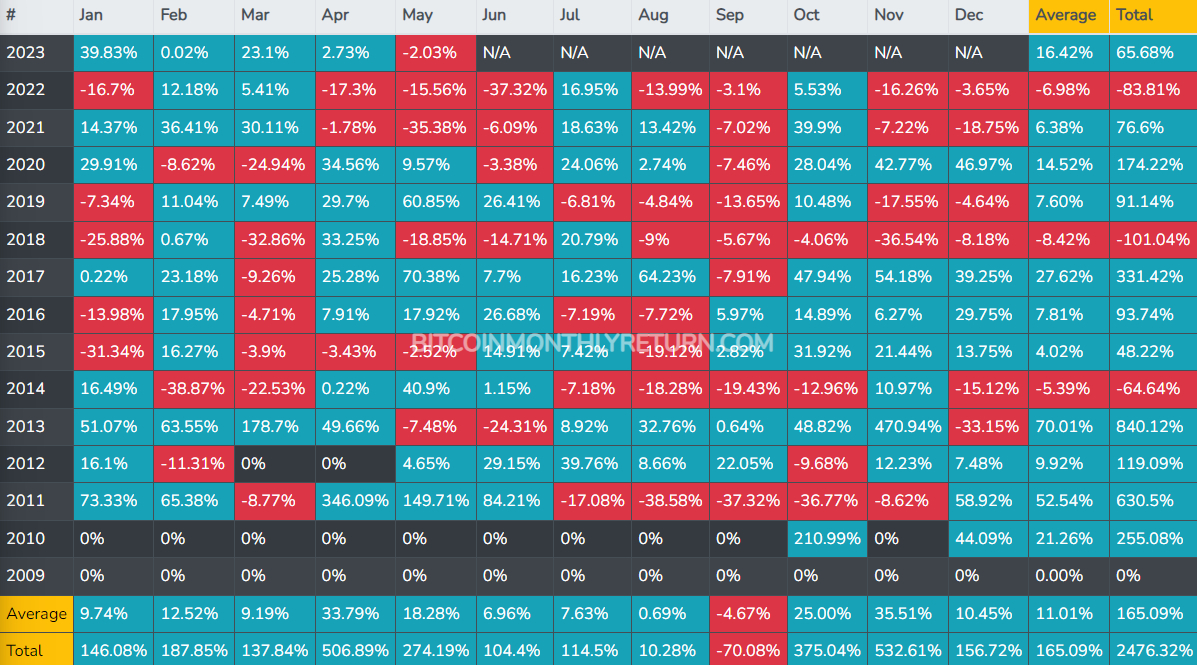

since 2011, Bitcoin (BTC) posted an average return of 18.3% in May, according to data presented by bitcoinmonthlyreturn.com.

However, two of the worst three may of bitcoin History has come in the last two years.

In May 2021, Bitcoin shed an astonishing 35.38% of its value.

In May 2022, Bitcoin Dropped a more modest, but still ugly 15.56%.

And it hasn’t been the best start to May 2023.

Bitcoin Price is already down about 2.0%, with BTC/USD at $28,600 the last time it changed hands on major exchanges.

This still leaves the cryptocurrency up nearly 73% for the year.

But traders are still worried that history may repeat itself Bitcoin Could shed a significant portion of its value between now and the end of the month.

Macro risks certainly weigh heavily Bitcoin worth.

US Federal Reserve announced its latest policy decision on Wednesday – a tenth consecutive rate hike is expected (of 25 bps, taking rates to a range of 5.0-5.25%), and Fed Chair Jerome Powell pushed back against money market expectations It is expected that the Fed will cut interest rates later this year.

For now, still-high inflation and a still-strong US labor market justify continued tightening.

There is a risk that if upcoming US jobs and inflation data are strong enough, this could push back against market expectations of a rate cut later this year, resulting in the US dollar and US yields rising, Which can affect bitcoin.

Meanwhile, US liquidity continues to slide as the Fed steps in with liquidity support for the banking sector following a surge in March, presenting another potential macro tailwind for bitcoin.

Bank crisis/US default concerns to the rescue?

While bitcoin is currently above its 50-day moving average at $28,200, suggesting that the market’s near-term bullish momentum has not yet exhausted itself, downside risks to the $26,500-$27,000 support remain acute. Has happened.

A breakdown of this support area would open the door for a possible test of the key long-term support-resistance area around $25,250-400.

But a major macro tailwind could save the day for bitcoin and potentially propel it to a new yearly high of $30,000.

This is a resurgence of fears of a US bank crisis.

failed regional bank first republic It was taken into FDIC receivership late last week and swiftly sold via auction to US banking giant JP Morgan.

The collapse of the First Republic followed the demise of three other regional American banks in March.

The KBW regional banking index fell 5.5% on Tuesday, its biggest intra-day decline since bank crisis concerns first surfaced in early/mid-March and its lowest level since late 2020.

Investors are worried that another chain of regional banks is about to collapse and that the broader US financial system is at risk.

In March, concerns of a bank crisis created safe haven demand for bitcoin as investors sought an alternative, independent and decentralized form of money.

In fact, bitcoin was up over 2.0% last Tuesday, with some Analysts cite bank related safe-haven bid,

Even if US regulators are able to avert a full-blown bank crisis, recent events have substantially increased the risk of recession through a contraction in bank lending (as banks become more cautious). go), as well as increasing pressure on the Fed not to exert fiscal pressure. Terms excessive.

This will also act as a long-term macro tailwind for bitcoin.

Another factor that could offer bitcoin price support in May is the rising risk of a US sovereign debt default.

US lawmakers are currently battling over terms for raising the US debt ceiling.

If they fail to do so before the US Treasury runs out of cash (likely by June), it could result in the US government defaulting on some of its debt obligations (as the US government can eliminate through debt issuance). To finance the loan due (of new loan).

We’ve been through this merry-go-round dozens of times before and so far, it’s always been a last-minute deal to avert a default.

But as the deadline for raising the debt limit fast approaches and the probability of default increases, we could see safe-haven flows into bitcoin.

This is because default would take a devastating blow to the credibility of the US government and its currency, the US dollar, which is currently the world’s reserve currency.

Investors looking for hard-money alternatives are likely to hoard gold (the oldest form of money) and bitcoin (which many refer to as the new digital gold).