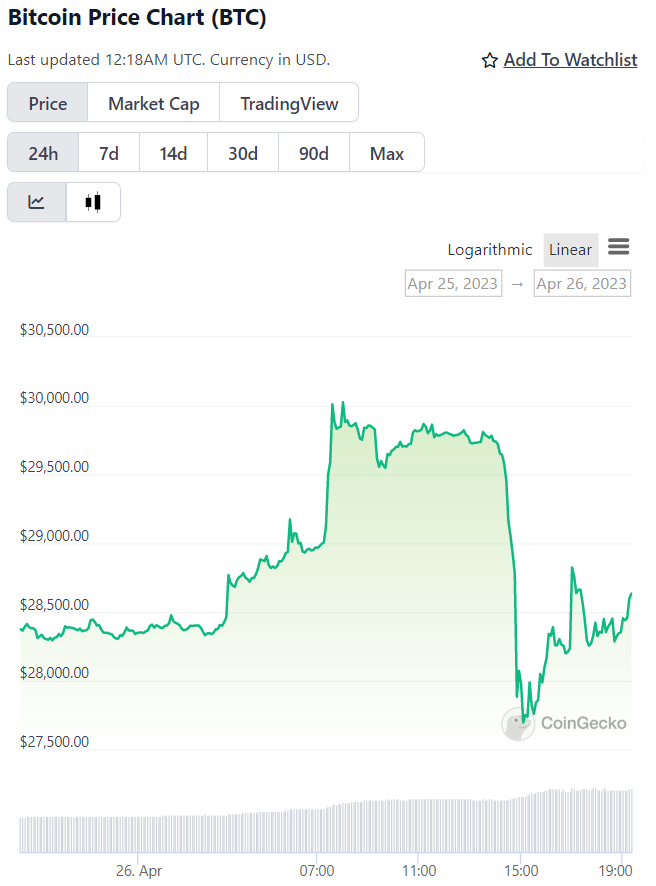

Bitcoin (BTC) price jumped wildly on Wednesday.

At one point the world’s largest cryptocurrency by market capitalization soared above $30,000 in the day’s opening session. B T c was up over 6% on the day.

At the end of the session, BTC was down 3.8% at a low of $27,200.

Bitcoin’s high-to-low swing of more than 9% is the largest (percentage) intra-day trading range since the cryptocurrency rallied nearly 10% in a single day on the 17th.th of March.

Finally, bitcoin ended the session roughly in the mid-$28,500 range, where it continues to trade as an Asia Pacific bearish.

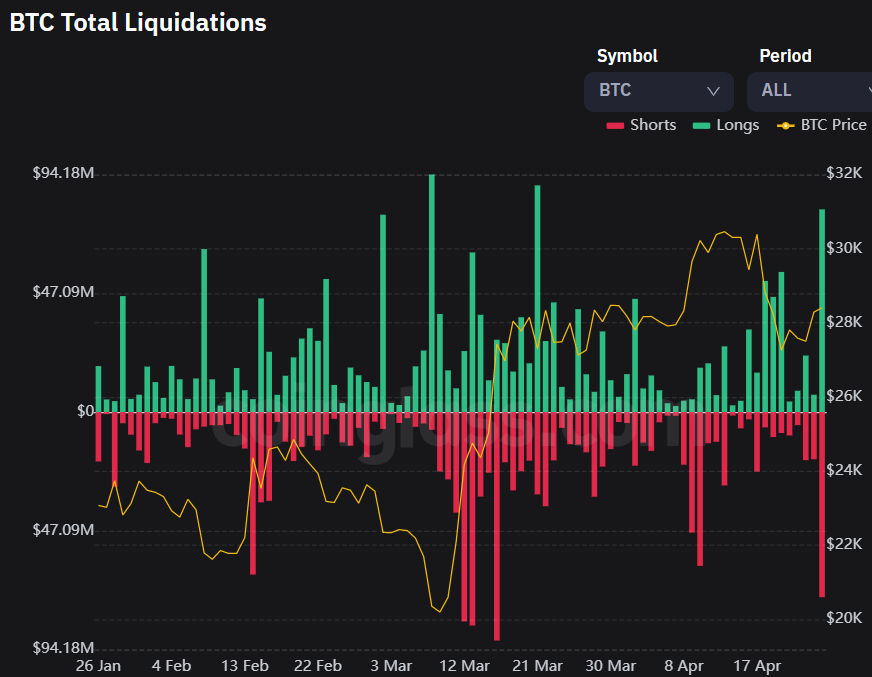

But market participants were not left untouched.

More than $150 million worth of bitcoin futures positions were liquidated (i.e. closed out or “rekt”) on Wednesday, according to crypto derivatives analytics website CoinGlass.com.

The split between liquidation of long and short positions was relatively even.

Wednesday marked the biggest day of liquidations in the bitcoin futures market for at least three months.

Short-term bitcoin bulls will take heart from the fact that the cryptocurrency once again found strong support in the form of recent lows in the low $27,000s and its 50-day moving average.

A Short-Term Buy Signals Monitored by Bloomberg fired a week ago Bitcoin Was changing hands for less than $29,000.

Historically, B T c Around 7% profit within next 10 days after this trading signal.

If history is a good guide, bitcoin price could be set for a rapid upward move towards $31,000 over the next three days.

Here are the major themes driving bitcoin right now

The prospects for a sustained recovery above $30,000 for bitcoin in the coming days and weeks are looking increasingly strong.

That’s because bank crisis fears, which powered bitcoin higher in March, are back in focus following weak US bank earnings. First Republic Unveils $100 Billion in Customer Withdrawals In the past quarter, renewed fears arose about bank solvency and the health of the broader pool of regional US banks.

As Concerns grow about the health of the US banking sectorso worry about a contraction in bank creditWhich usually leads to recession.

Thus bearish fears weighed on the US dollar and US yields on Wednesday and could continue in the near future, with traders raising their bets. Rate cut cycle from the US Federal Reserve later this year,

A combination of concerns about the bank crisis, which fueled “safe haven” demand for alternative forms of money such as Bitcoin And bets on gold, and easier financial conditions, are major macro tailwinds for bitcoin right now.

US Q1 GDP, March core PCE inflation and Q1 Employment Cost Index data coming this week will provide important insight into the current state of US growth, inflation and wage inflation – all very important considerations for the Fed.

If they remain strong enough, this should leave the Fed ready to raise interest rates again (5.0-5.25%) at its meeting next week.

But this rate hike is widely expected and the market is more focused on the upcoming rate cut cycle (when will it start, how aggressive will it be etc.).