With the fourth Bitcoin halving taking place in just 12 days, the community is buzzing with anticipation and speculating on the possibility of Bitcoin crossing the significant $100,000 threshold. Joe Consorti of Theya Research has offered a comprehensive analysis, delving into the complexities of Bitcoin’s current market position and the factors that could catapult its value to new heights.

This event, a cornerstone in Bitcoin’s design of halving the rewards for mining new blocks every four years, historically creates bullish momentum, and the current scenario appears to be in line with past precedents.

The significance of Bitcoin’s consolidation phase

Consortis analysis titled: “Bitcoin’s 4th Halving is [12] Days Away, and $100,000 Ain’t Much Further Behind It,” begins with a deep dive into Bitcoin’s ongoing consolidation phase, which he argues is a critical period preceding a potential bull run.

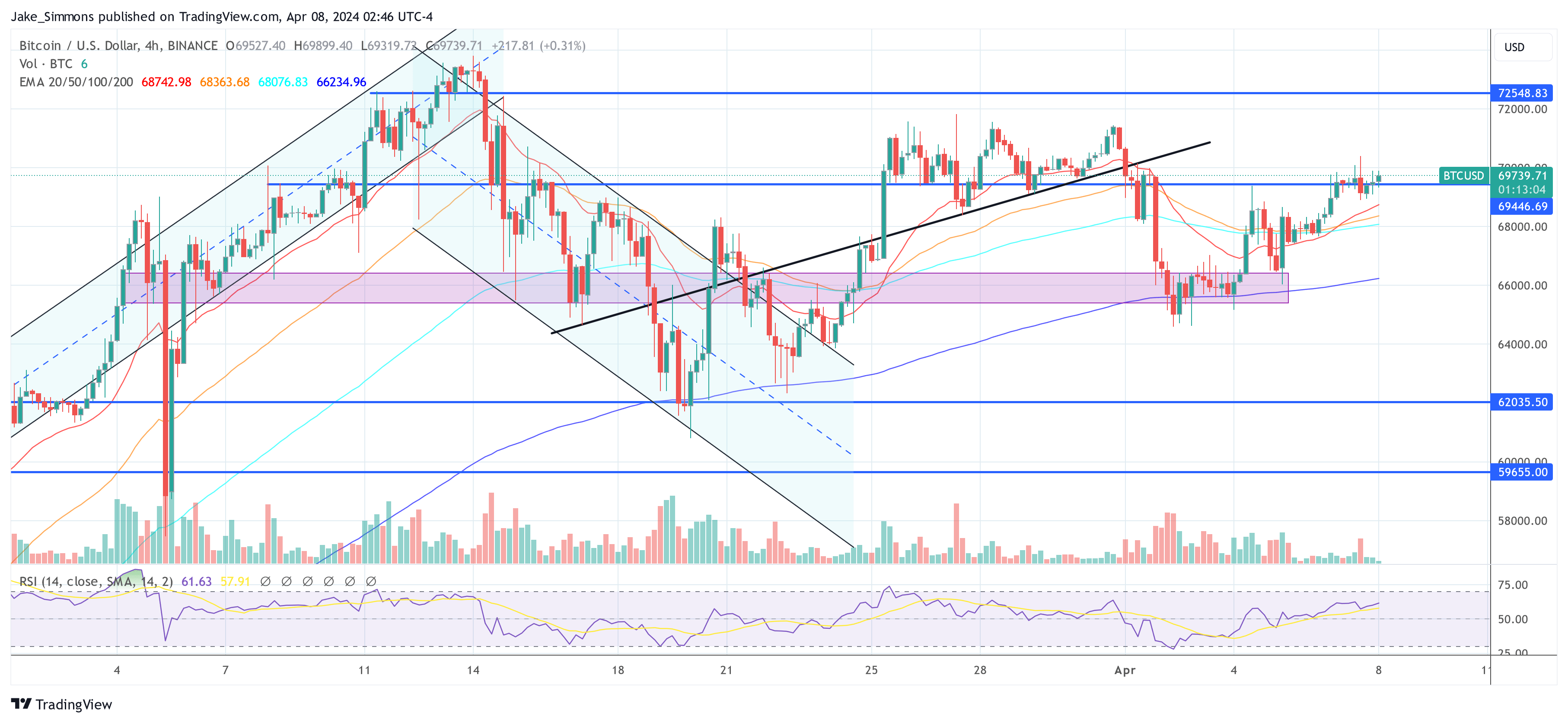

“Bitcoin continues its consolidation. In accordance with the previous phases of consolidation At $30,000 and $40,000, BTC spends several weeks at key psychological price levels exchanging hands between buyers and sellers before moving higher,” Consorti said on X.

He highlights that this is the sixth week of Bitcoin’s consolidation above $60,000, which is the least volatile period at this price level and follows a new all-time high. According to Consorti, this indicates strong market confidence that could form the basis for the next wave.

The analysis further examines broader market dynamics, particularly the correlation breaks within the current cycle that have made the stock market an unreliable indicator of the economy. American economic sentiment. “The market as a whole has suffered massive correlation breaks in this cycle […] This has a lot to do with companies extending their debt into 2021, when interest rates were still low, and with the US Treasury’s massive budget deficit at crisis levels,” Consorti explains.

He argues that these factors have contributed to the decoupling of traditional economic indicators from stock market performance, inadvertently benefiting the prices of assets including Bitcoin.

The role of ETFs and the spot market

A significant portion of Consorti’s analysis is devoted to the behavior of Bitcoin ETFs and their interaction with the spot market.

Despite a slowdown in net inflows into Bitcoin ETFs, volume remains robust, indicating a healthy market. “This was one of the lowest weeks yet for BTC ETF inflows, although if you include outflows, they are still healthy compared to previous weeks,” Consorti notes, suggesting that ETF shares are actively changing hands change, reflecting the consolidation observed on site. market.

This interaction between ETFs and the spot market provides a stable base for Bitcoin’s price, further strengthening the case for an impending bull run, according to Consorti. “The financing rate is extremely low and we are still at the same price [around $70,000]. In this period of consolidation, the spot market has really taken control of Bitcoin’s price action. This means a more stable basis for the subsequent bull run, which makes me even more confident that this consolidation precedes a move higher instead of lower,” concludes Consorti.

Expert consensus on the bullish outlook

Consorti’s bullish forecast is echoed by other industry experts, who have also shared their bullish predictions. CRG, another renowned analyst, highlighted the importance of Bitcoin’s recent performance, saying: “Great weekly close. New all-time highs this week,” indicating positive momentum that could be maintained in the post-halving period.

Great end of the week

New all-time highs this week

Source: my plums pic.twitter.com/wyxwomdDjZ

— CRG (@MacroCRG) April 8, 2024

TechDev, a crypto analyst, highlighted a rare pattern in Bitcoin trading history: “It doesn’t happen often. Bitcoin closed above the upper Bollinger band for two consecutive months. Each time it has then doubled within 3 months before the next red candle.” If this historical pattern repeats itself, Bitcoin’s price could potentially soar well above $100,000.

It doesn’t happen often.#Bitcoin Closed over the upper Bollinger band for 2 consecutive months.

Each time it has subsequently doubled within 3 months before the next red candle. pic.twitter.com/veOOOmT8Id

— TechDev (@TechDev_52) April 7, 2024

Daan Crypto Trades provided a technical perspective, focusing on Bitcoin’s resistance levels and potential targets: “Those previous ‘resistances’ ultimately didn’t amount to much. It is precisely the previous record high that ensures that the price will remain stuck for the time being. The above objectives are ideas for pricing if we can move beyond this area.” Daan’s targets are the 1,272 Fib of $83,562, the 1,414 Fib of $91,164 and the 1,618 Fib of $102,085.”

#Bitcoin High Timeframe Level Cheat Sheet ✍️

Those previous ‘resistances’ ultimately did not result in much of a fight. It is precisely the previous record high that is causing the price to stagnate for the time being.

The above objectives are ideas for pricing if we can move beyond this area. https://t.co/AeP9vzOk7M pic.twitter.com/BWvcg8EjLE

— Daan Crypto Trades (@DaanCrypto) April 7, 2024

At the time of writing, BTC was trading at $69,739.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.