Bitcoin price made a significant move above the crucial $27,200 mark, but buying support seems to be losing strength.

As bitcoin continues its volatile journey, investors and analysts are closely watching the market for insight into its future price movements.

The recent breakout of the $27,200 level has generated both optimism and caution, leading to speculation about the sustainability of this upward move.

In this BTC price prediction, we’ll explore the key factors shaping bitcoin’s current trajectory and examine possible scenarios for its future performance.

Michael Saylor Emphasizes the Importance of Bitcoin as a Valuable Asset in People’s Portfolios

Michael Saylor claims that one of the primary motivations for people to hold bitcoin is its moral imperative and its importance on a global scale. Saylor includes these rationales, along with more widely recognized features of bitcoin that attract users.

In his interview, Michael Saylor stressed that bitcoin has the potential to provide hope and property rights to the eight billion people living on the planet.

They believe that bitcoin’s ability to offer digital assets or digital scarcity to the entire global population via mobile devices represents a paradigm shift.

Saylor also expressed his belief that rising inflation is causing a crisis of confidence in fiat money, banks and the governing bodies that oversee them. He highlighted the widespread loss of faith in the traditional banking system.

According to Saylor, people are turning to commodity money because of their dwindling trust in traditional fiat currencies.

They argue that commodities such as gold, oil and property lack the necessary adaptability for seamless transactions between alternatives.

As a result, bitcoin emerges as a commodity that serves as an important medium for all types of transactions and provides solutions to the world’s growing financial challenges.

These positive comments from Saylor have contributed to bitcoin’s recovery from its previous losses.

Wallet addresses holding one million or more bitcoins (1 BTC+)

According to data from Glassnode, the number of BTC wallet addresses holding one bitcoin or more has passed one million.

The number of wallet addresses holding one or more bitcoins increased significantly, coinciding with a significant decline of over 65% in bitcoin’s price throughout the year.

The most notable increases occurred during the severe market crash in June and the collapse of FTX following its bankruptcy filing on November 11.

Since the beginning of February 2022, when the price of bitcoin began to decline from its peak in November 2021, approximately 190,000 new holo-coiners have emerged.

It’s important to note that a bitcoin wallet address doesn’t always correspond to an individual, and the milestone of reaching “one million” addresses represents a new record.

Many bitcoin owners use multiple addresses, and significant organizations such as bitcoin exchanges and financial companies also hold substantial bitcoin holdings. This news contributed to BTC/USD’s gains on Monday.

Data Suggests Long-Term BTC Holders Are Lacking Market Activity

Output spent per Glassnode bitcoin (btc) After remaining inactive for one to two years, it has reached a 10-month low.

The “number of spent outputs with lifetime 1y-2y (7d moving average)” statistic tracks the usage of bitcoin outputs that have been inactive for at least a year and a half.

On May 13, 2023, the indicator reached its lowest level since July 13, 2022, at 164.214. A decline in this indicator indicates a possible change in trading behavior or a decrease in market activity among long-term investors.

This indicates that long-term holders are either selling or transferring their coins, possibly indicating a lack of confidence in bitcoin’s long-term growth prospects.

Furthermore, it may indicate a preference among some investors to hold their BTC for the long term instead of engaging in short-term trading.

bitcoin price

Bitcoin It is currently trading at $27,400, experiencing an increase of 2% on Monday. After a significant decline last week, bitcoin has managed to regain some lost ground and is now trading above $27,000.

Several factors have contributed to this upward momentum. After finding support at 26,650 on Monday, bitcoin climbed higher, crossing the 27,000 mark.

A bullish engulfing candle has formed on the four-hour time frame, indicating that bitcoin price could continue to rise.

The 15-day exponential moving average and the 26,700 level provide immediate support.

As the 50-day exponential moving average is now decisively above the 200-day, buyers now have the upper hand in the market.

Therefore, if bitcoin price rises to $28,000 then it is not out of the question whether it can successfully break through the $27,000 barrier.

Specifically, a lot of resistance can be counted near 28,700. Both the RSI and the MACD are indicating a buy zone, which raises the odds of a move above 26,700.

If bitcoin price declines below $26,000, however, the next level of support is expected at $25,900, if not as low as $25,000.

Top 15 Cryptocurrencies to Watch in 2023

cryptonews The Industry Talk team has put together a list of the most promising cryptocurrencies for 2023, each of which exhibits substantial potential for expansion in the immediate and long-term future.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

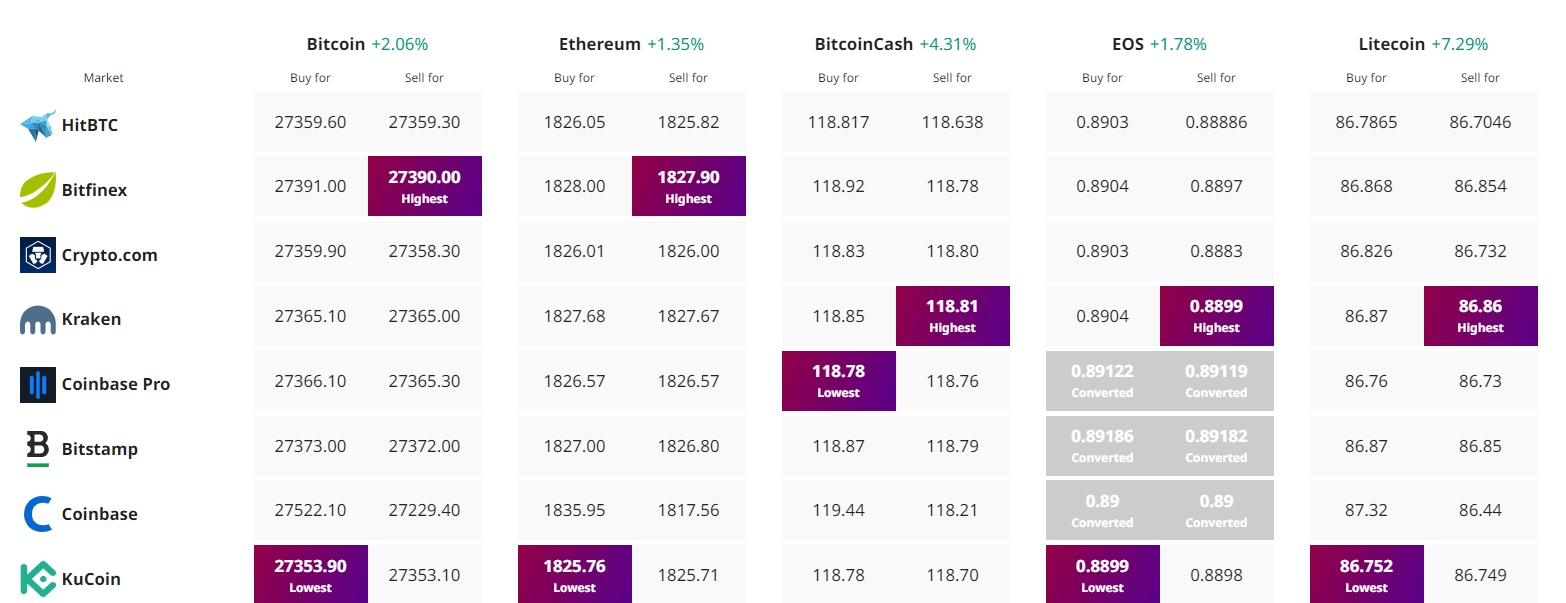

Find the best price to buy/sell cryptocurrency