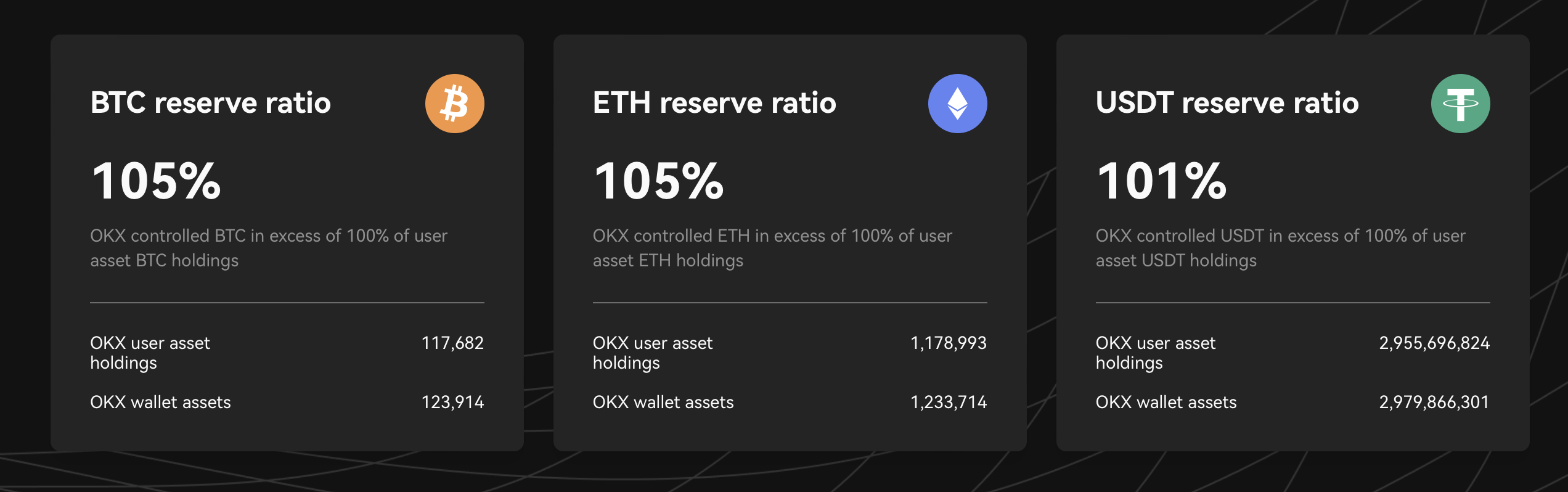

Crypto-exchange OKEx has released its third monthly Proof-of-Reserves (PoR) report, confirming that all of its reserves are in Bitcoin, Ethereum and USDT. It also means that while it has none in its native token, OKB, OKEx claims it has the largest ‘clean’ asset reserves of any major exchange, equivalent to around $7.5 billion.

In line with previous reports, the latest release from OKX may go some way to calming fears of further contagion in the cryptocurrency industry. FTX collapse in November There is a knock-on effect on other platforms. However, with DCG-owned Genesis declared bankruptcy yesterdayIt is clear that the industry has not weathered the storm yet, and it may take more than a monthly PoR certification to restore investor confidence.

OKX Publishes Third Proof of Reserves Report, Shows It Has None of Its Native Tokens as Collateral

According to OKEx’s latest PoR report, its reserves are actually over-collateralized. This means that it holds more Bitcoin, Ethereum and USDT in reserve than the amount deposited by its customers.

OKB’s lack of reserves in OKX is significant because its heavy reliance on FTT was one of the major reasons for FTX’s demise and eventual collapse. By not using OKB in its reserves, OKEx shows that it is not sensitive to a situation where the price of OKB drops dramatically, making its reserves all-but worthless.

According to the exchange, it has published more than 23,000 addresses for its Merkle tree-based PoR program, in which the OKEx PoR protocol is open source and Available to the public on Github (Additional OKX holdings can be viewed at OKX Nansen Dashboard,

For OKEx CMO Haider Rafiq, such transparency should assure customers that OKEx — the world’s sixth-largest exchange by volume (according to coingeco) — one of the more stable exchanges in the industry.

Commenting on the PoR report in a press release, he said, “Safety, transparency and trust are the core principles of the OKEx business process and customer service philosophy. We have already achieved a leadership position by publishing our PoR monthly. As As the industry standard for PoRs continues to take shape, we expect the quality of our reserve assets to be one of many key factors for OKX in the market.”

Of course, critics have pointed out that an exchange publishing its reserves is all well and good, but without similar transparency for its liabilities, there is no reliable way of knowing how secure its financial position is.

Still, in the wake of the horrific FTX collapse, proof-of-reserve is at least a positive first step in restoring confidence in the industry. This starts a community-wide conversation about how to assure traders and investors about the security of exchanges, and if trading platforms are really serious about demonstrating their stability, they will soon be able to proof-off. -Liabilities (and full balance sheet) will be considered.

okex vs binance

It is also worth noting that, even without proof of liabilities, OKX’s report contrasts favorably with one of its main rivals, Binance. back in november It emerged that Binance only had 97% of bitcoin held as customer deposits.,

That said, recent data suggests that Binance has enjoyed substantial inflows into its reserves, potentially filling any gaps in its collateralized ratio.

Nonetheless, the skepticism probably won’t end until most major exchanges become publicly traded entities, something that will oblige them to publish full quarterly financial reports.

However, public listings are probably somewhat further away, if only because the global economic downturn makes IPOs less attractive (to the extent that they will raise less money during the development period).

So for now, the industry and its investors will have to make do with proof-of-reserves reports. However, based on how OKB price reacted to the latest report, it appears that the market is not particularly convinced by the proof of reserves.

It had reached $31.03 with a slight increase of 1% in the last 24 hours. This shows a 5% gain in one week and 36% growth in one month. That said, BNB is down 1% in a day and only 14% in a month, so maybe the strong proof-of-reserve report makes a difference.

Bitcoin Crypto Related Post