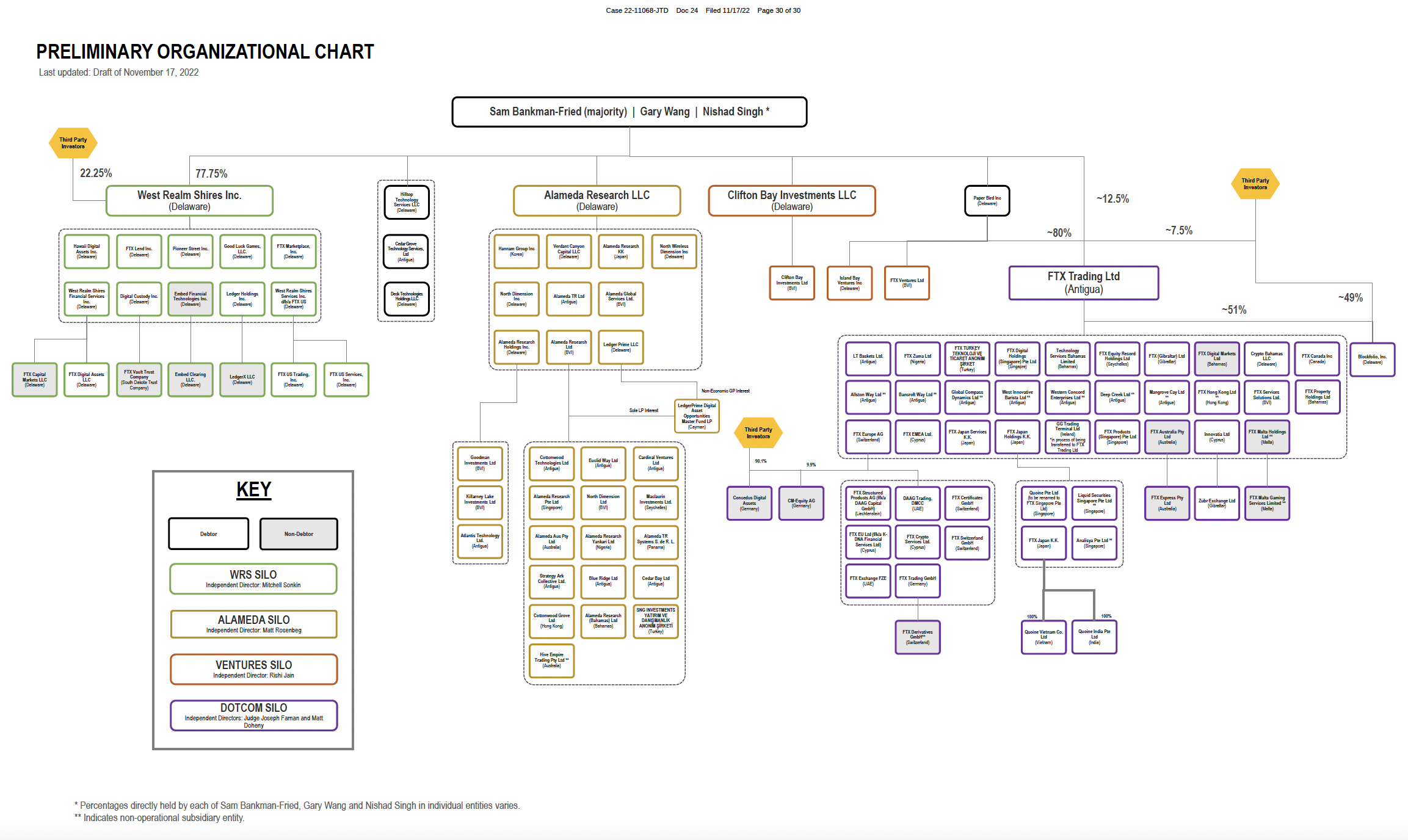

“Unacceptable management practices include the use of an unsecured group email account as root user to access confidential private keys and critically sensitive data for FTX Group companies around the world, the absence of daily reconciliation of positions on the blockchain, the software Almeida’s covert exemption from certain aspects of FTX.com’s auto-liquidation protocol, and the absence of independent governance between Almeida (90% Mr. Bankman-Fried and 10% Mr. Bankman-Fried. Wang) and Dotcom Silo (in which third parties invested).

You will not be surprised to hear that House Financial Services Committee is holding a hearing And looks forward to hearing directly from SBF, Alameda and Binance.

Want to buy a great new home? emoji reply in chat app will recover company fund for him

And when it came to buying a house and other personal items using company money, only one emoji was needed for authorization:

62. The debtors did not have the kinds of disbursement controls that I think are appropriate for a business enterprise. For example, FTX Group employees submitted payment requests via an on-line ‘chat’ platform, where a separate group of supervisors approved disbursements by responding with personalized emoji.

63. In the Bahamas, I understand that FTX Group’s corporate funds were used to purchase homes and other personal items for employees and consultants. I understand that there does not appear to be documentation for some of these transactions as loans, and that some real estate was entered on Bahamas records in the individual names of these employees and advisors.

FTX Group was a hobbyist operation and its depositors and other creditors are now paying the price.

Even basic record-keeping and reconciliation are so lacking, that none of the debtors have much idea which assets belong to its many entities, or its digital assets on different blockchains. How to go about finding and securing

to address and track $372 million unauthorized transferr And in what else could be an unauthorized transfer, before filing for Chapter 11, Ray reports that debtors have called in professionals:

In response, the debtors have hired forensic analysts to identify potential debtor assets on the blockchain, cyber security professionals to identify the parties responsible for unauthorized transactions on the date of the petition and subsequently, and investigators to identify What can be very important transfers to start the process. Debtor assets in the days, weeks and months prior to the petition date.

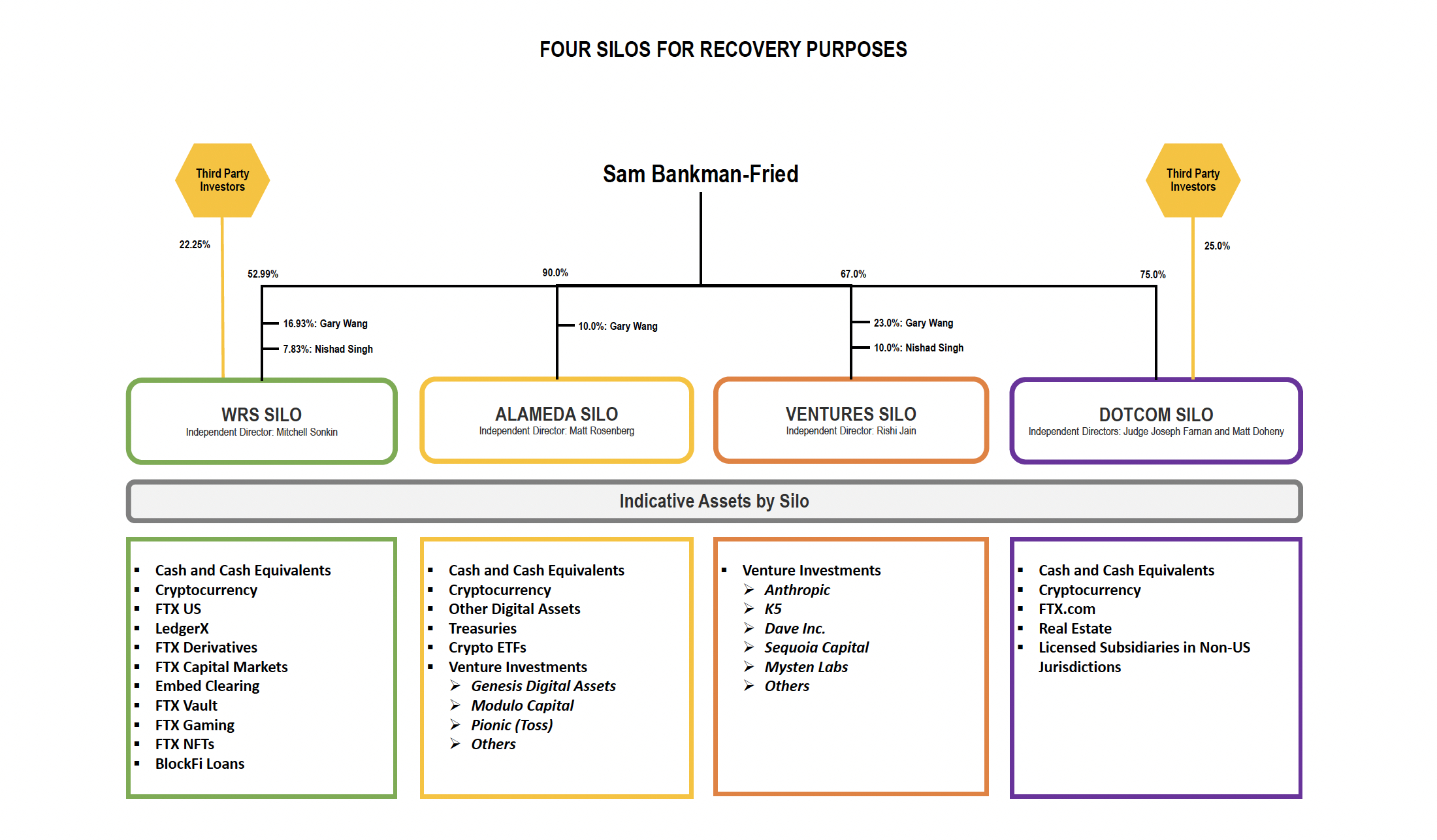

Helpfully, the new CEO has “identified four clusters of businesses” for recovery purposes which he divided into four silos:

- West Realm Shares (WRS) silo, which includes FTX US and Ledger X, FTX Capital Markets. This is where some of the more solvent parts of the group are found, such as FTX Capital Markets, which is an SEC regulated broker dealer.

- Alameda Silo

- Ventures Silo, which includes Island Bay Ventures, FTX Ventures and Clifton Bay Investments

- Dotcom silos, which are FTX.com and similar exchanges in non-US locations. This silo includes third party investors.

See the chart below:

Loose or Non-existent FTX Controls Inevitable for Downturn as Crypto Winter Begins

Some of us in the Cryptonews Virtual Office joked when crypto winter started that if you want to know which companies will shut down first, look at which companies spend the most on marketing.

Marketing generosity was indeed a trait that could be associated with FTX, with logos popping up in its stadium sponsorship deals and high-profile sports such as Formula 1 racing.

Add to this an allure for buying real estate and venture investment, it is not too difficult to see how all this could overcome any buffer. ftx group May be for lean times.

Adding to the precarious situation was FTT lending to FTX using FTT as collateral, and then loans going bad to crypto lenders in the wake of the explosion of TeraUSD and Luna in May, and this was retroactive, only time before the moment. It was about the arrival of truth.

The moment came when CZ and SBF decided to turn the feud into a bank run – or rather let things get out of hand and destroy the entire industry.

Here are some more details, reportedly from the Alameda All Hands meeting, ‘explaining’ how the trading desk lost all its money:

SBF says ‘f**k regulators’ in latest interview – he may live to say so

In An interview with Vox’s Kelsey PiperSBF, when asked if the comment he made in a previous interview about the need for good rules was just PR, he replied (in a DM conversation on Twitter):

Yes just PR; rubbish regulator; they spoil everything; They don’t protect customers at all.

The SBF has since claimed that their online conversation was never intended for publication, but it is now too late, although Vox remains adamant that the SBF knew it was for publication.

The casual observer of this colossal crypto catastrophe could be forgiven for speculating that the SBF’s cavalier approach to running business could get it some serious jail time.

The interview is essential reading and some of her throwaway lines are shocking — and thus, let’s hope it’s not true:

“Most exchanges did some version of what they did”.

Elsewhere on Twitter, SBF’s activity — including their increasingly delusional posts about perfecting customers, increasing liquidity, and futile attempts to distance themselves from the “sketchy” behavior identified in the VOX interview — didn’t go down well with CEO Ray. Used to be:

Will Grayscale Bitcoin Trust be forced into liquidation?

In other news, there are rumors that the Grayscale Bitcoin Trust is the next victim. ftx infection, Genesis’ lending problems may necessitate the liquidation of GBTC by the Digital Currency Group, of which they are both constituent parts.

Such an outcome would actually be good news for the Trust’s investors as it currently trades at a 40% discount, and investors would receive an equivalent valuation of their holdings – ie the full value of bitcoin.

But for the DCG Group conglomerate, which started last year with Coinbase Time as one of the top 100 most productive businesses On the planet, it would be catastrophic.

DCG has investments in 114 businesses, including Coinbase, Circle, Ripple, Protocol Labs, and many other leading crypto firms. according to messari data (DCG is invested in Messari), and owns Foundry, Luno, TradeBlock, HQ, and news site CoinDesk, in addition to Genesis and GBTC.

Looking for some coins worth checking out? read on

If you are looking to add some alpha to your portfolio, a good place to start is the Presale sector, and we have two interesting propositions for your watchlist – dash 2 business (D2T) and robot era (Torah).

Dash 2 Trade is the perfect antidote to the post-FTX world – its trading intelligence tools, signals and metrics will help traders and investors spot and clarify problems.

vote of confidence in the project, lbank and, more recently, bitmart Both have signed deals to list the token after the presale ends. You can buy D2T in the pre-sale now for $0.0513.

have another project robot eraWhich could be the next hot metaverse gaming project.

The gaming platform is similar to sandbox but better – you build planets using robots. Its TARO token is currently available for sale for $0.020. It’s already raised $100,000 in just a few days of its presale.

Bitcoin Crypto Related Post