Bitcoin And Ethereum There are two major cryptocurrencies that have gained significant popularity since the beginning of this year. Ethereum (ETH), the second most popular cryptocurrency, recently crossed the $2,000 milestone for the first time since May last year.

Meanwhile, the world’s largest cryptocurrency, Bitcoin, started the new week on a positive note, holding steady within the $30,000 level. Bitcoin reached $31,005 last week, its highest price since June 2022.

However, the gains in Ethereum price were mostly driven by the success of the Shanghai upgrade. It is worth remembering that the Shepela upgrade was implemented on April 12, and there were concerns that the update could cause the price of Ether to drop.

However, it seems that most validators who have Ether are simply withdrawing their rewards instead of selling their Ether. However, it appears that most validators who hold Ether are simply withdrawing their incentives instead of selling their Ether. This shows that the Shepela update did not have any negative impact on the pricing of Ether.

Crypto Prices Steady Despite Hawkish Fed Comments

The global cryptocurrency market was glowing green and held steady in early Asian trade on Monday, despite aggressive comments from Federal Reserve officials about the way interest rate hikes are headed.

At the time of writing, the global crypto market was valued at $1.27 trillion, up 0.19 percent in 24 hours. However, the Fed’s latest comments fueled previous speculation that it was on the verge of cutting interest rates, which led to a surge in bitcoin price. In particular, the likelihood of a rate cut was boosted by indicators of low inflation and a sluggish job market.

However, this appears to be a temporary trend, as hawkish statements from Federal Reserve officials sparked renewed concerns about rising interest rates, allowing the dollar to continue its rebound from one-year lows.

BTC has been supported by safe haven demand over the past month, partly due to the collapse of several US banks. While fears of a major crisis have subsided, expectations of a US recession have fueled inflows into BTC this year.

Therefore, a US interest rate hike in 2022 had a negative impact on BTC, but saw a sharp recovery this year as investors anticipate future rate hikes. Despite the expectation of stagnation in June, fed funds futures The prices indicated that the markets are still preparing for another hike in May. This was seen as one of the major factors that could limit further growth in BTC price.

Bitcoin and Ether’s Resilience in a Turbulent Banking Sector

According to Cathy Wood, CEO of ARK Invest, bitcoin and ether have shown resilience in the recent financial sector turbulence, outperforming other assets and performing on a par with gold. He believes that the two cryptocurrencies have become “flight to safety” assets during times of macroeconomic uncertainty, indicating widespread adoption and acceptance.

Wood predicts that cryptocurrency will eventually become an election issue once it becomes more widely accepted.

On the other hand, Bridgewater Associates founder Ray Dalio remains skeptical, claiming that bitcoin is too volatile to be used as a currency and that central banks will not accept it. This could put some negative energy on the BTC price.

bitcoin price

The current price of bitcoin is $29,980, with a 24-hour trading volume of $14.9 billion. Bitcoin is down almost 1% in the last 24 hours. on monday the BTC/USD It is trading with a bearish bias, and it is likely to find immediate support near the $29,750 level.

On the 4-hour time frame, the BTC/USD pair has formed a symmetrical triangle pattern that is likely to find support near the $29,790 level. A bearish breakout of this level has the potential to push bitcoin price towards $29,190.

Both the RSI and the MACD indicators are in the sell zone, indicating the potential for a bearish correction. Hence, it is advisable to wait for BTC to retest the $29,750 level before taking any buy positions.

If the BTC/USD pair breaks above the $30,250 level, it is likely that the $30,500 or $31,000 levels will act as resistance.

ethereum price

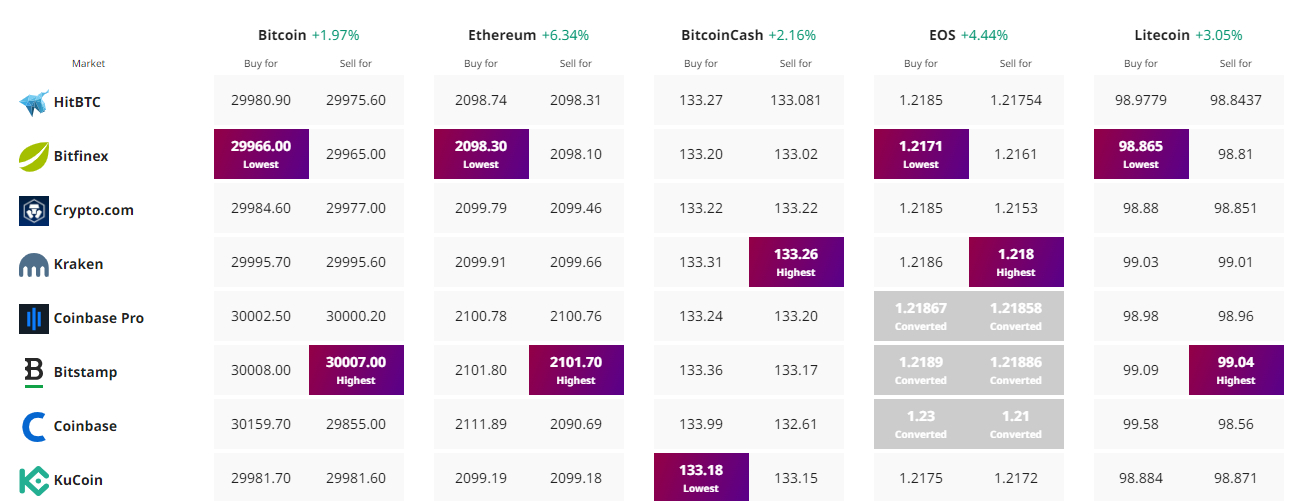

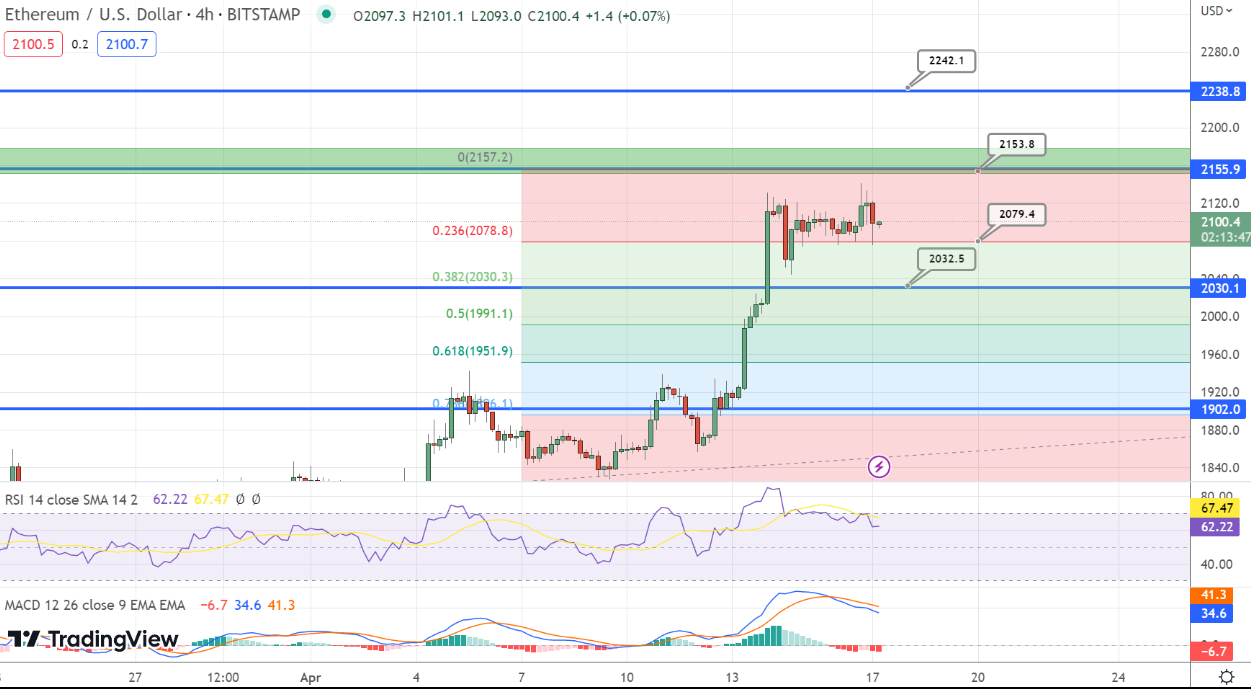

The current price of Ethereum is $2,098, with a 24-hour trading volume of $8.9B. Ethereum is up 0.10% in recent hours.

Ethereum, the second most popular cryptocurrency, is currently experiencing a significant bullish trendline after overcoming the $2,075 resistance. The cryptocurrency is now correcting higher towards the $2,150 mark.

If ETH manages to successfully close above the $2,150 level, it could trigger an uptrend that could reach as high as $2,250 or $2,300.

However, if Ethereum fails to close above the $2,160 level, the price could decline further towards $2,075 or $2,030. It is important to keep a close eye on the $2,160 level to determine whether to consider a buy or sell trade today.

Top 15 Cryptocurrencies to Watch in 2023

Stay abreast of the latest ICO projects and altcoins by frequently consulting this expert-curated list of the top 15 most promising cryptocurrencies to watch in 2023, as recommended by industry experts at Industry Talk and Cryptonews.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

Find the best price to buy/sell cryptocurrency