Core inflation rose in August as the CPI saw prices rise across a number of points, including energy, housing and airfares.

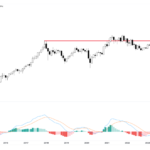

Core inflation saw its largest monthly increase of the year in August as consumer prices rose on housing, energy and many other goods. According According to the United States Department of Labor, the consumer price index (CPI) rose a seasonally adjusted 0.6%, up 3.7% from the same period last year. Economists polled by Dow Jones had predicted the CPI would rise 0.6%. However, growth was estimated at 3.6%, slightly lower than last August.

CPI is a metric that measures general changes in consumer prices based on a market basket of consumer goods and services.

In July, the CPI rose 0.2% from June, which was also 0.2% more than May. Moreover, growth in July was 3.2% from last year, compared to 3% in June.

For August, the CPI, excluding food and energy, rose 4.3% from 2022. This was less than 4.3% recorded in July. Energy prices rose 5.6% this month, with food and shelter costs rising 0.2% and 0.3%, respectively.

The report also revealed that although airfares increased by 4.9% this month, they were still 13.3% lower than last year. Transportation prices also rose 2% in August. However, the price of used vehicles declined between 1.2% and 6.6% year on year.

Housing key catalyst for rise in August core inflation

According to Lisa Sturtevant, chief economist at Bright MLS, housing costs are a major factor behind the increase in inflation. Sturtevant said that if shelter were not included in the calculations the annual CPI increase would have been only 1%:

“Housing has a very high share in inflation measures. Rent growth has slowed significantly and average rents nationally declined year-over-year in August…However, it takes months for CPI measures to show those overall rent trends, which the Fed needs to know in its Something to keep in mind when taking ‘data driven data’. ‘ approach to take a decision on interest rate policy at their meeting later this month.

In August, the Federal Open Market Committee (FOMC) of the Federal Reserve agreed to Interest rates increased by 25 basis points As it continues to deal with inflation. At the new 5.25% – 5.50% range, the midpoint is the highest since 2001. At that time, the Fed Chairman jerome powell Noted that another increase was possible as inflation was far from the 2% target.

As the US tries to rein in inflation, the UK is in the clear. JPMorgan Chase & Co. (NYSE:JPM) recently caution Potential economic (as the Bank of EnglandBOE) also fights inflation. JPMorgan said it expected interest rates to reach 5.75%, but warned that the figure could rise to 7%. As of August 1st release From the Office for National Statistics, UK CPI climbed 6.8% in the 12 months to July 2023. However, the CPI fell 7.9% in June and 11.1% from October last year.

In an interview in July, BoE Governor Andrew Bailey acknowledged the challenges posed by inflation to the BBC. He said the BoE is aware of the tough choices for the average person given rising costs, and assured that the apex bank is working on tackling inflation.

Tolu is a cryptocurrency and blockchain enthusiast based in Lagos. He likes to strip down the secrets of crypto stories to the basics so that anyone anywhere can understand without too much background knowledge. When Tolu is not deeply immersed in crypto stories, he enjoys music, loves to sing and is an avid film buff.

Subscribe to our Telegram channel.

Add

Bitcoin Crypto Related Post