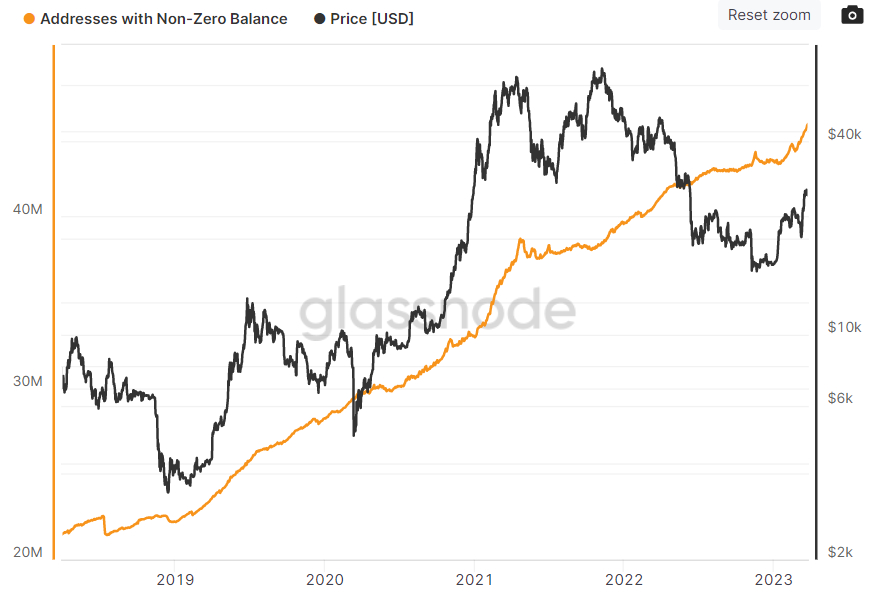

number of Bitcoin Wallets holding non-zero BTC balances reached a new all-time high of 45.388 million on Sunday, according to data presented by crypto analytics firm Glassnode.

This is an increase of over 2 million since the beginning of 2022 and is the fastest rate at which Bitcoin The network has added non-null wallet addresses since early 2021.

good news for Bitcoin Price, higher number of non-zero balance wallets means a larger number of investors are stepping in Bitcoin The market, or, simply put, the demand it keeps growing.

However, some other widely followed metrics related to activity Bitcoin The blockchain has weakened over the past few days in the wake of bitcoin’s failure to test $30,000 last week.

A pickup in these metrics will be needed if bitcoin is to explode above $30,000.

bitcoin network activity weak

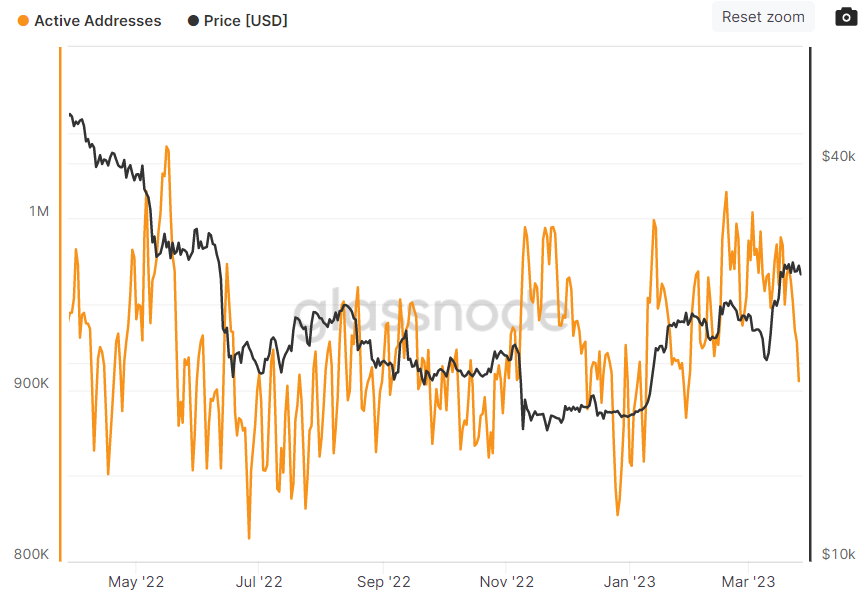

The seven-day moving average of the number of active addresses interacting with the bitcoin network on a daily basis recently fell to its lowest level since late January.

The low activity among wallets on the bitcoin network suggests that bitcoin trading volumes have fallen relative to their levels over the past few weeks, weakening demand.

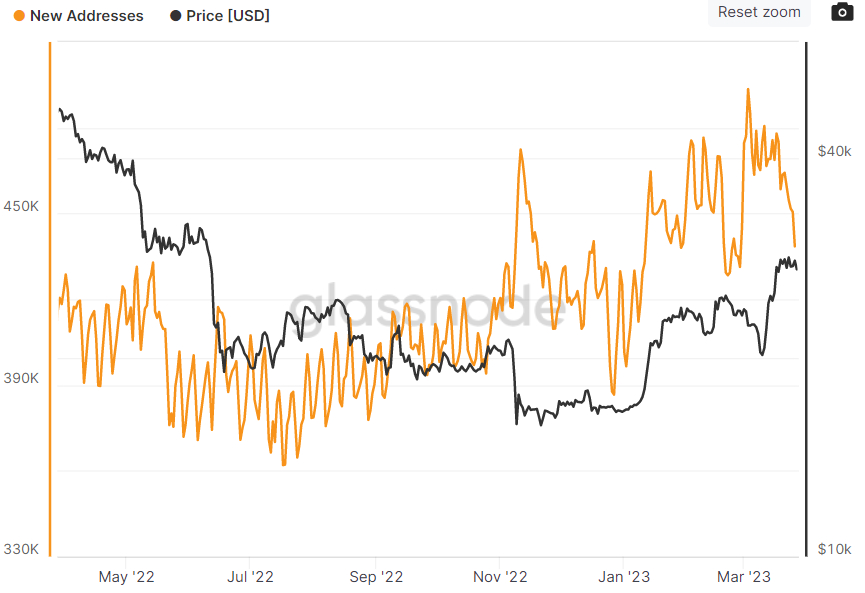

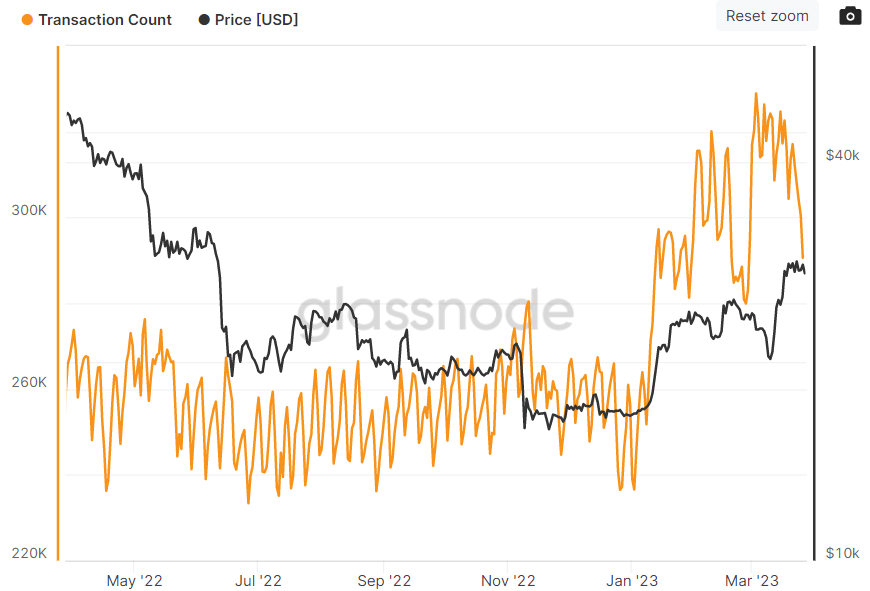

Meanwhile, the seven-day moving average of the number of new addresses interacting with the bitcoin network recently fell to a one-month low, as did the seven-day moving average of the number of transactions taking place on the bitcoin network.

As above, this weakness in key metrics measuring network activity, usage and growth indicates a slight decrease in demand for bitcoin.

But Bulls Shouldn’t Panic

Bitcoin bulls need not panic. Despite some minor weakness in these metrics, all three remain in an uptrend for the year and should, at the very least, remain higher through 2022, assuming the bitcoin price moves above at least $20,000. Can live in part. S.

Whereas Bitcoin is in danger of falling Back towards key support at $25,000, some technical indicators have also extended the March rally slightly higher, with analysts expecting the declines to be bought and predicting the price to be mostly bullish.

This is because the core narrative that led to the spectacular rally from below $20,000 since mid-March is likely to remain a tailwind for the foreseeable future.

readers will remember three american banks went off earlier this month, sparking concerns about a wider global banking crisis and pushing merchants Back off aggressively on stakes when over-tightened from the US Federal Reserve.

As expected, the Fed provided a clear pivot in its rate guidance at its meeting this week (despite still lifting interest rates by 25 bps), now with investors betting that the cut cycle will begin in the second half of the year. .

The combination of financial crisis concerns and bets on easy monetary policy has given bitcoin a dual push of safe-haven demand (as a fiat currency alternative) and demand for an asset performing well in a low-interest rate environment (which is typically bitcoin). Air is given.

Despite some recent positive developments, such as SVB buyout and by action taken report American officers designed to save the First RepublicThe risk of bank contagion remains high.

Meanwhile, the US economic outlook has turned largely dark, and a combination of these factors means that the tailwind for bitcoin should remain strong.

As the price moves higher in the coming months, on-chain metrics should continue to follow suit, adding further validity to the rally.