Representatives from Coinbase, Robinhood and the Commodity Futures Trading Commission, among others, will speak to the House Agriculture Committee on the recently released draft crypto bill on digital asset regulation.

United States legislators introduced a crypto bill to provide clear regulations for cryptocurrency, its users and companies. The 162-page Bill seeks to establish regulatory jurisdiction and definitions. However, it was also acknowledged that the bill would require a comprehensive review. One of these is the House Agriculture Committee hearing on digital asset regulation today.

coinbase And the CFTC is among those testifying in Congress. The title of the event is “The Future of Digital Assets: Providing Clarity for the Digital Asset Spot Market”. The purpose of the meeting, as the title suggests, is to talk about each organization’s position on proposed crypto classifications and proposed bills that attempt to classify specific cryptos.

“I will testify before the House Committee on Agriculture tomorrow on issues related to #DigitalCommodityAssets. Watch the hearing here.” wrote Rostin Behnum, Chairman of the CFTC, on Twitter.

Paul Grewal, Chief Legal Officer at Coinbase, revealed some of his thoughts on cryptocurrency regulation and what he will be testifying about. He added that the US is missing out and ignoring crypto will see the US market continue to lag behind as other markets take advantage of the opportunities crypto provides. The regulations that should be made should be such that allow the industry to flourish and even offer solutions for international markets. He also mentioned that he would support the proposed cryptocurrency bill, which he sees as an important step towards the long-awaited regulatory solution.

Grewal shared his thoughts on his Twitter page where did it go,

“We need a clear rulebook in the US to realize the full promise of crypto. Until rules and regulations are developed that reflect the realities of this new economic system, we can’t keep our financial system from accelerating, May not realize full potential to make fair and more affordable.”

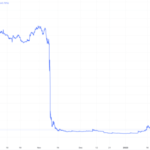

Major step towards clear crypto regulatory guidelines

The cryptocurrency market is riddled with anomalies mainly due to unclear regulations. There have been several legal disputes between regulators and cryptocurrency exchanges. three year old XRP And the SEC lawsuit, which is expected to be resolved this year, is a famous example. The lawsuit filed against Binance this week is a recent example. The SEC claimed that the crypto firm used BNB and BUSD without registering them as securities. The situation reveals a violation of Binance’s security rules and general irregularities in classifying crypto assets according to the law and their intended use.

Providing clear regulatory guidelines for the crypto industry is an important step forward. With so many people owning and using cryptocurrency, such clear guidelines will be needed to protect crypto users, guide crypto usage, and help the industry grow healthily. The move apparently falls in line with the wishes of several major cryptocurrency exchanges, which have been the target of several lawsuits due to their unclear regulatory stance.

Bitcoin Crypto Related Post