Bitcoin, the world’s top cryptocurrency, has declined heavily, reaching its lowest value in two months. Ether, the second most valuable cryptocurrency, followed a similar path and experienced a decrease in value as well.

On March 10, bitcoin briefly fell below $20,000 for the first time in nearly two months, hitting a low of $19,918.

The decline in cryptocurrency prices can be attributed to several factors, including comments from US Fed Chair Jerome Powell, Joe Biden’s budget proposal, and the recent closure of Silvergate Bank.

As a result, the fall in cryptocurrency prices is causing concern among investors and the entire industry. Furthermore, the fact that the total market capitalization of all cryptocurrencies has fallen below $1 trillion is a clear indication that the overall market is in for a challenging period.

The collapse of Silvergate Bank and its impact on the crypto industry

The recent closure of Silvergate Bank is believed to be one of the main reasons behind the decrease in cryptocurrency values. The bank played a key role in providing services to crypto ventures in the United States. Therefore, its shutdown could have a significant negative impact on the crypto sector.

In fact, the closure of Silvergate Bank could hinder the growth of the cryptocurrency industry, as it provides vital banking services to these enterprises.

The bank’s suite of services, such as custody, wire transfers and fiat deposits, were essential for many cryptocurrency firms. Without such support, it may be challenging for these companies to find other banking partners offering similar services, which may ultimately hinder the growth of the sector.

US crypto miners could be subject to a 30% tax on electricity costs

The release of a supplementary budget explainer letter on March 9 was another contributing factor to the decline in the price of bitcoin. The paper revealed that under a Biden budget proposal that aims to “reduce mining activity,” United States crypto miners could eventually be subject to a 30% tax on electricity costs.

If implemented, this proposal could have a significant impact on the crypto-mining industry, as it relies heavily on low electricity costs. A decrease in mining activity in the US could have a negative impact on the entire crypto market.

Crypto market cap falls below $1 trillion

The massive fall in the price of bitcoin significantly affected the entire crypto market, resulting in the global crypto market cap falling below $1 trillion once again.

Other widely used altcoins, such as Ethereum, Dogecoin and Litecoin, also saw substantial losses across the board.

This indicates that the cryptocurrency market remains volatile and subject to unpredictable volatility, as demonstrated by the current challenging times for overall crypto values.

Impact of US Fed Chair’s Comments

Jerome Powell’s statements regarding inflation and interest rates have had a significant impact on the cryptocurrency market. His recent announcement that the central bank may start raising interest rates earlier than expected has raised concerns among investors about its potential impact on the economy and cryptocurrencies, causing crypto prices to slide.

Powell’s comments continued to negatively impact the cryptocurrency market for a second day in a row, adding to pre-existing concerns about the regulatory environment and the future of cryptocurrencies.

bitcoin price

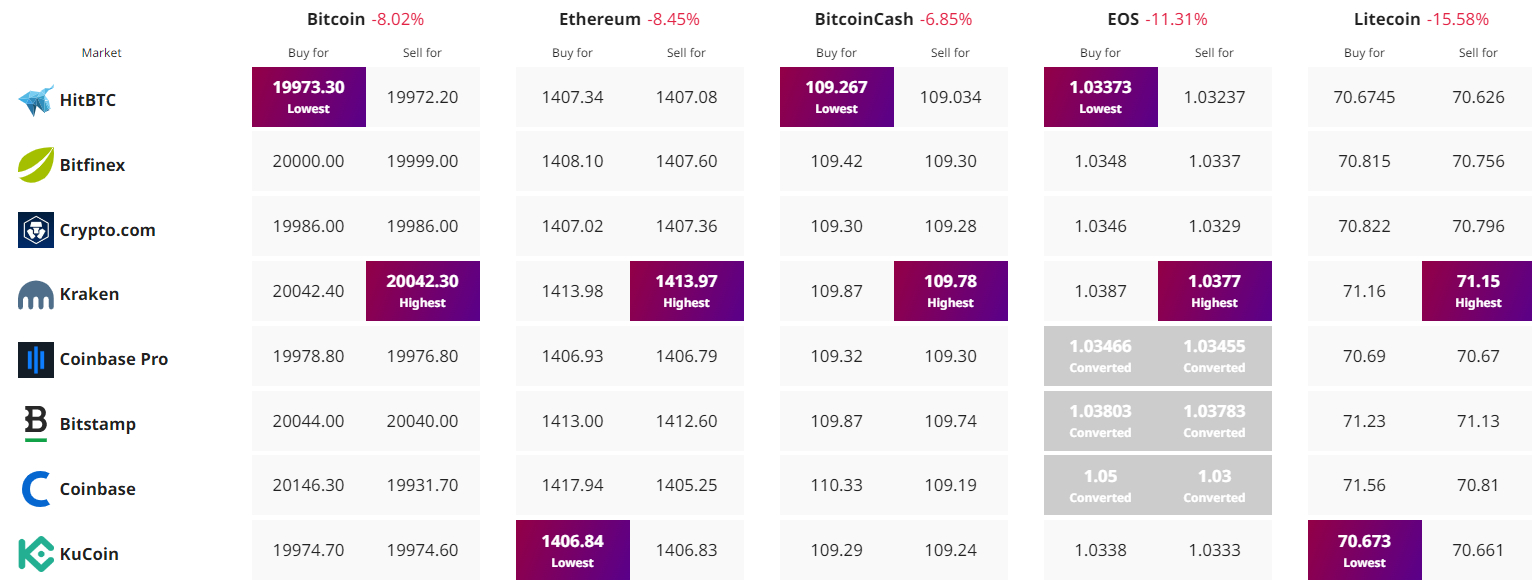

current live price of Bitcoin $19,938, with a 24-hour trading volume of $43 Billion. Bitcoin has lost 8.50% in the last 24 hours. It is currently ranked #1 on CoinMarketCap, with a live market cap of $385 billion.

Technical analysis of bitcoin is indicating a strong bearish trend for the BTC/USD pair as it surpassed the double-bottom support at $20,350. An immediate support for bitcoin is at $18,430. A breach below this level could intensify the selling pressure, which could lead to a further decline towards the $16,400 level.

Conversely, an initial resistance is located at $20,300, a breakout above which is likely to put buying pressure and push bitcoin price towards the $21,400 level. If there is additional bullish momentum, BTC price could reach the $25,000 mark.

Top cryptocurrencies to watch in 2023

Check out Cryptonews’ Industry Talk team’s pick of the top 15 altcoins to watch in 2023, regularly updated with new ICO projects and altcoins. Keep up to date with the latest happenings by visiting the list frequently.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

Find the best price to buy/sell cryptocurrency