The announcement of the Federal Reserve’s interest rate decision has stirred financial markets, and Bitcoin (BTC) investors are watching closely to see how this will affect the cryptocurrency’s price.

As BTC has experienced a volatile year, with highs and lows that have thrown many investors on edge, the question on everyone’s mind is whether BTC can reach $30,000 this week.

In this article, we will explore the factors that could affect the price of BTC and predict where it could be headed.

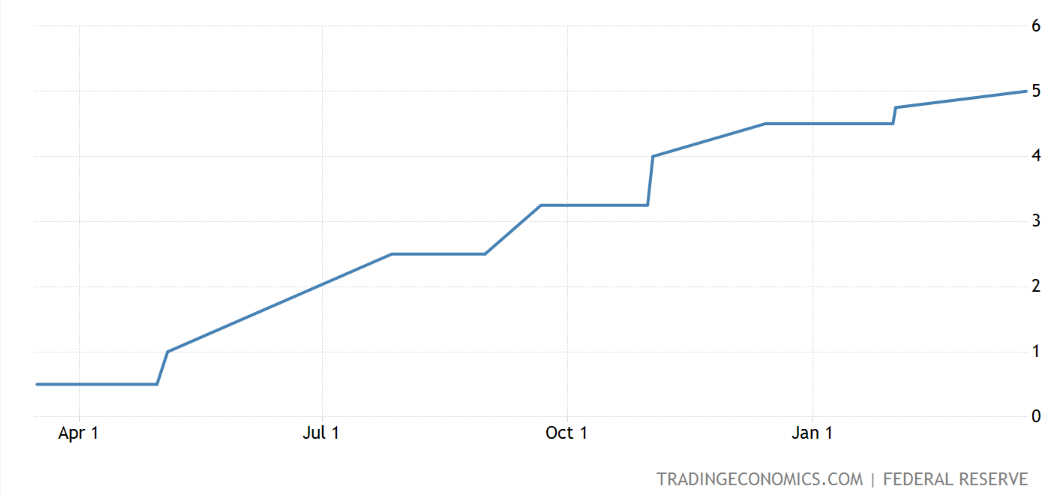

Federal Reserve raised interest rates by 0.25 basis points

Despite the financial instability triggered by the Silicon Valley bank failure, the Federal Reserve opted to maintain its aggressive inflation-fighting effort and raised its key short-term interest rate by a quarter percentage point on Wednesday.

Fed officials forecast another quarter-point increase in rates this year, resulting in a higher range of 5% to 5.25%, which is in line with the December projection and lower than the level markets expected before the SVB erupted.

In a statement released after the two-day meeting, the Fed acknowledged recent stresses at the nation’s banks could lead to tighter credit conditions for households and businesses, as well as a negative impact on economic activity, hiring and inflation. may also be weighed down, but added that the financial system is stable, and the US banking system is strong and resilient.

According to the Fed, the impact of recent events on the economy remains unpredictable.

How will the Fed rate hike affect the price of bitcoin?

The Federal Reserve’s decision to raise interest rates could have a significant impact on the price of bitcoin.

Typically, when the Fed increases interest rates, it strengthens the US dollar and makes it more attractive to investors. This may reduce demand for bitcoin, which is seen as a store of value and a hedge against inflation.

On the other hand, if a Fed rate hike is seen as a response to rising inflation, investors may turn to bitcoin as an alternative investment option. Bitcoin’s limited supply and decentralized nature make it an attractive option in times of economic uncertainty and inflationary pressures.

Overall, the impact of a Fed rate hike on bitcoin price depends on the market sentiment of the move and the macroeconomic environment. As the US economy grapples with rising inflation, BTC is performing bullish after the rate hike announcement.

bitcoin price

the current Bitcoin The price is $28,500, with a 24-hour trading volume of $27.6 Billion. In the last 24 hours, bitcoin has seen an increase of 1.5%. With a live market cap of $550 billion, it holds the top position in Coinmarketcap’s ranking.

The BTC/USD pair is currently consolidating near $28,400 and it broke the $29,250 resistance. With the ongoing bullish trend, there is a possibility that bitcoin price could further increase towards $29,250 or even $30,700.

Meanwhile, the support levels near the $26,600 and $25,200 remained tight.

Top 15 Cryptocurrencies to Watch in 2023

Industry Talk has compiled a list of the top 15 cryptocurrencies to keep an eye on in 2023, with insights from the experts at Cryptonews. Whether you are a seasoned crypto investor or new to the market, this list provides valuable information on promising altcoins that could potentially make a significant impact on the industry.

Stay updated with new ICO projects and altcoins by checking back regularly.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

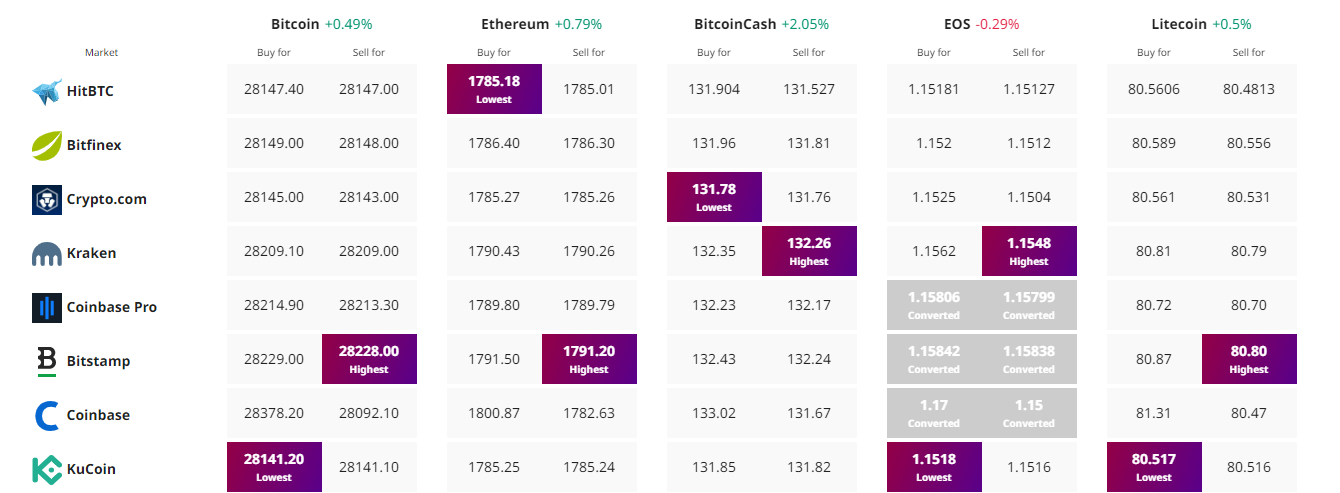

Find the best price to buy/sell cryptocurrency