The first monthly gain since March, bitcoin mining revenues rose 10% in August.

Bitcoin mining revenues soar

About $657 million was earned by miners last month, according to statistics collected by The Block Investigation.

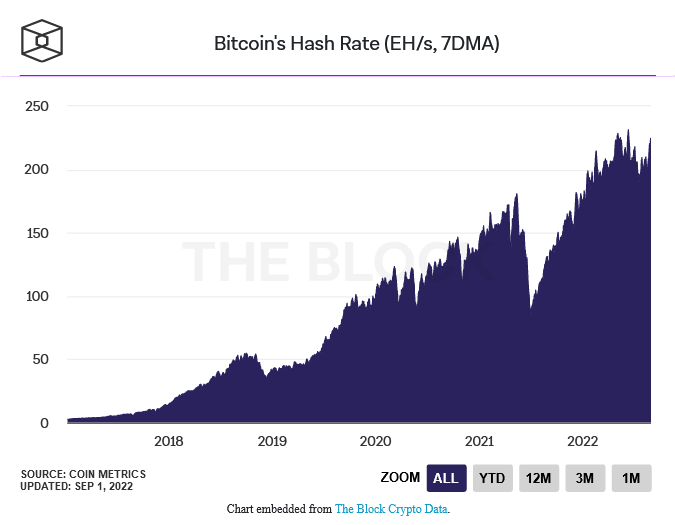

In the most recent update published on Wednesday, the difficulty of mining bitcoin increased by 9.26%, while the hash rate increased by more than 13%.

According to Kevin Zhang, senior vice president of mining strategy at Foundry, which manages Foundry USA’s mining pool, the hash rate increase is caused by “a combination of heat waves that are finally abating (on a global level) and facilities that are slowly coming online.” “There’s also the added kicker of the higher efficiency Bitmain S19 XPs finally hitting the market!”

Source: The Block Crypto Data.

Only a small portion of the crypto mining pioneers’ profits ($9.24 million) came from transaction fees, and the bulk ($647.72 million) came from the block reward subsidies. Bitcoin transaction costs fell to 1.4% of total revenue.

Ethereum miners generated $725 million in revenue in August, which is 1.1 times more than bitcoin miners.

Mining difficulty increases

The difficulty of mining bitcoin is increasing. According to data from BTC.com, the mining difficulty for the largest cryptocurrency in the world has increased by 9.26% in the past two weeks.

The website’s analysis shows that the network’s mining difficulty is at its highest point since January, reaching 30.97 trillion, with a hashrate currently averaging about 230 exahashes per second (EH/s).

Last month, miners in Texas stopped working to support the electrical system and conserve energy during a heat wave. This move probably made Bitcoin easier to mine.

Weeks later they went back on, and as the difficulty increases, miners may see their income drop as more computing power (and energy) is required, but Bitcoin’s price has remained stable.

BTC/USD trades at $20k. Source: TradingView

According to TradingView data, the price of BTC was $20,060 at the time of writing. It has struggled for months to surpass the $25,000 level and is down more than 70% from the all-time high of $69,044 it reached in November.

Featured image from FT and chart from TradingView.com and The Block