Bitcoin enthusiasts and investors are buzzing with excitement as the world’s foremost cryptocurrency surged 4% in just 24 hours. sudden increase in bitcoin price Many speculate about the factors driving this boom, while others struggle to understand the market dynamics.

Bitcoin enthusiasts and investors are buzzing with excitement as the world’s foremost cryptocurrency surged 4% in just 24 hours. sudden increase in bitcoin price Many speculate about the factors driving this boom, while others struggle to understand the market dynamics.

As we explore the possible reasons for this unexpected surge, we’ll consider several key factors that could be affecting the market and attempt to predict where bitcoin’s value could be headed in the near future.

Stay with us as we uncover the mystery behind this sudden jump in the price of bitcoin and what it could mean for the crypto ecosystem.

The First Republic Bank Price Crash and Its Effect on the Bitcoin Bounce

First Republic announced results that exposed the bank’s precarious position since mid-March, which was blamed for the collapse of the bank Silicon Valley Bank And signature bank, The bank reported a surprise withdrawal of $102 billion in deposits during the first quarter, up significantly from $176 billion at the end of the previous year.

Shares of the bank fell nearly 50% on Tuesday following the revelation that customers had withdrawn more than $100 billion in deposits in the first three months of the year.

As a result, concerns are growing that First Republic Bank could soon become the third major bank to collapse this year, as concerns spread throughout the United States and around the world.

This news has given different reactions in the US stock market. Nevertheless, BTC/USD experienced a boost as the First Republic Bank deposit debacle intensified fears of a possible financial crisis in the United States.

Standard Chartered Predicts $100K Bitcoin Milestone in 2024

in a research report published Bitcoin, the world’s leading cryptocurrency, could potentially reach $100,000 by 2024, it was suggested by Standard Chartered Bank on Monday. The bank’s analysis indicates that several factors could contribute to bitcoin’s ascent above $100,000.

One such factor is the ongoing banking sector crisis, which could help re-establish bitcoin’s role as a decentralized, scarce digital asset.

Additionally, the research found that improvements in the macroeconomic background for risky assets, as federal Reserve Nearing the end of its tightening cycle, price could act as a driver as well.

Standard Chartered is not the only institution to predict a huge increase in the price of bitcoin. At a blockchain conference in Paris last month, several crypto industry insiders predicted that bitcoin would hit new highs in 2023.

A representative from US-based cryptocurrency exchange Gemini also suggested that $100,000 is a viable target.

bitcoin price

Bitcoin broke the important $28,790 resistance, which led to further gains and broke the $29,350 resistance. Currently heading towards $30,500, BTC could face challenges due to more technical indicators such as RSI and MACD.

A close below $30,500 could trigger a decline towards $29,360, making it important for investors to monitor this level for potential sell or buy positions. A bearish correction below $30,500 can be expected.

Top 15 Cryptocurrencies to Watch in 2023

Bitcoin’s rally may be slow, with major profit-seeking traders looking at alternative options. With a variety of emerging altcoins and tokens available for pre-sales, there are many promising cryptocurrencies in the market offering the potential for significant returns.

As a result, the cryptonews The Industry Talk team has compiled a list of the top 15 cryptocurrencies for 2023, each with solid short- and long-term potential.

The list is constantly updated to include new altcoins and ICO projects.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

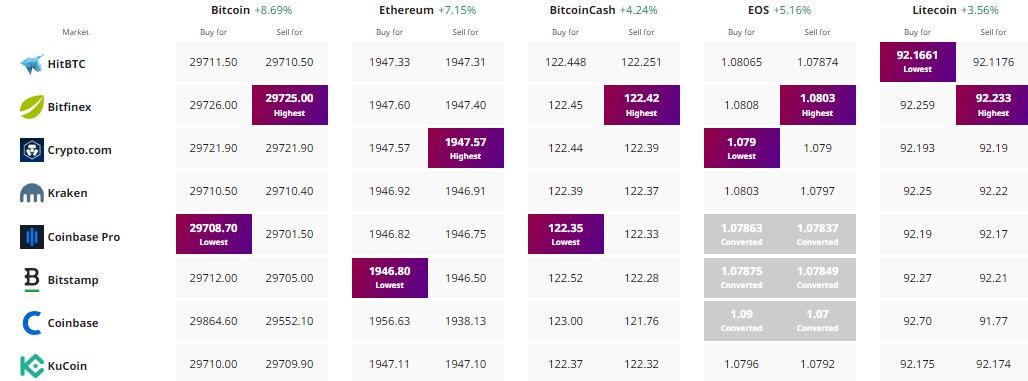

Find the best price to buy/sell cryptocurrency