In recent days, Bitcoin has shown signs of a potential turnaround, with the cryptocurrency charting three consecutive green daily candles. The last time such a pattern was observed was in early July and between mid-to-late June, when Bitcoin rose from just under $25,000 to over $31,000. This shift in price dynamics has led to a change in market sentiment, with the bearish outlook slowly giving way to a more bullish outlook.

Although Bitcoin has currently successfully averted the confirmation of a double top on the 1-week chart, this price action has fueled discussions among analysts about the possibility of Bitcoin forming a double bottom pattern, a key technical indicator.

Bitcoin double bottom in the making?

A double bottom is a classic technical analysis pattern that signals a potential trend reversal from bearish to bullish in the markets. It is characterized by two distinct valleys or lows on the price chart, separated by a peak or small high in between. The pattern resembles the letter ‘W’, with the first low indicating a significant low, followed by a temporary recovery, and then a second low, usually near the same price level as the first. A valid double bottom is confirmed when the price breaks above the peak or resistance level between the two lows, indicating a possible uptrend reversal.

Rekt Capital, a renowned crypto analyst, recently shared his insights suggest that Bitcoin’s current price pattern on the weekly chart resembles a double top, which typically signals a bearish reversal. This pattern is characterized by an ‘M’ shape. However, to confirm this, the price would need to break away from the $26,000 support. At the time of writing, Bitcoin was trading at $26,618, successfully fending off the double top validation at this point.

On the other hand, a double bottom, forming a ‘W’ shape, would require Bitcoin to recover from the $26,000 mark, tweeting today: “Could This BTC Double Top Actually Be a Double Bottom? And the simple answer is: technically yes. […] But for BTC to form a double bottom, it would have to recover from $26,000 and rise to $30.6,000 (which is the validation point).

He further highlighted the challenges facing Bitcoin, noting the uncertainty surrounding the $26k support level and the numerous converging resistances ahead, which could hinder the completion of the double bottom formation. Rekt Capital elaborated on the significance of the $26,000 level, tweeting: “It appears BTC may be going the ‘relief rally’ route first in an attempt to potentially convert old support into new resistance. The black monthly level (~$27,200) also roughly matches the Bull Market support band.”

He also pointed out Bitcoin’s recent bearish monthly candle close for August, highlighting that Bitcoin closed below around $27,150, confirming that this was a lost support. Therefore, he warns that Bitcoin’s current price movement could only be a relief to confirm the $27,150 as new resistance before it falls into the $23,000 region.

“It is possible that BTC could rise again to ~$27,150 in September, perhaps even upside. […] $23,000 is the next major monthly support now that ~$27,150 has been lost,” he noted.

More resistance levels for BTC price

So it is clear that BTC needs to break a major resistance level at $27,150 before the bulls can even dream of confirming a double bottom pattern. But there are also other key resistances that need to be overcome before the $30,600 can be broken and the double bottom can be confirmed.

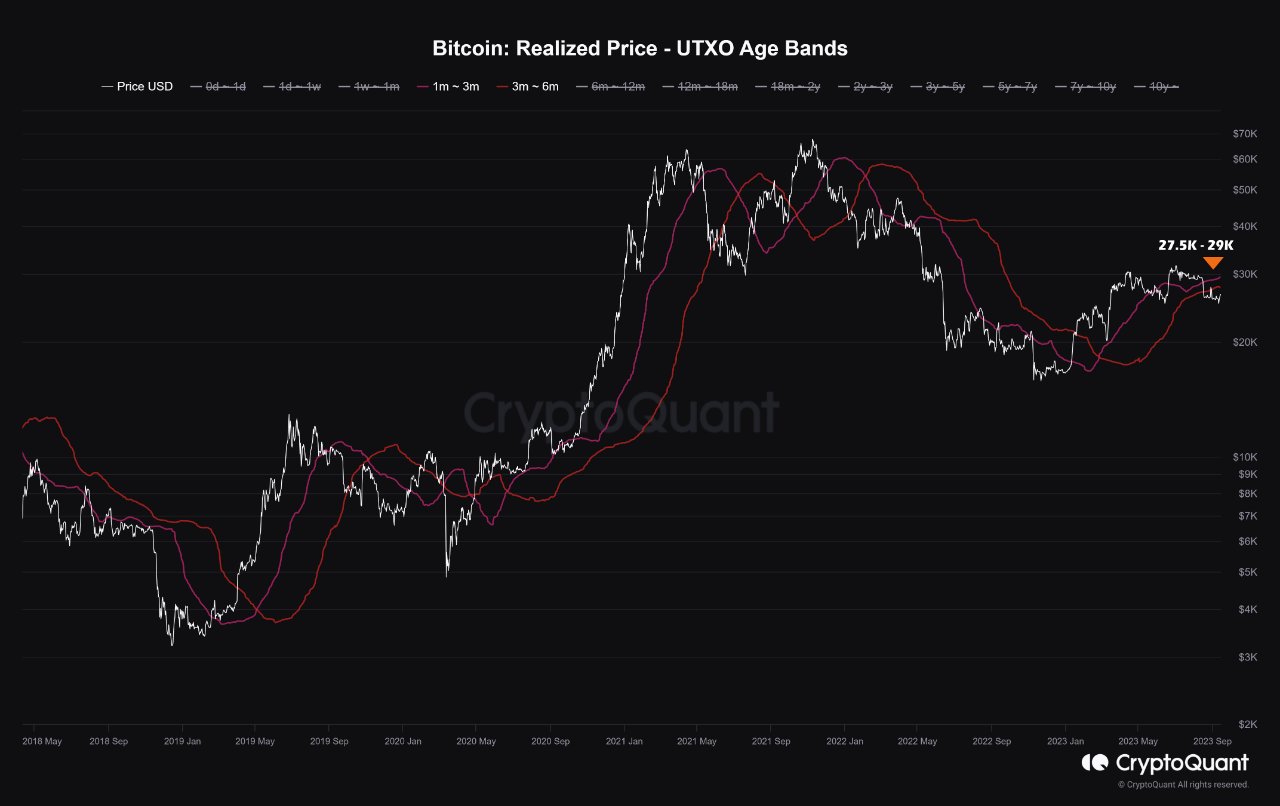

On-chain analytics company CryptoQuant emphasized the role of short-term Bitcoin holders, often providing the liquidity for significant price movements. According to their data, the breakeven price for these holders is between $27,500 and $29,000. If Bitcoin remains below these levels for an extended period of time, these holders could be incentivized to sell, potentially putting downward pressure on the price:

The more time we spend below these price levels, the more incentive there will be to exit liquidity from the market, and the basic condition for the return of Bitcoin’s uptrend depends on the price jump above the short-term realized prices.

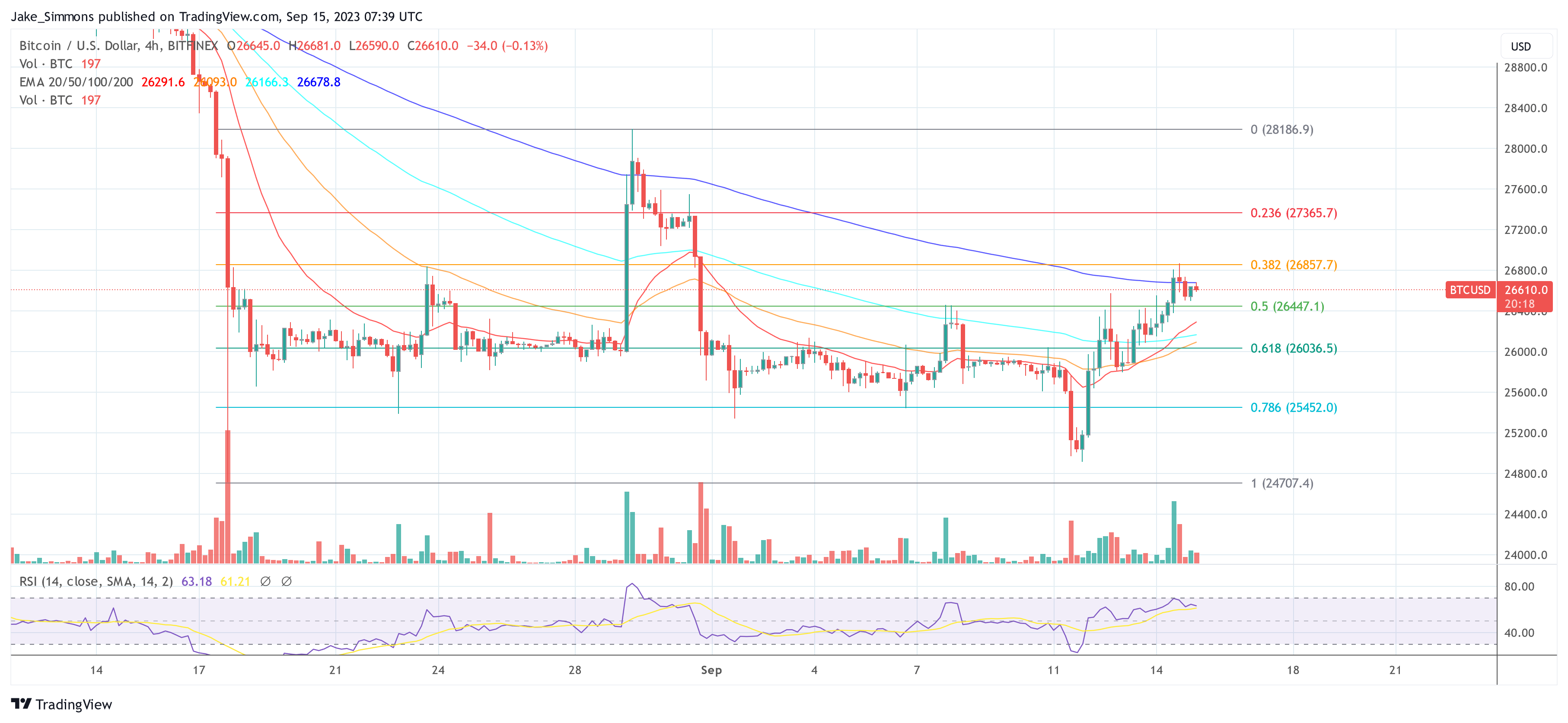

Within a four-hour time frame, BTC needs to overcome three major resistances: $26,857 (38.2% Fibonacci retracement level), $27,365 (23.6% Fibonacci retracement level), and $28,186 (post-grayscale high from August 29).

Featured image from iStock, chart from TradingView.com