As bitcoin reclaims its position at the $28,450 mark, investors are questioning the future direction of this leading digital asset.

Will the bullish trend continue, which will lead to further increases in the value of bitcoin, or should we prepare ourselves for a possible bearish correction?

As we delve into technical and market indicators, we aim to highlight these inquiries in our bitcoin price forecast for today.

Digital Currency Rally Amid US Debt Ceiling Talks, Boosting Bitcoin Over $28,000 Mark

Bitcoin (BTC) price is up 3%, and the rest of the cryptocurrency market is showing a green hue, indicating a possible weekend rally.

However, this capital inflow was seen only after Kevin McCarthyRepublican leader and US President Joe Biden reached a preliminary agreement to raise the $32.4 trillion federal debt limit.

The agreement reached after 90 minutes of phone discussion for four consecutive days is tentative for the time being. Biden has expressed confidence that this deal will prevent America from facing default.

Meanwhile, Kevin McCarthy blamed the delay on Biden, accusing him of wasting time and repeatedly breaking down talks over several months.

By agreement, spending by the US government would be restricted for the coming two years. The important thing is that the expenditure related to national security will be exempted.

The settlement was established a month after US Treasury Secretary Janet Yellen issued a warning regarding the potential risk of default on 1 June.

Following the debt cap announcement, bitcoin saw an increase in inflows of funds, which led to an increase of over 3% in BTC/USD price in a single day.

The rise lends support to former Wall Street trader Macrojack’s claim about the primacy of tangible assets like bitcoin, especially as he speculates the dollar will be “printed into oblivion.” He has famously said, “Bitcoin is the fastest horse in the race.”

Mayer suggests that raising the debt limit may force the Federal Reserve to increase its currency-printing activities.

While this could lead to a depreciation in the value of the USD, it could be beneficial for BTC, as the two currencies generally exhibit an inverse trading relationship.

“Bitcoin Increases Causality and Security in Cyberspace,” Says Michael Saylor

In a recent interview with Kitco News, MicroStrategy Executive President, Michael Saylor, Proposed Bitcoin can be a powerful defense against cyber security risks like deepfakes.

Saylor speaks of a digital “civil war” currently underway, fueled by billions of fraudulent accounts operating among genuine users of digital platforms.

Saylor has over 3 million followers on Twitter and receives approximately 2,000 fake followers daily.

He cites an example where “1500 bot accounts were removed from my account in less than an hour – all bots.”

The current situation is untenable, he argued. Saylor believes that decentralized identity (DID) solves deepfakes and various other digital trust issues.

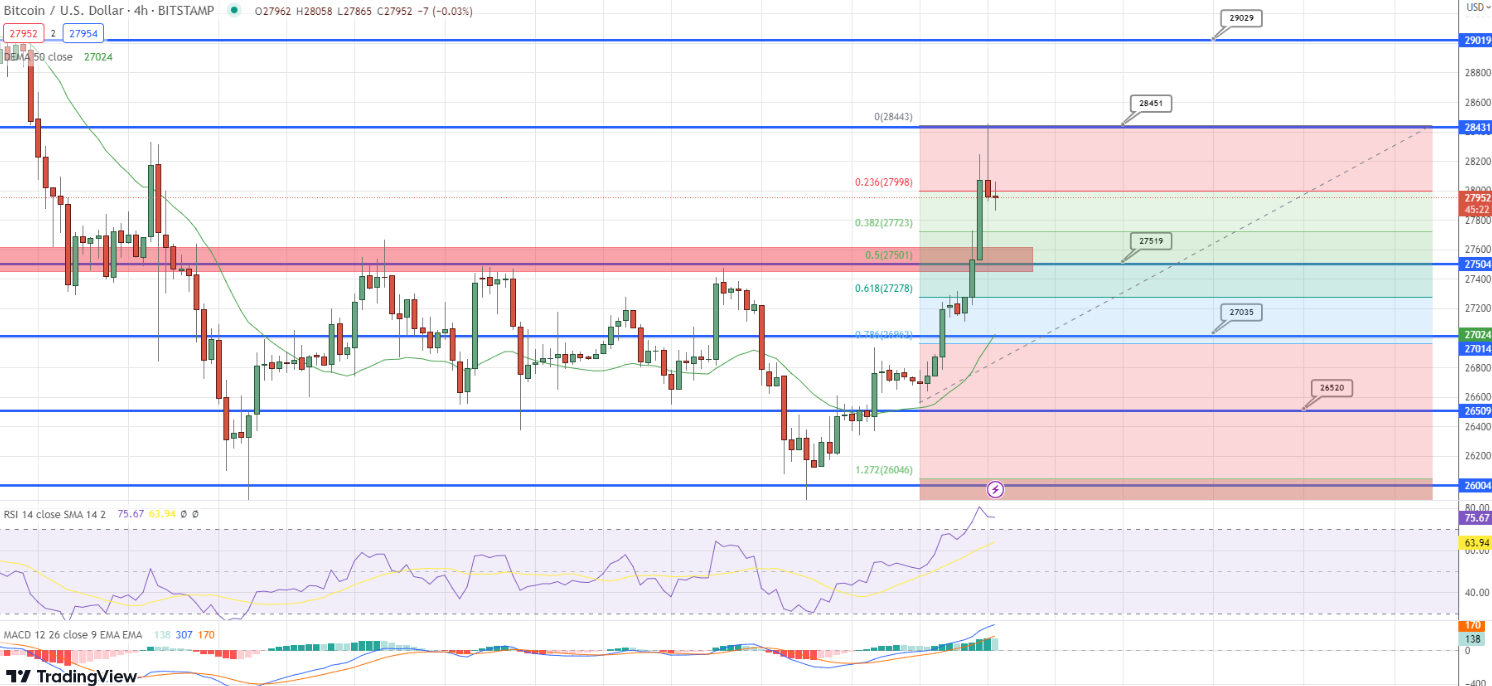

bitcoin price prediction

on Monday, Bitcoin It experienced a gain of 3%, trading at $28,068. This is the first time since May 10 that the world’s largest cryptocurrency has crossed the $28,000 mark.

Bitcoin’s upward trajectory has continued for five days in a row, including a strong performance on Monday.

An important resistance for bitcoin lies at the $28,300 level, as indicated by the ‘double tap’ pattern on the four-hour chart. Repeated closes of candles below this level may indicate exhaustion among buyers, indicating a possible transfer of market dominance to sellers.

Major indicators like RSI and MACD are currently in the overbought zone, with RSI hovering near 76.75 and MACD forming long-term histogram near 171.

A wide gap between the 50-day EMA, roughly $27,000, and bitcoin’s current trading price near $28,000 indicates an overbought market, hinting at a possible price adjustment.

If bitcoin fails to overcome the $28,300 range, investors may have an opportunity to bet on a downside move in price, aiming for a drop to $27,500 or even $27,000.

On the other hand, if bitcoin successfully breaks above $28,300, it could encourage investors to bet on price gains, with an initial target of $29,000 and potentially a higher high around $29,450. .

Top 15 Cryptocurrencies to Watch in 2023

cryptonews Industry Talk presents an intriguing roster of cryptocurrencies set for a promising trajectory in 2023.

Prepare yourself to discover the exciting opportunities that await you with these digital currencies.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

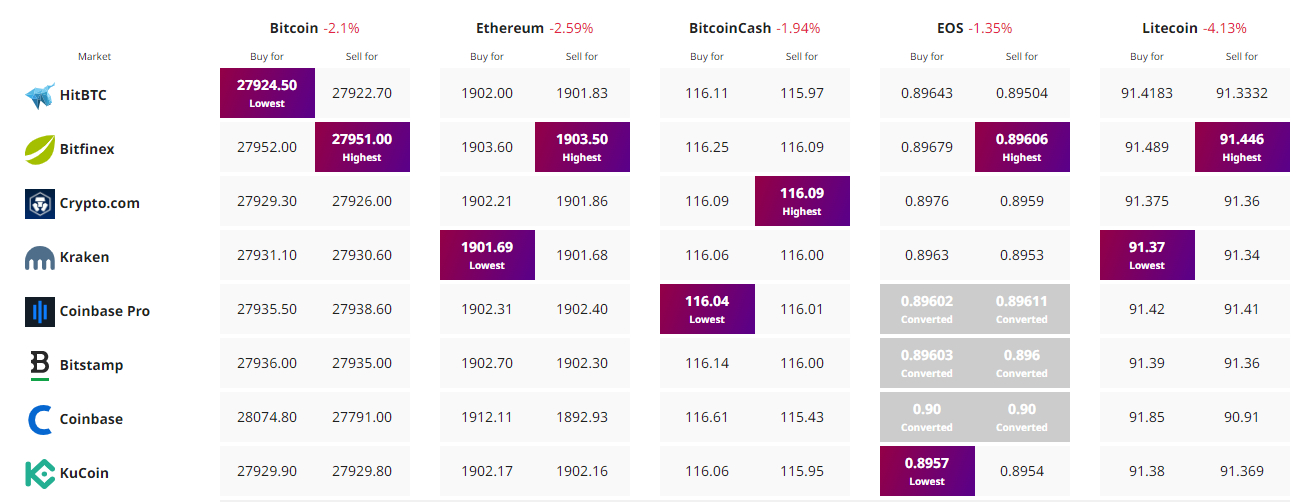

Find the best price to buy/sell cryptocurrency