As we delve into bitcoin price predictions, Consumer Price Index (CPI) Report looms large, raising questions about its potential impact on the cryptocurrency market.

This key economic indicator has historically influenced market trends, but what can we expect for bitcoin specifically in this scenario?

This bitcoin price prediction will explore the possible outcomes and how they could shape bitcoin’s price trajectory in the near future.

US core inflation in focus

Consumer Price Index (CPI) reports 5.0% The year-on-year increase in US consumer prices in March 2023, a seasonally adjusted annual rate of 301.836.

The market had predicted a higher rise of 5.2%, which would have reached the 302.254 mark, indicating that the decline is as expected.

So far, headline inflation has been declining for nine consecutive months and is currently at its lowest level since May 2021. The reduction in energy costs is the primary contributor to the drop in prices.

The US core inflation rate, which excludes volatile food and energy prices, is a primary focus for economists, policy makers and investors.

The core inflation rate is considered a better gauge of long-term price trends, and a significant deviation from expectations could potentially affect financial markets, including cryptocurrencies such as bitcoin.

How does the US CPI affect bitcoin and the cryptocurrency market?

The US core inflation rate has a significant impact on the price of bitcoin. If the inflation rate is higher than expected, it usually results in a stronger US dollar, which puts pressure on the bitcoin price.

Conversely, if the inflation rate is lower than expected, it could weaken the US dollar, which could lead to an increase in bitcoin price.

As a result, many investors and traders closely monitor the release of the CPI report as it can significantly influence their trading decisions.

bitcoin price

Bitcoin is currently trading at $27,600 with a trading volume of $13.8 billion in the last 24-hours.

It is ranked first by Coinmarketcap with a market capitalization of $536 billion.

however, bitcoin is struggling There was a break above the key resistance at $27,700, which suggests that a bearish sentiment could dominate as the bulls struggle to break above the threshold.

Nevertheless, bitcoin remained in a trading range between $27,250 and $27,700.

But wait, there’s more!

Today, US inflation data is due to be released, which could lead to a breakout from this range.

A stronger US dollar usually causes bitcoin prices to decline, while weak US CPI figures indicate a struggling US economy, which tends to drive bitcoin prices higher.

Therefore, if bitcoin can surpass the $27,700 level, it has a chance to move higher to $28,050 and possibly $28,650. However, if bitcoin sustains below $27,700, investors can consider going short bitcoin with targets at $27,450 and $27,150. Fingers crossed for some positive news!

Top 15 Cryptocurrencies to Watch in 2023

The team at Cryptonews Industry Talk has compiled a roster of the most promising cryptocurrencies for 2023, each of which has demonstrated significant potential for growth in the near and distant future.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

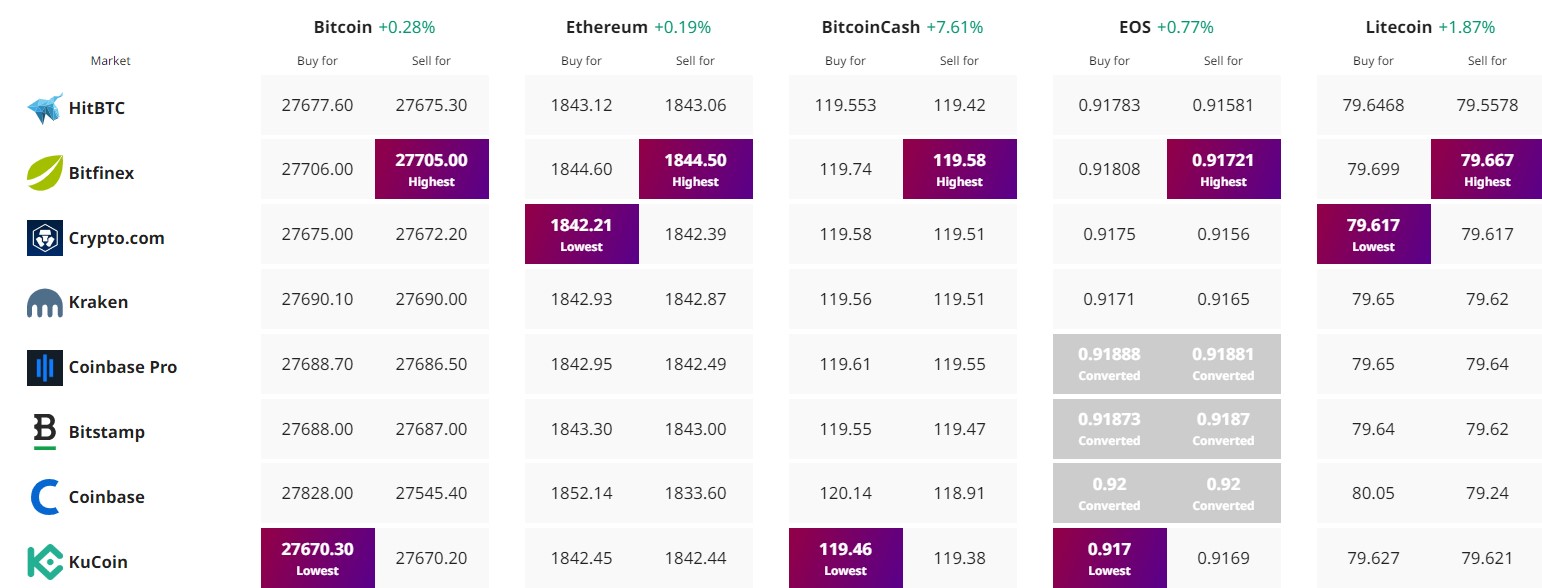

Find the best price to buy/sell cryptocurrency