The recent US interest rate decision sent the bitcoin price down before experiencing a bounce back – raising questions about where BTC is headed now.

As investors and market analysts seek to understand the future direction of bitcoin’s price, this update aims to provide valuable insights and predictions to help navigate the ever-changing cryptocurrency landscape.

Interest rates in the US have reached the highest level in 16 years

federal Reserve recently approved its 10th interest rate hike in just over a year, suggesting this tightening cycle may soon be coming to a close.

In a widely anticipated decision, the central bank’s Federal Open Market Committee raised the benchmark lending rate by 0.25 percentage points.

This rate affects a variety of loans, including mortgages, auto loans and credit cards, because it sets the rate that banks charge each other for overnight lending.

The new fed funds rate is now between 5% and 5.25%, the highest since August 2007.

Market observers are keen to know whether the Fed will hold off, especially given concerns about economic growth and a possible banking crisis. Stocks and Treasury yields showed mixed reactions following the announcement.

US interest rate decision sent BTC down before bouncing back

The recent decision by the Federal Reserve to raise US interest rates resulted in a brief drop in the price of bitcoin, as the cryptocurrency market reacted to the anticipated change in monetary policy.

This move by the central bank has had a direct impact on the global financial landscape, including the world of digital currencies.

As investors and traders adjusted their strategies in response to higher interest rates, bitcoin experienced a momentary drop in value.

However, bitcoin’s resilience was on display as it managed to bounce back quickly after the initial drop.

This recovery highlights the growing maturity of the cryptocurrency market as it weathers the effects of macroeconomic factors and global financial developments.

Bitcoin’s ability to withstand external pressures reflects its growing stability and growing investor confidence in the digital asset space.

bitcoin price

Today’s live bitcoin price is $28,800, with a 24-hour trading volume of $15.8 Billion. Bitcoin is down less than 1% in the past 24 hours.

According to Coinmarketcap, it is currently ranked #1 with a live market capitalization of $551 billion.

On the four-hours chart, bitcoin continues to trade above the 50-day exponential moving average, which is now acting as an important support near the $28,700 mark.

This level has acted as a major resistance for BTC throughout this week. However, a close of the candle above $28,700 is likely to push BTC higher.

The candlestick pattern shows a dominant bearish mood in the market, with the RSI and MACD indicators pointing to a possible downside bias for bitcoin price today.

Bitcoin may face immediate support near the $27,600 level, marked by a clear trendline on the 4-hours chart. If the price surpasses this important $27,600 level, BTC could move towards the next support at $27,200.

Top 15 Cryptocurrencies to Watch in 2023

Besides bitcoin, there are a number of promising cryptocurrencies in the market, including emerging altcoins and presale tokens that offer the potential for substantial returns.

As a result, the Cryptonews Industry Talk team has compiled a list of the top 15 cryptocurrencies for 2023, each of which has demonstrated impressive growth potential in both the short and long term.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

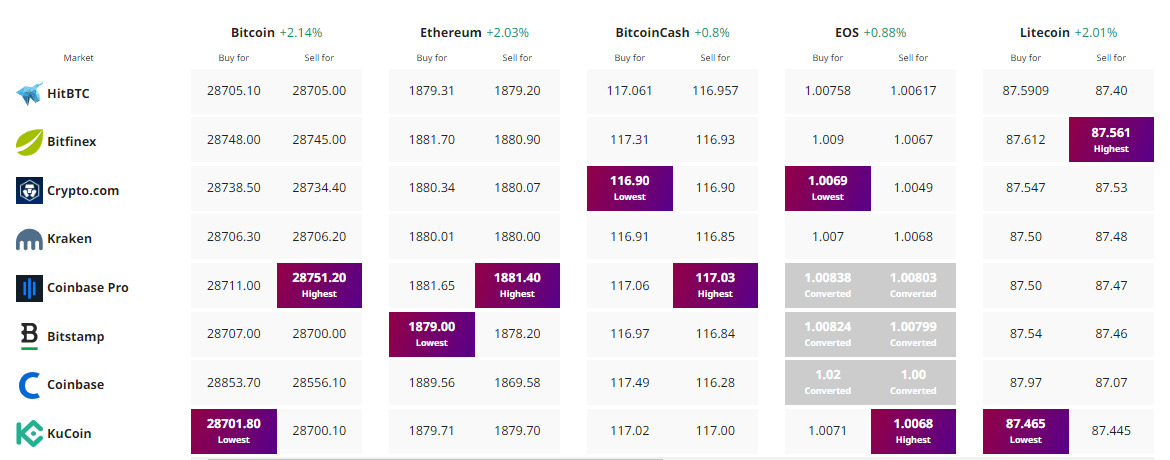

Find the best price to buy/sell cryptocurrency