The cryptocurrency market has been on a roller coaster ride over the past few weeks Bitcoin And Ethereum Fluctuating prices wildly. As the market remains unpredictable, it is important to stay informed about the latest developments in order to make informed decisions.

Recently, whales have moved an estimated $743 million in crypto, which could indicate a possible price rally or crash. In this article, we will discuss what you need to know about this development and how it could affect the price of Bitcoin and Ethereum in the future.

Whales Take $743 Million in Crypto – Here’s What You Need to Know

Bitcoin recently touched an all-time high of $23,000 and has been the talk of the crypto world. Attention is also being paid to three big BTC and ETH whales who are turning heads in the crypto trading community. In what can be considered a surprising event, whales traded a combined $743 million in crypto through the 3 transactions.

On Friday, a large investor in the cryptocurrency space known as a bitcoin whale, Transferred 13369 BTC $311 million worth from one unknown wallet to another. A crypto transaction was detected in one of the top 65 bitcoin wallet According to Bitinfocharts. The wallet was used for both sending and receiving funds.

On Saturday, a large amount of Ethereum worth $309 million was moved from one unknown wallet to another by an alleged whale. The amount transferred was 186,009 ETH.

At a later time, Whale Alert detected another large bitcoin transaction worth $123 million, which originated from Gate.io and was transferred to an unknown wallet. The amount sent was 5,278 BTC tokens.

Someone recently moved funds to a cold wallet to make purchases, or they may have done so as an added security measure. Moving money from an exchange to a cold wallet is often considered safer than keeping funds on the exchange.

Bitcoin has reached $23,305 with a slight decline of 0.5% in the last 24 hours. Ethereum, on the other hand, saw a slight increase of 0.1% to reach 1,664 in the same period.

Ray Dalio on bitcoin: why it doesn’t fit the bill as money, store of value or medium of exchange

Ray Dalio, the founder of Bridgewater Associates, is a well-known investor and has recently expressed his opinion on Bitcoin. In his view, bitcoin does not fit the bill as money, store of value or medium of exchange.

They believe that it is too volatile and unpredictable to be used as a currency. They also believe that it cannot be used as a store of value due to its lack of intrinsic value and lack of regulatory oversight.

Lastly, they believe that it cannot be used as a medium of exchange as its transaction fees are too high as most people cannot use it in daily transactions.

Despite this criticism, he believes that bitcoin could become an asset class in the future and could have some uses in certain contexts.

I think it’s quite amazing that for 12 years it’s been done… but I think it has no relation to anything… It’s a small thing that gets too much attention.

Billionaire investor, Ray Dalio recently compared the total market capitalization of bitcoin to that of Microsoft stock. Microsoft was worth $1.92 trillion on Friday, while bitcoin held only a third of that amount.

According to Ray Dalio, biotech and other industries prove to be far more interesting than investing in cryptocurrencies.

It’s not going to be an effective penny. It is not an effective store of wealth. It is not an effective medium of exchange.

Hence, his comments are putting pressure on the leading cryptocurrency.

bitcoin price

the current Bitcoin The price is $23,365 with a 24-hour trading volume of $15B. It has gained 0.10 percent in the last 24 hours. It holds the first rank on Coinmarketcap with a live market cap of $450 billion.

The current amount of bitcoin in circulation is 19,281,825 coins out of an eventual maximum supply of 21 million.

Recently, bitcoin is trending lower, with $23300 being its immediate support area. If it breaks this level, it could lead to further losses in price – eventually settling at $23000 which is marked by an ascending trend line and can be seen as a potential point of support.

The RSI and MACD indicators are indicating that an increase in selling pressure could result in a drop in BTC price towards $22,750 as its next support.

Currently, the 50-day exponential moving average is pointing positive momentum above $23,300 for BTC/USD. This suggests that a rally may be imminent. If the price breaks out of the $23,950 mark, it could potentially increase further towards $24,500.

ethereum price

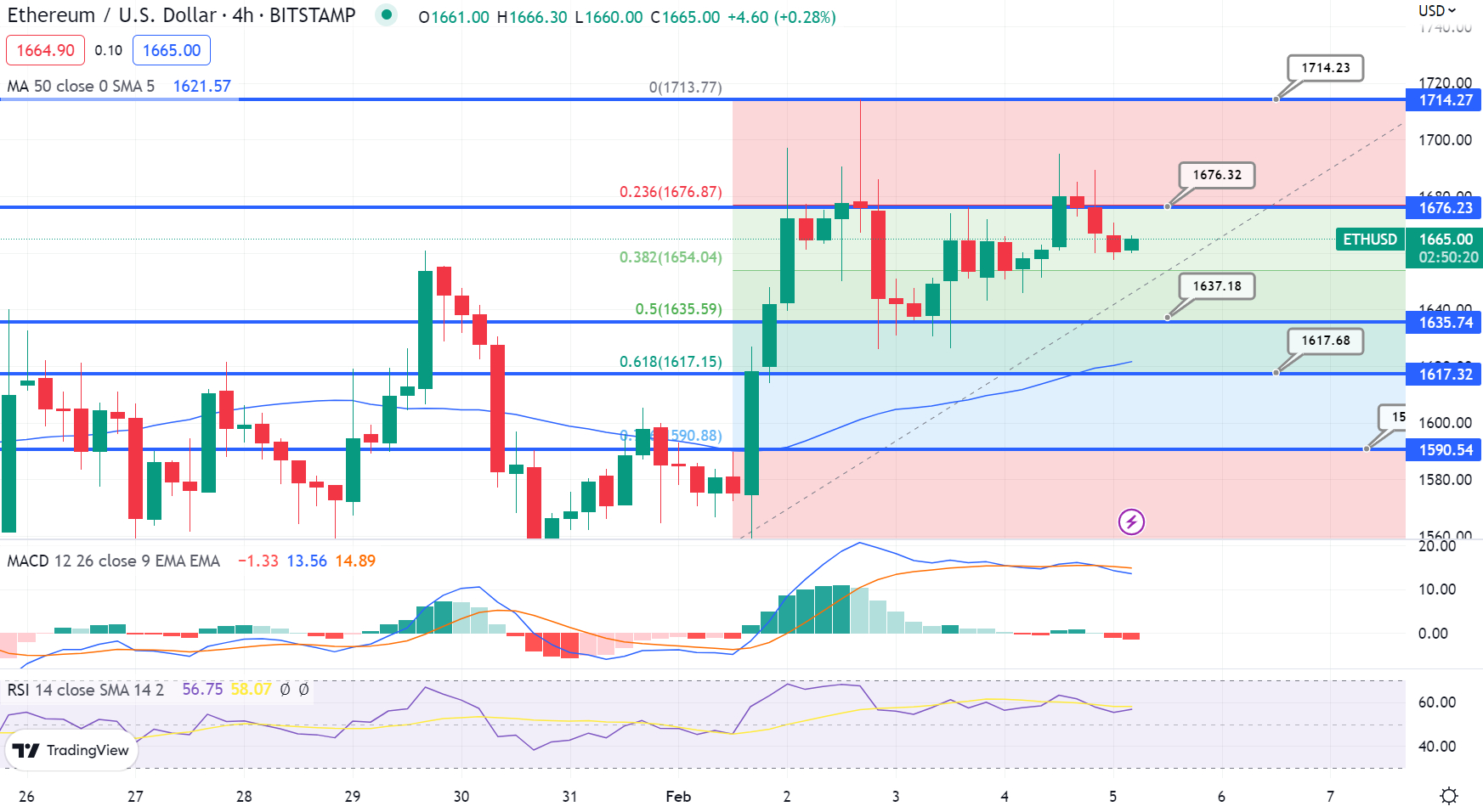

EthereumThe current price is $1,664 with a 24-hour trading volume of $5.9B. It has also seen an increase of 0.50% in its value in the last 24 hours. With a total market cap of around $203 billion, Ethereum ranks second on Coinmarketcap.

The ETH/USD pair did not make much progress in the past few days and is currently trading in a narrow range of $1,650 to $1,685. If it breaks out of this range, there are chances of the price reaching $1,720.

The Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) indicators have started pointing in opposite directions, indicating a possible change in trend. One indicator is suggesting a buy, while the other is giving a signal that investors should be looking to sell.

The 50-day exponential moving average is indicating a possible bullish trend with values above $1,620 indicating an increase in the coin price.

bitcoin and ethereum options

Cryptonews Industry Talk recently identified the top 15 cryptocurrencies for 2023. If you are aiming to invest in something more promising, there are many other options that you can explore.

On a weekly basis, the number of cryptocurrencies available and new ICOs (Initial Coin Offerings) continue to grow.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

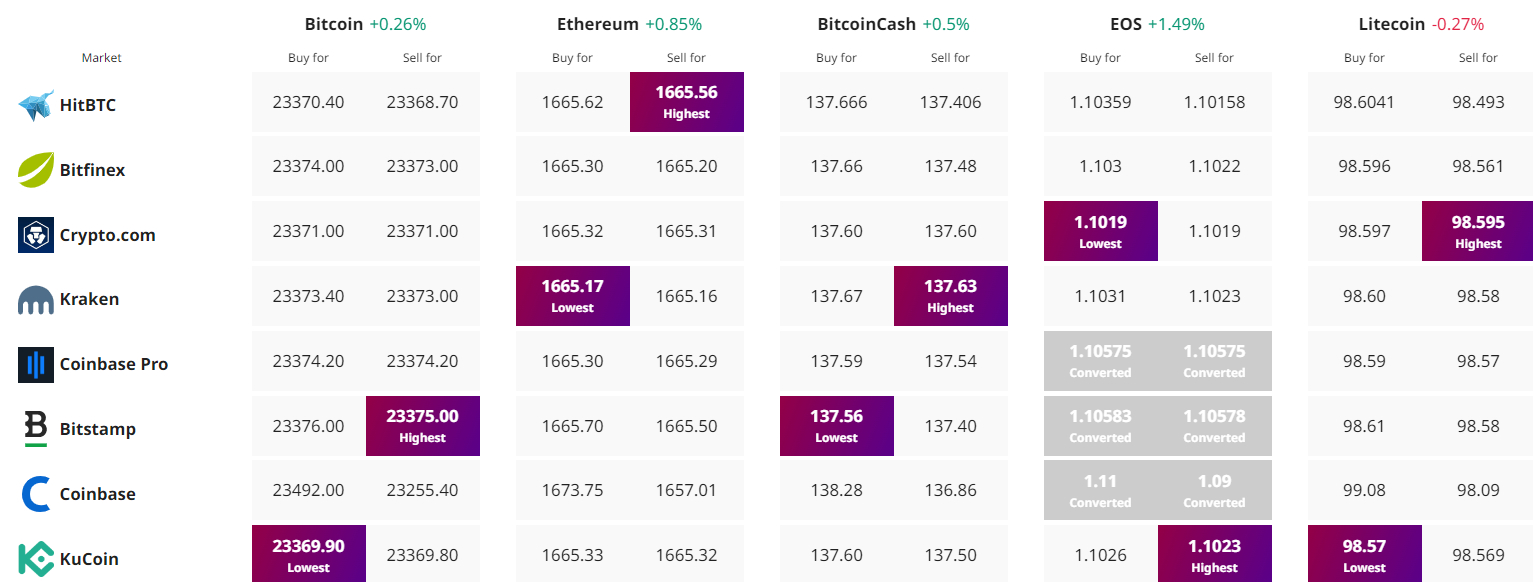

Find the best price to buy/sell cryptocurrency

Bitcoin Crypto Related Post