took advantage of long positions in Bitcoin The futures market has been “rekt” (i.e. closed in internet lingo) over the past few days.

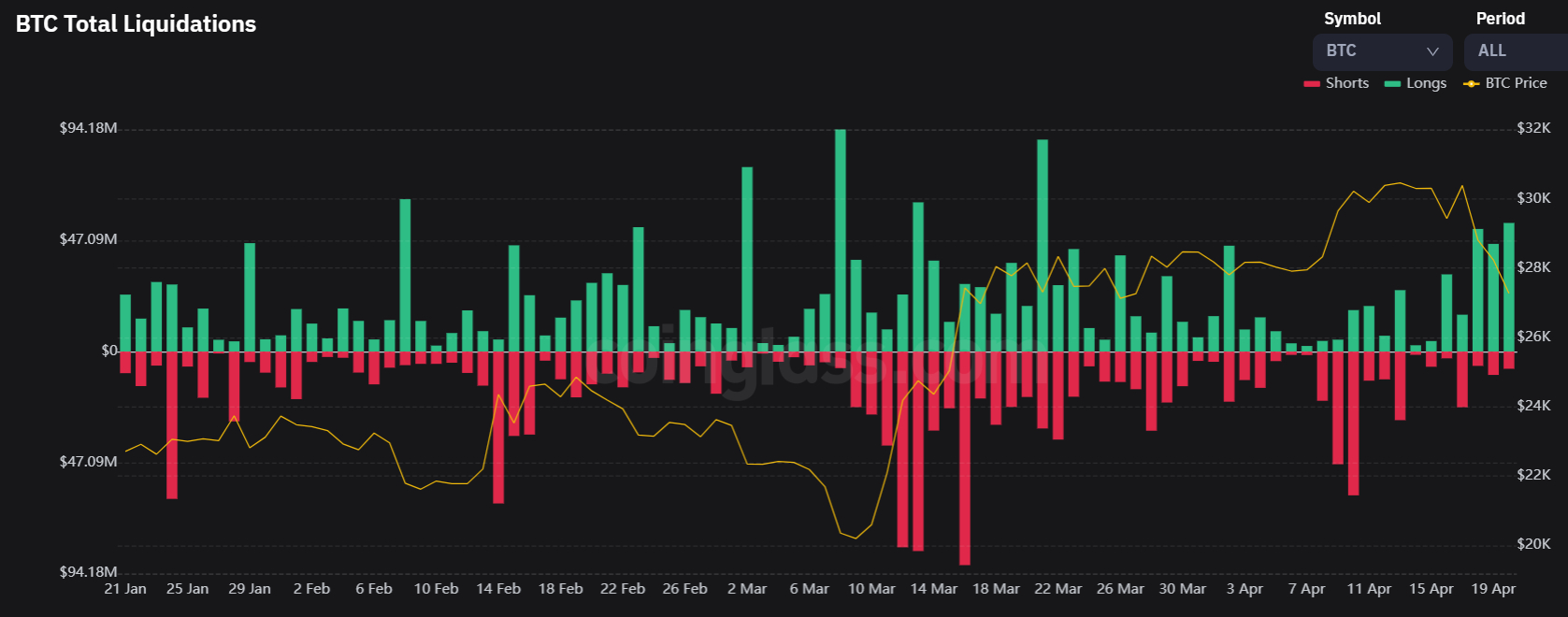

Liquidations of long positions have exceeded $150 million during the past three days, according to data offered by crypto derivatives analytics website CoinGlass.com.

In fact, of bitcoin The 10% drop over the past three days from the mid-$30,000s to the current lows of $27,000 marked one of the most rapid periods of liquidation of long positions since the beginning of the year.

The selling pressure intensified earlier this week when B T c The price broke below key support in the $29,000 area as 1) the 21DMA, 2) an uptrend since late March, and 3) the late March high.

Since this bearish break, technicians are targeting a retest of the support-resistance level from March and the $26,500-800 area as the 50DMA.

Why is bitcoin down this week?

Macro evolution can partially explain of bitcoin The week’s decline, which is now just shy of 10% (for context, this would be bitcoin’s worst weekly decline since the FTX debacle last November).

US survey data painted a mixed picture about economic momentum in the US, muddying the waters regarding the economic outlook as well as expectations about the Fed’s outlook for further tightening.

This, combined with warmer-than-expected UK inflation data pushed US yields higher in the week typically negative for non-yielding crypto assets like bitcoin.

Some analysts have pointed to ongoing uncertainty about the regulatory situation in the US as another factor weighing on crypto, with SEC Chairman Gary Gensler’s appearance before Congress earlier this week providing some certainty in the outlook. Has come

Meanwhile, the passing of landmark crypto regulations in the European Union did not boost the mood.

Indeed, this week has been dominated by profit-taking after 1) a very strong start to the year, which led to 2) the liquidation of a large number of overly optimistic/greedy bulls who expected bitcoin to settle above $30,000. It was

bitcoin market cooling off

Indeed, several metrics were flashing last week that the bitcoin market could heat up in the near term when BTC price hit a 10-month high above $30,000 last week.

The 14-day Relative Strength Index had climbed above 70, indicating overbought conditions in the market. It has now dropped to around 42 and if bitcoin’s decline extends to $25/26,000, it could signal an oversold market soon.

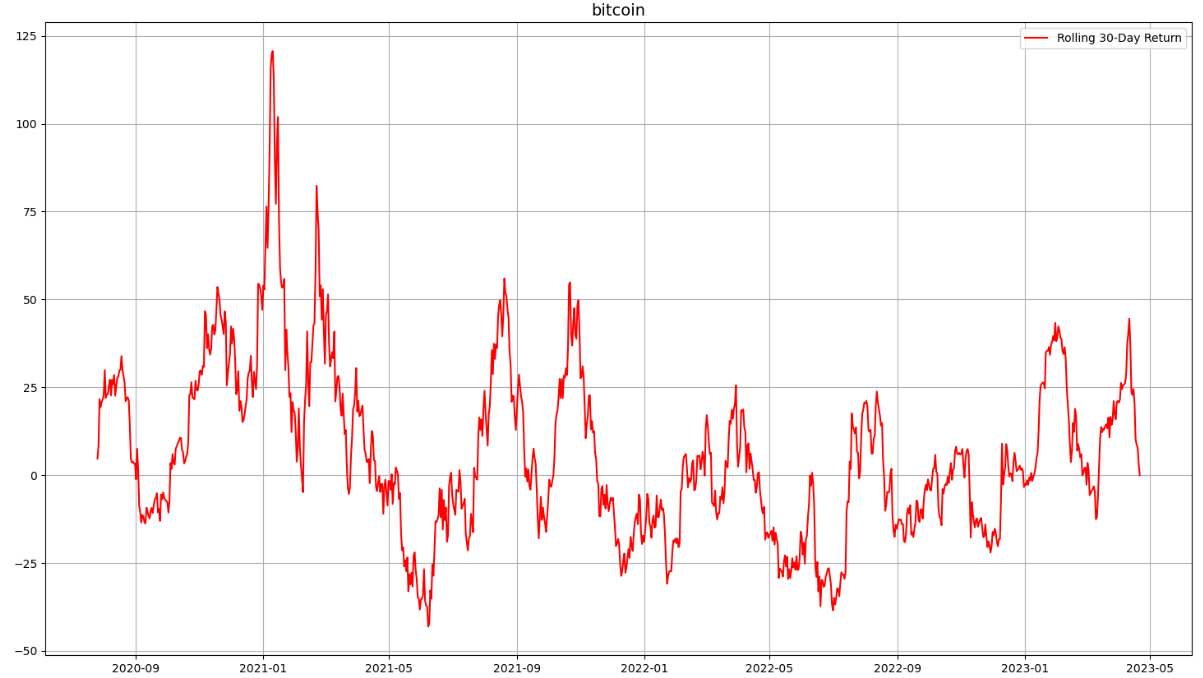

Meanwhile, BTC’s 30-day rolling return also hit its highest level since late November.

A drop back towards the support in the $25,200-400 area is likely as further optimism is definitely on the table for the coming days/weeks.

But this shouldn’t do too much damage to the long-term bull thesis, and could present an excellent entry point for long-term bulls back into the market.

as mentioned in a Article On Thursday, the 25% delta skew of short-term bitcoin options turned negative, but the bias of long-term options remained positive.

The belief in bitcoin’s long-term price outlook makes sense when you consider macro factors, on-chain trends, and medium to long-term technical indicators.

While significant uncertainty remains about how often US Federal Reserve will raise interest rates and when will it start Cutting To them, one thing seems certain – as US inflation and economic growth decline, the Fed’s tightening cycle appears to be coming to an end.

This implies that adverse changes in financial conditions are unlikely to return as a major headwind for crypto markets in 2023, as they were in 2022.

Meanwhile, bitcoin is likely to continue to receive tailwinds from recent major technical developments, including 1) bitcoin’s spectacular jump from the 200DMA to true value in mid-March and 2) bitcoin’s “golden cross” (when the 50DMA moves from the 200DMA to the 200DMA). went up) in early Feb.

elsewhere, a litany of On-chain and market cycle indicators Screaming that last year’s low marked the end of the crypto bear market. The confidence of many investors will remain bitcoin 2023 bull market Will be alive and well.

So, expect bargain hunters and dippers to be eagerly waiting to jump in every time there is a significant drop in bitcoin’s value, as happened during mid-March.