The stablecoin market is expected to grow significantly amid the mainstream adoption of bitcoin and other digital assets globally.

Rise of Tether (usdt) Stablecoins have been undisputed for many years. Tether (USDT) stablecoin runs on more than 10 blockchains including Ethereum, Binance Smart Chain. polygon, and Tron, among others. On the Ethereum network, Tether (USDT) has over $36 billion in supply with approximately 4.3 million holders. The Tron network holds a large amount of Tether (USDT) with approximately $46 billion. But solana The total supply of the blockchain, Tether (USDT), is approximately $1.8 billion.

Overall, Tether (USDT) has a total supply of over $82 billion, thus being the top US dollar-backed stablecoin. Notably, Tether (USDT) has the highest daily turnover in the digital asset industry with approximately $25.57 billion compared to bitcoin at $16.5 billion.

Banking Crisis Lifts Tether (USDT)

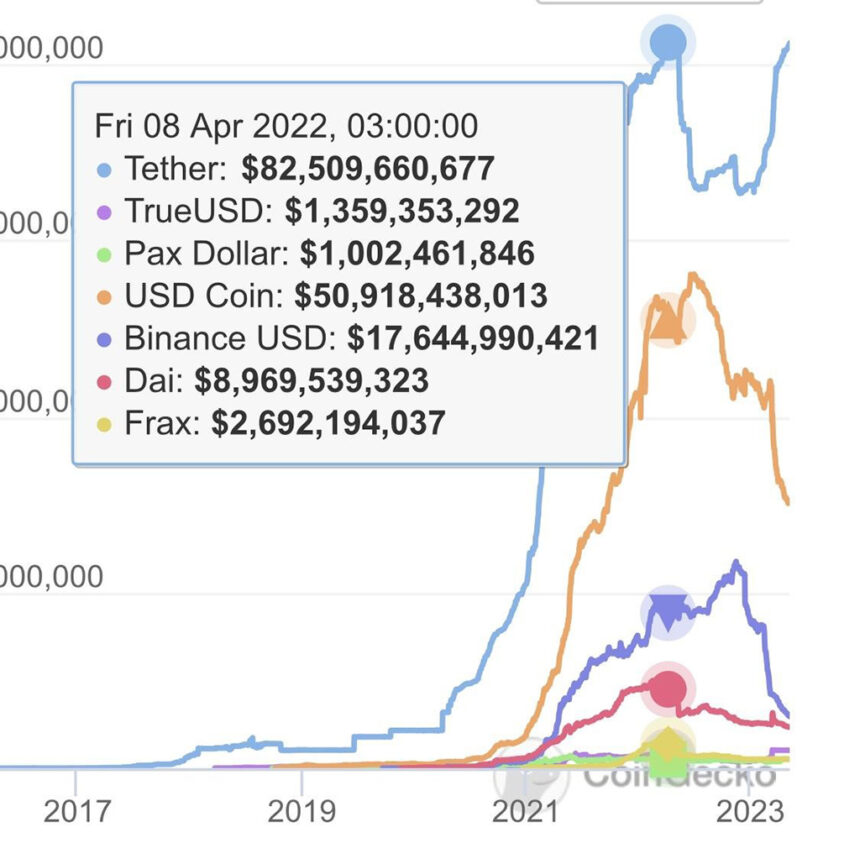

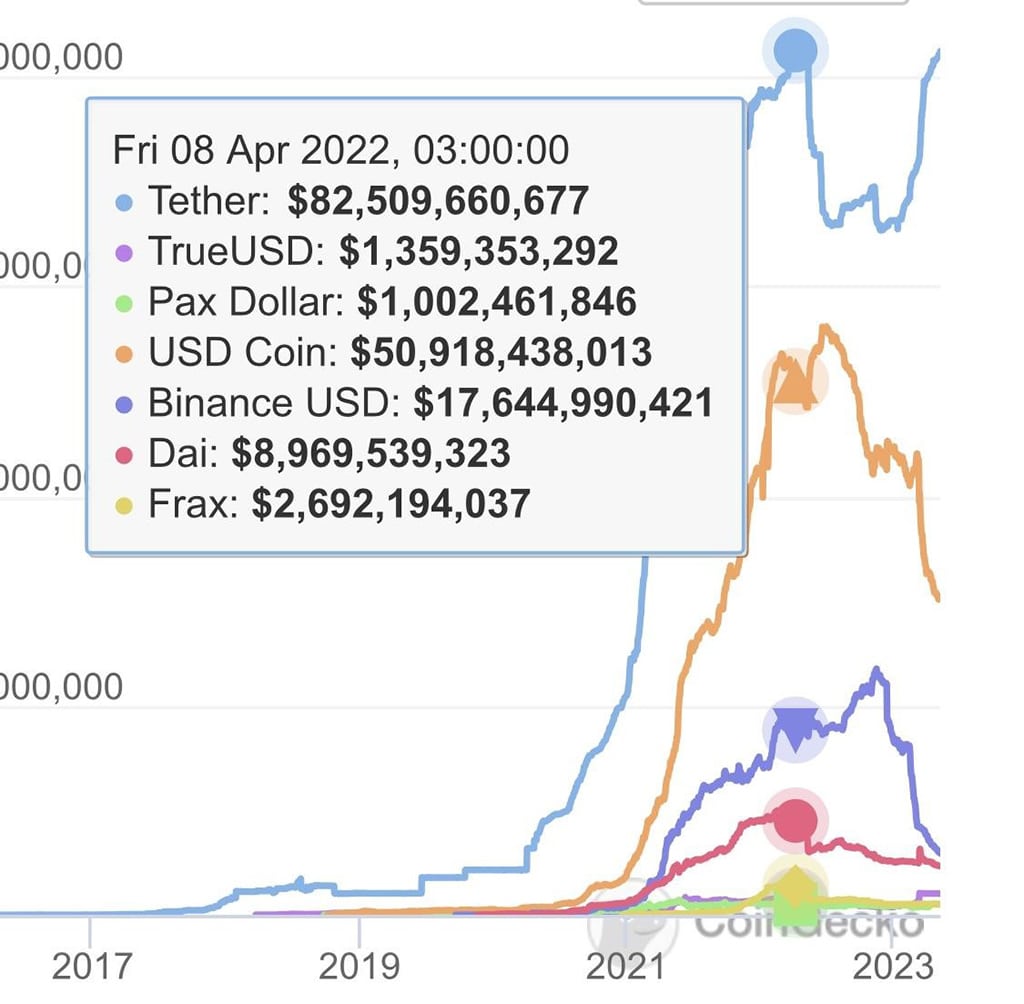

In the midst of a United States banking crisis that has seen more than three regional banks succumb to fintech and large value banks, investors are more aware of self-custody through stable coins. As per latest aggregate data from coingecoTether USDT market valuation has achieved the ATH just before last year’s crypto capitulation.

Notably, Tether USDT hit a market capitalization low of around $65 billion late last year during the FTX and Alameda Research implosions. With Circle’s de-pegging of USDC during the Silvergate Capital collapse, Tether USDT’s valuation climbed sharply.

The statement that bitcoin is a better hedge against inflation than any other market equity has led to an increase in the adoption of Tether stablecoins.

“The Banking Crisis Is Fueling ‘Hyper-Bitcoinization’ – The Inevitable Endgame That Will Cost The Dollar,” Said Anders Kwame Jensen, Oslo-based founder of AKJ Global Brokerage and Digital Asset Specialist.

king of the stablecoin market

With Tether controlling more than half, the stablecoin has a market cap of approximately $130,788,346,187. According to aggregate data from Binance-backed coinmarket capOf the top three stablecoins, only Tether (USDT) has seen its market valuation increase YTD. USDC, the second largest stablecoin by Circle, has declined since the Silvergate capital saga.

Similarly, Binance-backed BUSD has shrunk significantly as the issuer stopped issuing new coins following SEC charges.

Photo: CoinGecko

big picture

Stablecoin market expected to grow significantly amid mainstream adoption Bitcoin and other digital assets globally. Furthermore, there are more crypto-friendly markets than there were a few years ago – including the European Union, Hong Kong, the UK, El Salvador, and the UAE.

As a result, Tether (USDT) is expected to grow exponentially in the coming years. In addition, the company has launched more stablecoins in other global currencies, including the Euro.

Let’s talk crypto, metaverse, NFTs, Sedefi, and stocks, and focus on multi-chain as the future of blockchain technology. Let us all win!

Bitcoin Crypto Related Post