Bitcoin (BTC) is down sharply on Wednesday, with analysts citing massive sell orders on the world’s largest crypto exchange Binance and warmer-than-expected UK inflation data as weighing on price action.

B T c/USD was last changing hands at the $29,000 level, nursing losses of nearly 4.5% on the day, putting the cryptocurrency for its worst one-day performance since 9th of March.

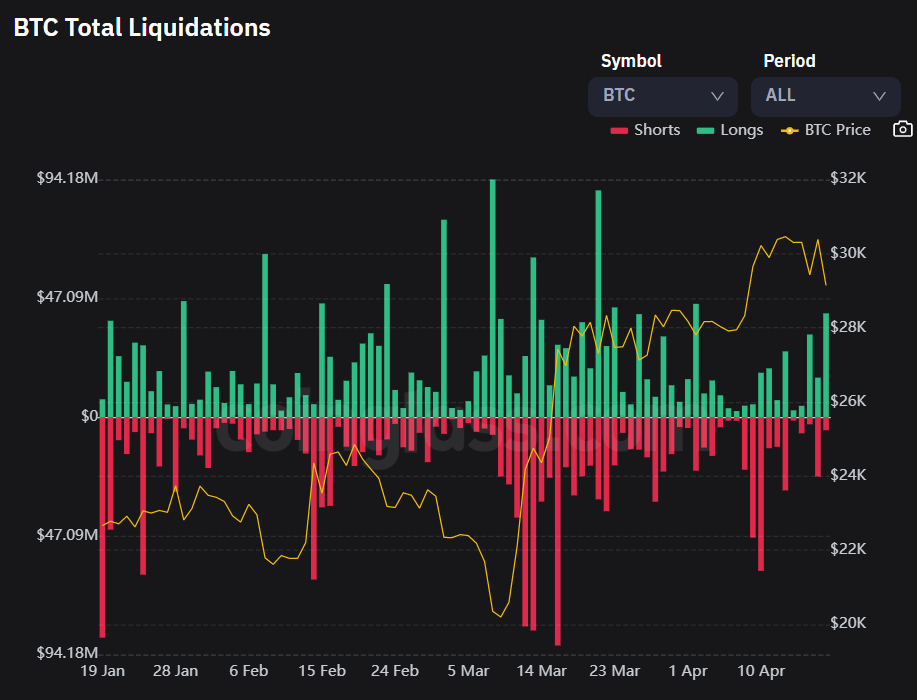

Notwithstanding, liquidation of leveraged long positions Bitcoin According to Coinglass, futures are relatively tight at just over $40 million.

It is also not the highest level of the month, suggesting that the latest move lower has not resulted in a prolonged squeeze.

for now, Bitcoin It is managing to hold the key psychological level as well as its 21-day moving average at $29,043 just above it.

Support in the form of the late March/early April highs of $28,780-$29,380 also holds a floor below the price for now.

But a break below this key cloud of support could open the door for a quick decline towards the $28,000 level, where BTC would slide further down from recent highs.

How low can the price of BTC go?

If this level also goes through, the door will be opened for a possible decline towards resistance-turned-support in the $26,500 area, roughly where the 50DMA also resides.

This would mark a decline of 8% from the current levels.

Beneath that, the next major support area lies in the $25,200-400 area.

If bitcoin were to drop back into the mid-$20,000s, it could mark a huge opportunity for bulls to add to long positions, or those that missed the March rebound from the sub-$20,000 lows to come into the market. They went.

This is because, despite the ongoing risk of short-term volatility and a sharp 20% correction (as seen in late February to March), bitcoin is showing strong signs of being in the early stages of a new bull market.

The widely followed on-chain indicators are screaming, as discussed in Earlier Material,

An analysis of bitcoin’s long-term market cycles also shows that, if history is anything to go by, last year’s low of $15,000 was the bottom of a previous bear market, as discussed in this recent one. Article,

Meanwhile, the macro background is set to be far more favorable for bitcoin in 2023.

Yes, there could be another interest rate hike or two from the US Federal Reserve, but the risks seem tilted towards a rate cut cycle beginning in the latter part of the year as the Fed deals with the (potential) impending recession. Is.

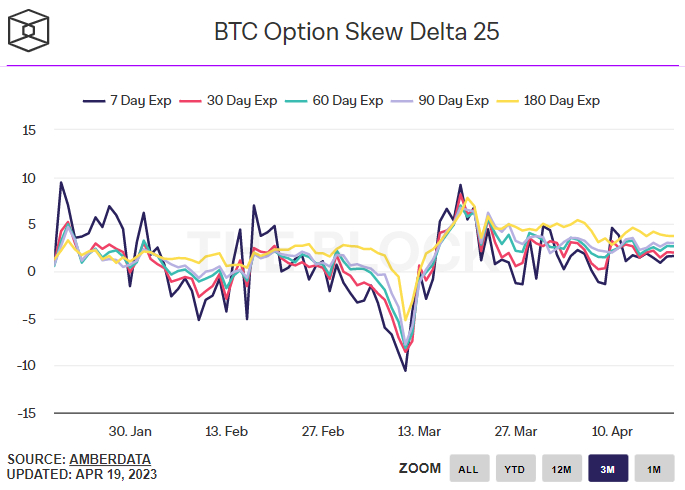

Options markets relaxed about downside volatility risks

For now, the bitcoin options market appears to be at risk of turning negative significantly ahead.

25% of bitcoin options expiring in 7, 30, 60, 90 and 180 days have delta skew above zero, suggesting that bitcoin options investors have a premium for bullish call options over equivalent bearish put options. Expectations remain tilted forward, suggesting that payments will continue. Not the other way around but the other way around.