US Treasury yields have reached levels not seen since 2007, reducing demand for risky assets like Bitcoin and altcoins.

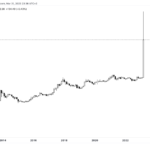

After a strong start to October and Q4 2023, Bitcoin (B T c) The price has fallen 3% in the last 24 hours to below $28,000. This happened amid some profit-taking as well as a global macro setup and rising bond yields.

Cryptocurrency markets rallied on Monday, driven by optimism over the ETF, which had traders hoping it would bring fresh enthusiasm and capital into an otherwise lackluster environment. Some also cited the historical pattern of price increases in October, expecting a repeat of this phenomenon.

However, skeptics argue that such optimism always runs the risk of disappointment. In a message to CoinDesk, Lucas Kiely, Chief Investment Officer at Yield App, said, Said,

“October is generally a good month for the cryptocurrency market. In fact, it has been rated “excellent” by market insiders. Bitcoin has closed in the red in October only twice since 2013, and the trend is expected to continue this year.

Marrow Environment Curbs Bitcoin’s Price Rally

The surge in US bond yields has significantly reduced demand for risky investments. 10-year US Treasury yields are approaching levels not seen since 2007, indicating growing anticipation of an extended period of raised Federal Reserve interest rates aimed at curbing inflation.

These tight financial conditions pose challenges for assets like stocks and cryptocurrencies. Speaking to Bloomberg, Sissy Lu McCalman, founder of blockchain consultancy Wayne Link Partners, said:

“The surge in prices was short-lived as the macro environment is still harsh on rates. The rise in US Treasury yields had an impact on Bitcoin.

Cleveland Fed President Loretta Mester has suggested that the fed funds rate may need to be raised once again this year. He Stressed on Policy decisions should be driven by real progress towards their dual mandate goals. In particular, they will closely monitor whether the recent positive momentum in inflation over the past three months is sustained and whether labor market conditions remain healthy despite the softening.

Bitcoin in Q4 2023

Historically, the last quarter of the year has always been bullish for Bitcoin and the broader cryptocurrency market. Bitcoin is up 67% this year, a notable improvement from its slump in 2022, though it is still far from its peak during the pandemic.

Historical data buffs find comfort in Bitcoin’s seasonal trends, especially in October, where it typically shows strength. Over the past ten years, Bitcoin has gained an average of 24% in October, based on Bloomberg data.

Bitcoin’s dominance in US crypto trading is increasing, accounting for 71% of trading volume on US exchanges in September, according to Kaiko. This has surpassed the 66% level seen during the financial turmoil in March.

One possible reason for this shift is institutional traders turning to Bitcoin due to rising real yields and growing global risk concerns. suggested By Kaiko.

Bhushan is a fintech enthusiast and has a good grasp of understanding the financial markets. His interest in economics and finance drew his attention to the newly emerging blockchain technology and cryptocurrency markets. He is in a constant process of learning and keeps himself motivated by sharing his acquired knowledge. In his spare time he reads adventure fantasy novels and occasionally explores his culinary skills.

Subscribe to our Telegram channel.

Add

Bitcoin Crypto Related Post