South Korean experts have predicted that the capitalization of the crypto market will grow from around $800 billion to around $1.5 trillion next year. And, they claim, that a “stabilisation” of inflation data “during the first half of next year” will whet investors’ appetite. bitcoin (btc) and other tokens.

The claim was made in a study titled “2023 Cryptoasset Market Prospect Report” by the research wing of South Korean crypto exchange Korbit, and reported by. Idelie,

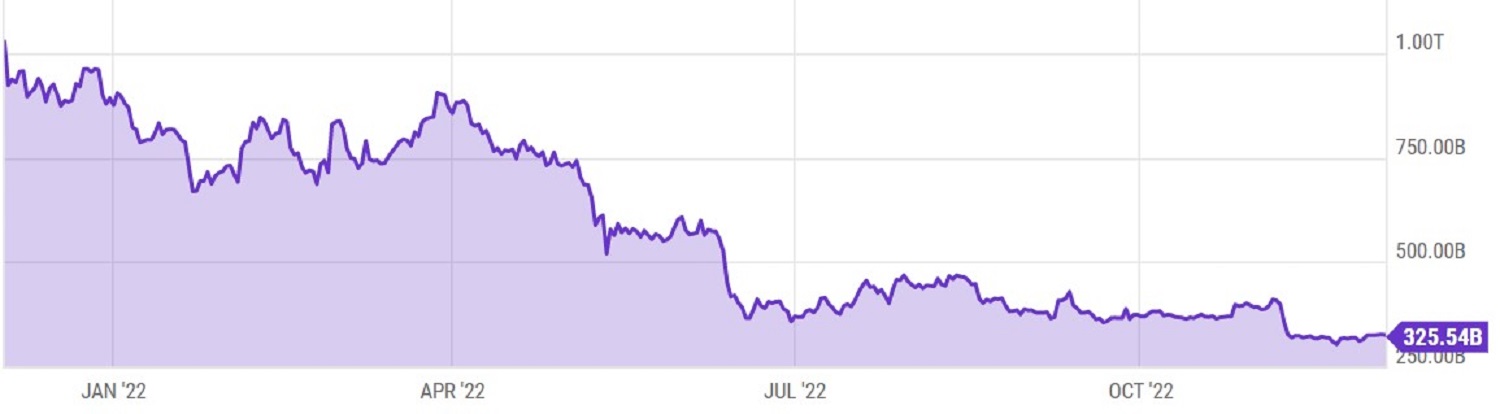

Bitcoin market cap is currently down more than 65% from a year ago, but some are optimistic of a recovery.

Korbit’s researchers claimed that central banks such as the United States Federal Reserve have “strengthened aversion to risk assets,” indicating the Fed will backtrack on policies next year to 2022 – in “demand for higher” gains. The spark of recovery”. Risky assets” such as crypto.

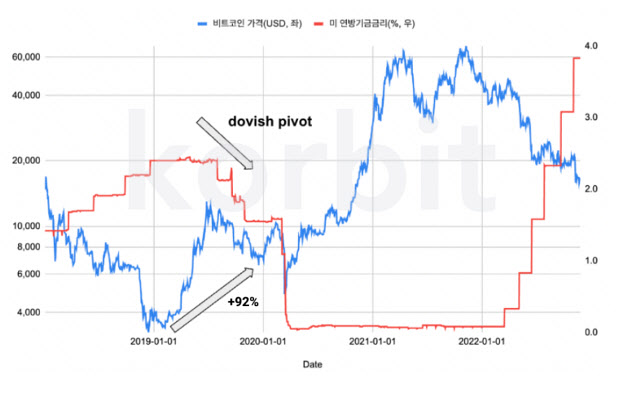

The researchers said they expect 2023 to be “similar to 2019” – a period when crypto began a gradual recovery after the snowy crypto winter of 2018.

One of the study’s lead researchers said:

“The public often thinks that the 2018 crypto crash continued in 2019. But in fact, 2019 saw a bitcoin price recovery of up to 92%.”

Fed policies in early 2019 saw the central bank stop a series of interest rate hikes, said Korbit researchers. This led to a “dowish pivot” in the bitcoin price in September of the same year. A similar event is likely to happen next year – provided the Fed actually refrains from raising interest rates.

The researchers also made the following predictions for 2023:

- Adoption will increase – and mainstream companies will not only start looking at BTC alternatives, but also Ethereum (ETH) offer to adopt

- Synergy between stablecoins, DeFi sector and traditional financial institutions will increase

- Tether (USDT), usd coin (usdc)And BUSD will “fight hard for supremacy” as stablecoins race to become “the next dollar.”

Potential “market volatility” triggering events over the next year include the following:

- New regulations introduced globally in wake of FTX collapse

- Fresh concerns over centralized exchanges again as FTX declines

- decision of legal conflict Between the US Securities and Exchange Commission and Ripple

- The Success Or Failure Of US Progressive Crypto Regulation Led By The Likes Of Wyoming Senator Cynthia Lummis

Bitcoin Crypto Related Post