of bitcoin The latest resurgence, which saw the world’s largest cryptocurrency by market capitalization hit a nine-month high in the mid-$26,000s on Tuesday, with several key technical and on-chain indicators returning to health and sending . A bullish BTC signal.

Although Bitcoin As the price dropped below the $25,000 mark once again in the Wednesday Asia Pacific session, BTC is still up over 27% from last week’s mid-$19,000 low. at that time, worries about a series of High-Profile Failures of Crypto/Start-up/Tech-Friendly Banks The cost was overwhelming.

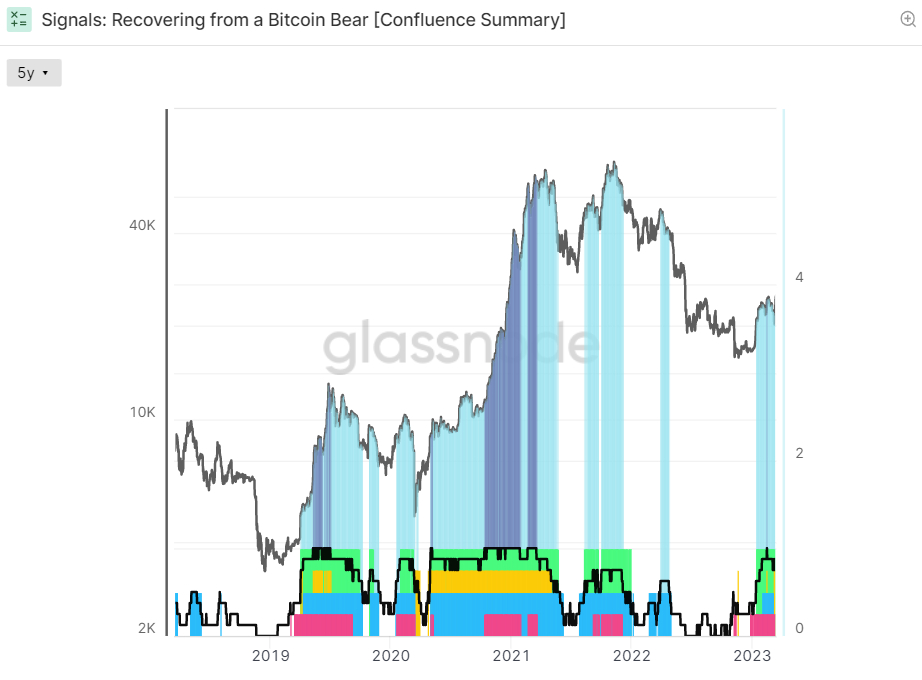

But the bulls aggressively held the 200 DMA and the realized price (both in the $19,700-800 range) as key long-term defenses. Then, came news over the weekend that US officials would 1) protect depositors and 2) introduce a new $25 billion bank liquidity program to shore up balance sheets. B T c High.

Other Major Narratives pump up rally 1) Involves the view that financial stability concerns are important and the Fed is unlikely to tighten and 2) Financial stability concerns fuel appeal BitcoinWhich represents an alternative, decentralized financial system.

Bitcoin’s strong defense of its 200DMA and realized price have also helped instill confidence in the rally. After showing some signs of weakness last week, the latest rally has several key on-chain metrics trending in the right direction.

More specifically, if bitcoin can maintain recent gains and/or move toward the next key resistance around $28,000 (as many technicians now seem to believe), crypto analytics firm Glassnode is widely calling the “Bitcoin Recovering from Beer” dashboard. The series and technical indicators are likely to flash bullish market signals once again.

Surviving a Bitcoin Bear

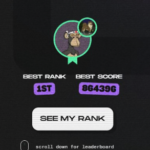

Glassnode’s “Bitcoin Recovering from Bears” dashboard tracks eight indicators to gauge whether bitcoin is trading above dominant pricing models, whether network utilization is gaining momentum, and whether market profitability is returning. is coming and whether the balance of USD-denominated bitcoin wealth is favorable for the long run. -Term HODLers.

The chart is shaded light blue when five of the eight indicators are glowing green and dark blue when all eight are glowing green.

When all eight are flashing green, this has historically been a strong bullish sign for the bitcoin market. At the moment, seven out of eight indicators are flashing green. Bitcoin is trading comfortably above its 200 DMA and the realized price, the first two. A break above these key levels is seen by many as an indicator that near-term price momentum is turning in a positive direction.

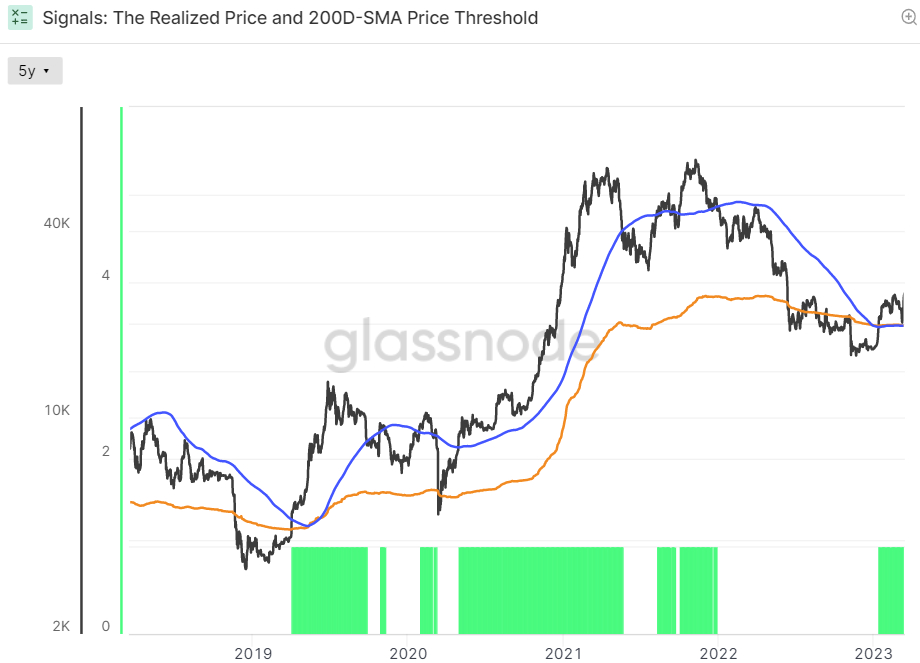

The 30-day SMA of new bitcoin address creation moved above its 365-day SMA from a few months ago, a sign that the rate at which new bitcoin wallets are being created is accelerating. This has historically happened at the beginning of a bull market.

Meanwhile, fee multiple was an indicator that turned positive on Wednesday, only to then turn negative again on Thursday. The Z-score is the number of standard deviations above or below the mean of the data sample. In this example, Glassnode’s Z-score is the number of standard deviations above or below the average bitcoin fee revenue over the past 2-years.

This means that the third and fourth indicators are related to whether network usage is once again trending positive, also sending a bullish signal.

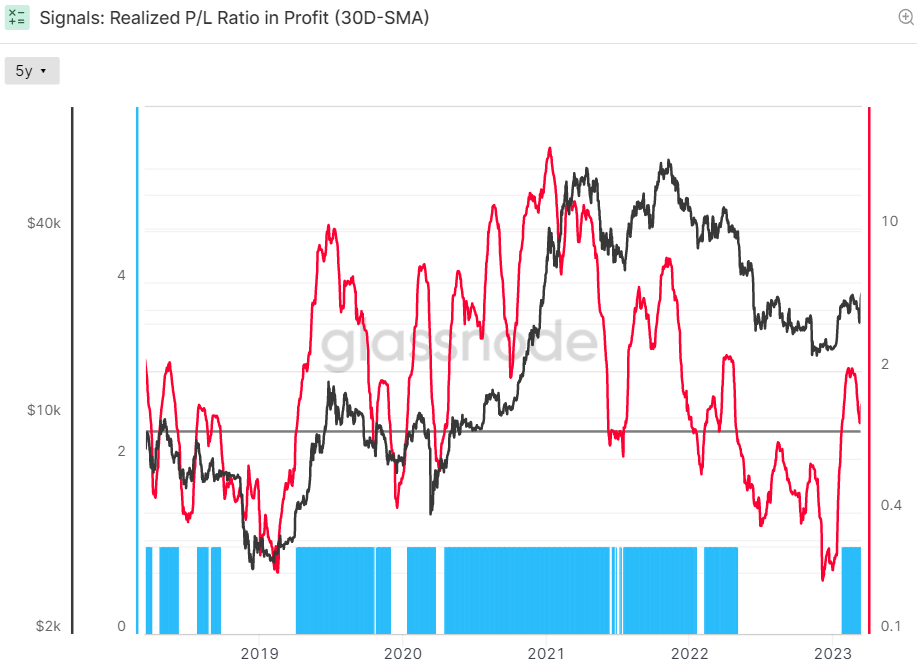

Despite a sharp pullback in recent days to reflect the recent decline in the bitcoin market, the latest reversal to new nine-month highs hit the 30-day simple moving average (SMA), moving on the fifth and sixth indicators related to market profitability. ) is placed. ) The Bitcoin Realized Profit-Loss Ratio (RPLR) indicator is above one.

This means that the bitcoin market is feeling a greater proportion of gains (denominated in USD) than losses. According to Glassnode, “this generally indicates that sellers with unrealized losses have been eliminated, and a healthy flow of demand exists to absorb profit-taking”. Therefore, this indicator continues to send a bullish signal.

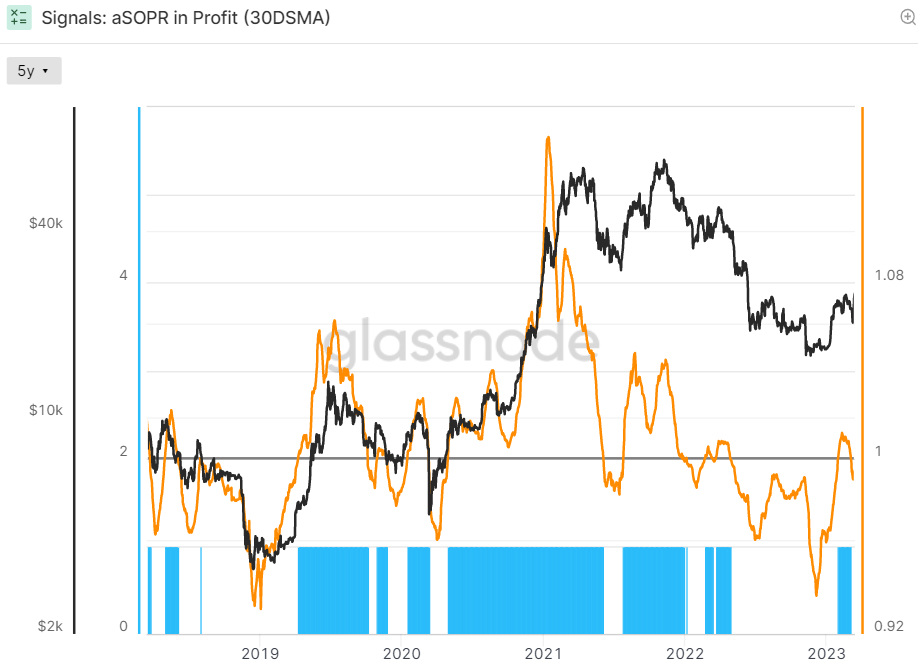

Meanwhile, the 30-day SMA of bitcoin’s Adjusted Spent Output Profit Ratio (ASOPR) indicator, an indicator that reflects the degree of actual profit and loss for all coins running on the chain, recently fell below one ( Which means it is no longer sending a )bull signal). This essentially means that, on average over the past 30 days, the market is no longer in profit.

However, the last rally in price, if sustained, is expected to push the indicator back north of one very soon. This would mean that all eight indicators on Glassnode are glowing green. Looking at bitcoin’s history over the past eight years, aSOPR rising above 1 after a long time has been a great buy signal.

Finally, there are the last two indicators that relate to whether the balance of USD money has shifted back enough in favor of HODLers to signal weak-handed seller exhaustion.

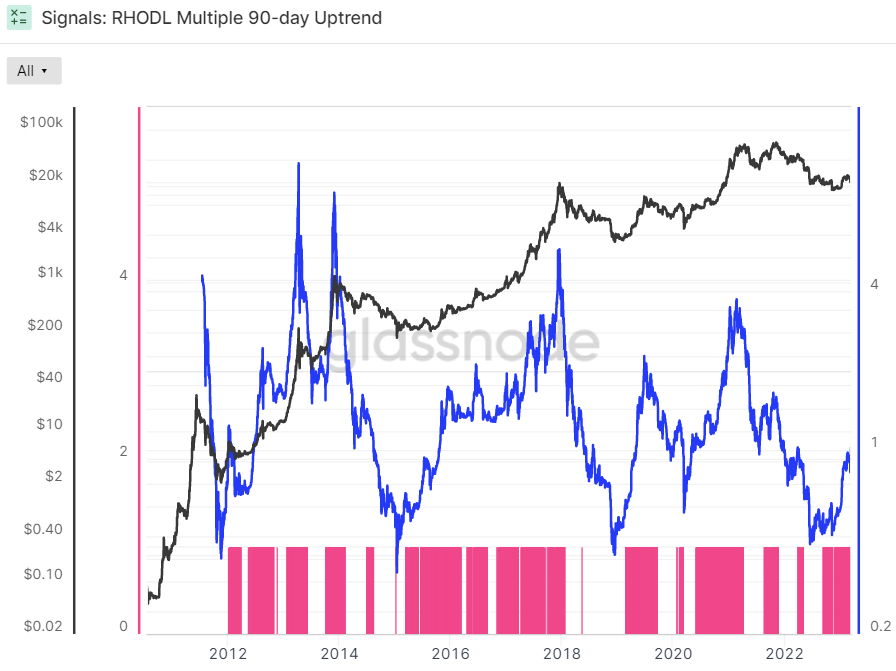

According to Glassnode, the Bitcoin Realized HODL multiple has been trending upward for the past 90 days, which is a bullish sign. The crypto analytics firm says that “when the RHODL Multiple Transition turns into an uptrend in the 90-day window, it indicates that USD-denominated funds are starting to move back towards new demand flows”. This “indicates that profits are being taken, that the market has been able to absorb them… (and) that long-term holders are starting to spend the coin,” says Glassnode.

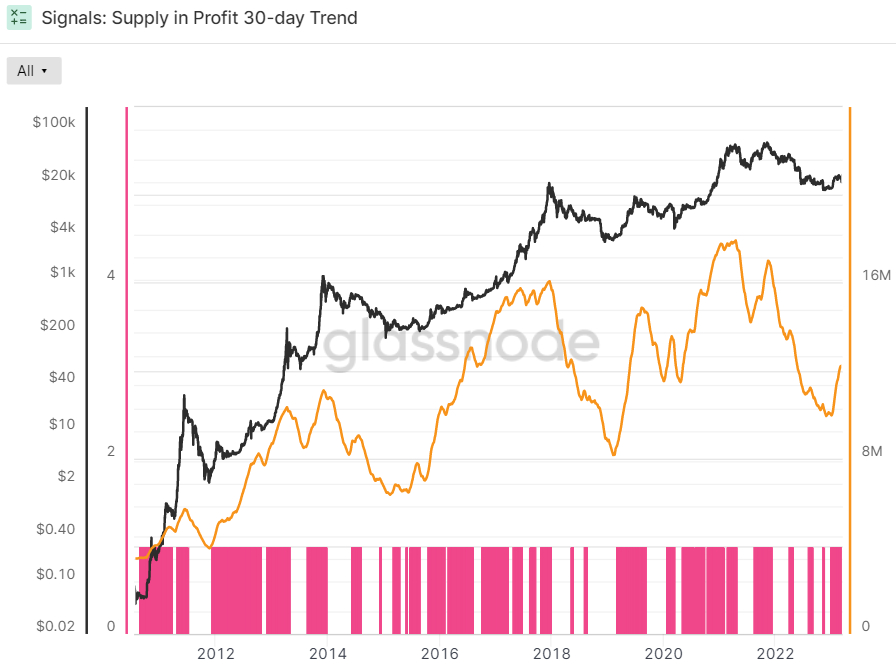

Glassnode’s final indicator of recovery from the bitcoin bears dashboard is whether the 90-day exponential moving average (EMA) of bitcoin supply has been in an uptrend over the past 30 days. Supply in profit is the number of bitcoins that moved last when USD-denominated prices were lower than they are now, meaning they were bought at a lower price and the wallet holds on to paper profit. This indicator is also flashing green.

Bitcoin market cycle analysis also gives reason to be bullish

The above positive change in bitcoin’s on-chain trends comes at a time when so-called “core” on-chain metrics are commonly cited, such as the number of active addresses, the number of addresses with non-zero balances, the rate of new Address creation and daily transaction numbers are also trending in a positive direction, indicating a growing demand for using the bitcoin blockchain.

The different ways of analyzing bitcoin’s long-term market cycle also give reason for optimism. In early January, the crypto-focused Twitter account @CryptoHornHairs identified that bitcoin was trending almost exactly along the path of a four-year market cycle, which has been fully respected for eight years now.

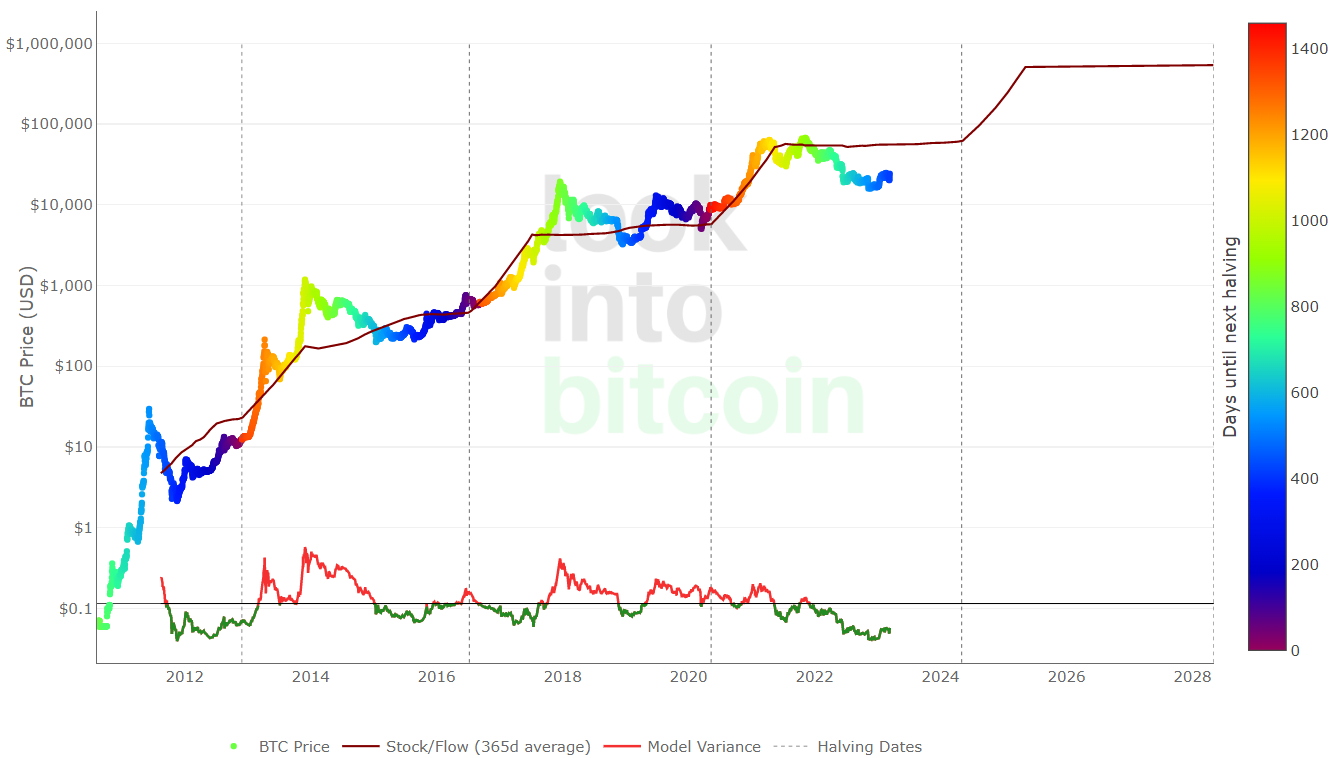

Elsewhere, a widely followed bitcoin pricing model is sending out a similar story. The bitcoin market cycle is roughly four years, according to the bitcoin stock-to-flow pricing model, which shows predicted price levels based on the number of BTC available in the market relative to the amount mined each year.

Bitcoin’s fair value is currently around $55K and could rise above $500K in the market cycle following the next halving – that’s a gain of almost 20x from current levels.

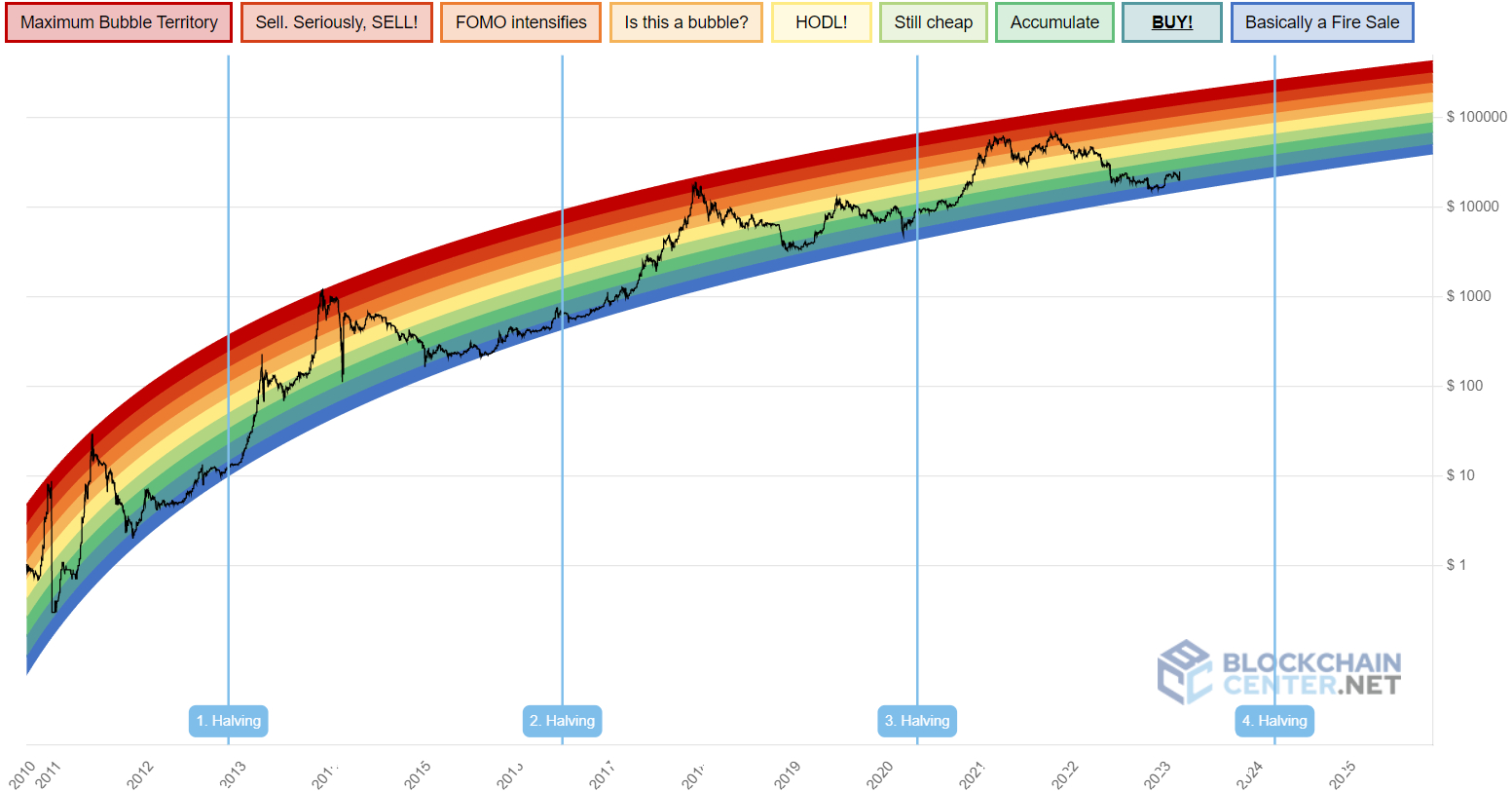

Finally, the popular Bitcoin Rainbow chart from Blockchaincenter.net shows that, at current levels, Bitcoin is a “Buy!” The area, most recently recovered from the late 2022 “basically a fire sale” area. In other words, the model suggests that bitcoin is slowly recovering from being extremely oversold. During its last bull run, bitcoin was able to reach a “sell”. Seriously, sell! Area.

If it can repeat this feat in the next halving market cycle within a year and a half after the next halving, the model suggests a potential bitcoin price in the $200-$300K region. This is about 8-13 times more than the current level.