As the popularity of particular NFT collections increases, so do their floor values; this is terrific news for investors, collectors, and artists who entered the market earlier. But what about those people attempting to enter the market at the moment?

Most people do not have sufficient funds to purchase the more expensive NFTs, but they might be interested in exploring the opportunities presented by fractionalized NFTs.

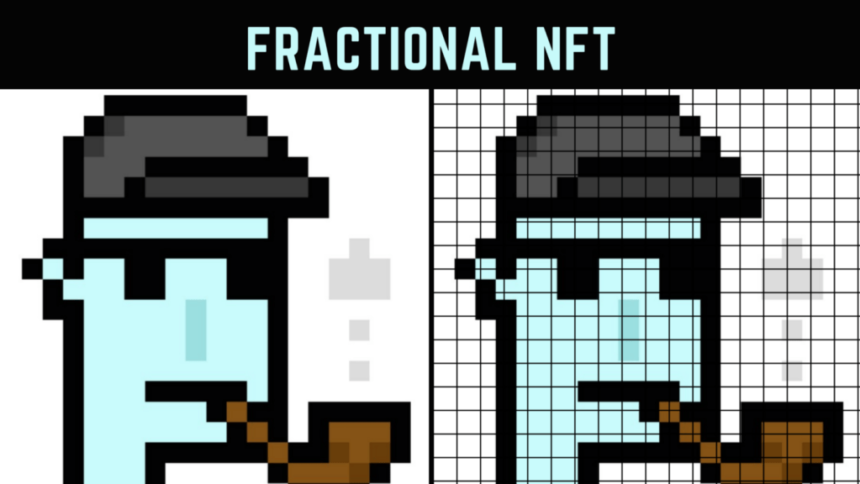

The idea of fractionalization is analogous to owning shares in a business. It opens up the possibility of NFT ownership to numerous collectors, making them available to everybody rather than limiting access to NFT whales.

In this post, we will discuss what fractional NFTs are, how they operate, their advantages, and much more!

How Does NFT Fractionalization Work?

NFT fractionalization is achieved through a process called tokenization. The NFT is converted into multiple ERC-20 tokens representing fractions of the original NFT. These tokens are then sold on a decentralized exchange or platform specializing in NFT fractionalization.

Investors can purchase any number of these tokens to own a portion of the NFT. The tokens are stored in a digital wallet, and the investors can sell them at any time, allowing for liquidity and potential profit.

Benefits of NFT fractionalization

There are several benefits to NFT fractionalization:

Increased accessibility

Fractionalized NFTs make it possible for NFT prices to be discovered effectively. The process by which a market identifies the appropriate price to charge for a particular asset is called “price discovery.”

Pricing freshly minted NFTs with a limited or nonexistent history of transactions is typically challenging. An NFT can be fractionalized into numerous parts, each of which can then be released into the market to be bid on. This simplifies pricing an NFT and makes it easier to do so. This assists in providing a more accurate estimate of the price of an NFT based on the demand for it on the market.

Therefore, Fractionalized NFTs are a speedy technique to determine the value that rare and unique NFTs bring to the market. In addition, the value of an NFT’s fractions increases whenever the price of the NFT itself does as well.

However, an NFT’s value can abruptly decline, just like it frequently does with cryptocurrencies; in this scenario, the importance of the fractions will likewise rapidly decrease simultaneously. This is a common occurrence.

Liquidity

NFT fractionalization creates a liquid market, allowing investors to buy and sell shares anytime. This is different from traditional art investing, where the value of the artwork is often locked up for long periods.

Risk diversification

Investing in multiple NFTs can be risky, but fractionalization allows investors to diversify their holdings and spread their risk across various assets.

Accessibility to illiquid assets

High-value NFTs can be challenging to sell, especially if there are no buyers in the market. Fractionalization allows these assets to be sold in smaller portions, increasing marketability.

Disadvantages of Fractional NFTs

The level of safety guaranteed to Fractionalized NFTs is proportional to the robustness of the underlying smart contracts that underpin them. Hence, this factor is determined by the quality of the code.

However, in certain circumstances, a prospective buyer or a part-owner of an NFT might initiate a buyout auction by transmitting the total sum of all fractionalized parts to the smart contract to acquire the remainder of the NFT.

If the other fraction holders can outbid the individual who started the auction, they will be able to maintain possession of their piece of the asset, albeit at a higher cost.

If the individual can outbid the other fraction holders, then the money for the fraction will be split among the owners in proportion to the amount of fractions they now own. Even while they will still be compensated for their portion, this may force you to sell your fraction even though you had no intention.

Where Can I Buy A Fractional NFT?

Users are now able to produce and purchase fractionalized non-fungible tokens on several different platforms, including the following:

Otis is a platform that allows users to invest in NFT collectibles and art, manage their NFT portfolio, and participate in real-time trading through the Otis app. Otis is known as an NFT investing platform. Investors can acquire fractional interests in crypto assets by using the platform to make purchases.

Unicly is designed for investors interested in turning their collection of NFTs into a marketable asset with an assured supply of buyers and sellers. Using the platform, investors can tokenize non-fungible tokens (NFTs) and establish trading collections of any size.

Fractional.art is a platform that allows investors to buy, trade, and manufacture fractions of non-fungible tokens (NFTs). NFT holders can use the platform to either produce new NFT fractions or become owners of fractionalized NFT collections that they otherwise would not be able to afford.

Read also: What Are Utility NFTs?

Difference Between Fractional NFTs and Traditional NFTs

Investors can take ownership of a portion of the complete non-fiat security through fractionalized non-fiat instruments. It is easy to see the distinction between a fractionalized NFT and a whole NFT. Whereas an NFT is an entire piece, fractionalized NFTs are simply portions of a full NFT.

Remember that the fractionalization process can be turned around and that a fractional NFT can be transformed into a full NFT. In most cases, a buyout option will be incorporated into the smart contract to fractionalize an NFT. This enables the original owner of the NFT or an investment in a fractionalized NFT to purchase all of the fractions and regain ownership of the original NFT.

Read also: Deep understanding of NFT tech insights

Conclusion

NFT fractionalization is an exciting development in the NFT market that allows more people to invest in high-value assets. It offers increased accessibility, liquidity, and risk diversification, making it an attractive investment option for a broader range of investors.

However, like any new technology, some risks are still associated with NFT fractionalization. Investors need to do their due diligence and research the platform they are investing in and the NFT itself. With the proper research and caution, NFT fractionalization has the potential to unlock new investment opportunities and reshape the art market.