The largest publicly traded Bitcoin miner in the US based on hash rate and mining fleet, Core Scientific (CORZ), issued a bankruptcy warning in a filing with the SEC on Oct. 26.

Shortly thereafter, the stock took a nosedive. The stock plummeted from $1.02 to $0.22. While CORZ stock traded at $10.43 at the start of the year, it is now down 97% year-to-date.

The price of Bitcoin in particular was unimpressed by the news. Like NewsBTC reported, a capitulation of Bitcoin miners is currently the biggest intra-market risk. Therefore, the question is whether the risk of a capitulation event is now over or whether Core Scientific is the harbinger of a bigger crash?

Bitcoin Miner Core Scientific on the Ropes

Documents archived with the US Securities and Exchange Commission revealing that there is a possibility of bankruptcy. The company said it will not pay its debts in late October and early November.

In addition, Core Scientific announced that holders of its common stock “could suffer a total loss of their investment.” The money could run out by the end of the year or sooner, in part because Celsius arguably owes the miner $5.4 million.

However, responsible for the Bitcoin miner’s situation, management says, “operational performance and liquidity have been severely affected by the prolonged decline in the price of bitcoin, the rise in electricity costs”, as well as “the increase in the global hash rate of the bitcoin network”.

Compass Point analysts say bankruptcy is a real possibility, according to CNBC quotes:

But without knowing how discussions with CORZ’s creditors are going, we think a scenario where CORZ needs to file for Chapter 11 protection should be taken seriously, especially if BTC prices continue to fall from current levels.

At the moment, the Bitcoin miner is considering several options to raise additional capital.

Everything clear for the Bitcoin price for now?

The SEC document gives the all-clear to the bitcoin price in that a sale of Core Scientific’s bitcoin holdings has already taken place. The company now has only 24 Bitcoins; Last month, 1,027 Bitcoins were already sold.

In this regard, Core Scientific’s treasury is no longer a concern, but rather the overall poor state of the Bitcoin mining industry. The industry is suffering from skyrocketing electricity costs and the low price of Bitcoin.

Many larger Bitcoin mining companies ordered new hardware when the price was much higher. Due to long delivery times, they received the machines much later, at a time when the hash price was already much less profitable.

Another well-known Bitcoin miner, Compute North, filed for bankruptcy in September and owes at least 200 creditors up to $500 million, such as Bitcoinist reported.

The coming months will therefore show whether a deeper shake-out is needed to flush unprofitable and overburdened miners from the market. Core Scientific had the industry’s highest debt-to-equity ratio at 3.5x.

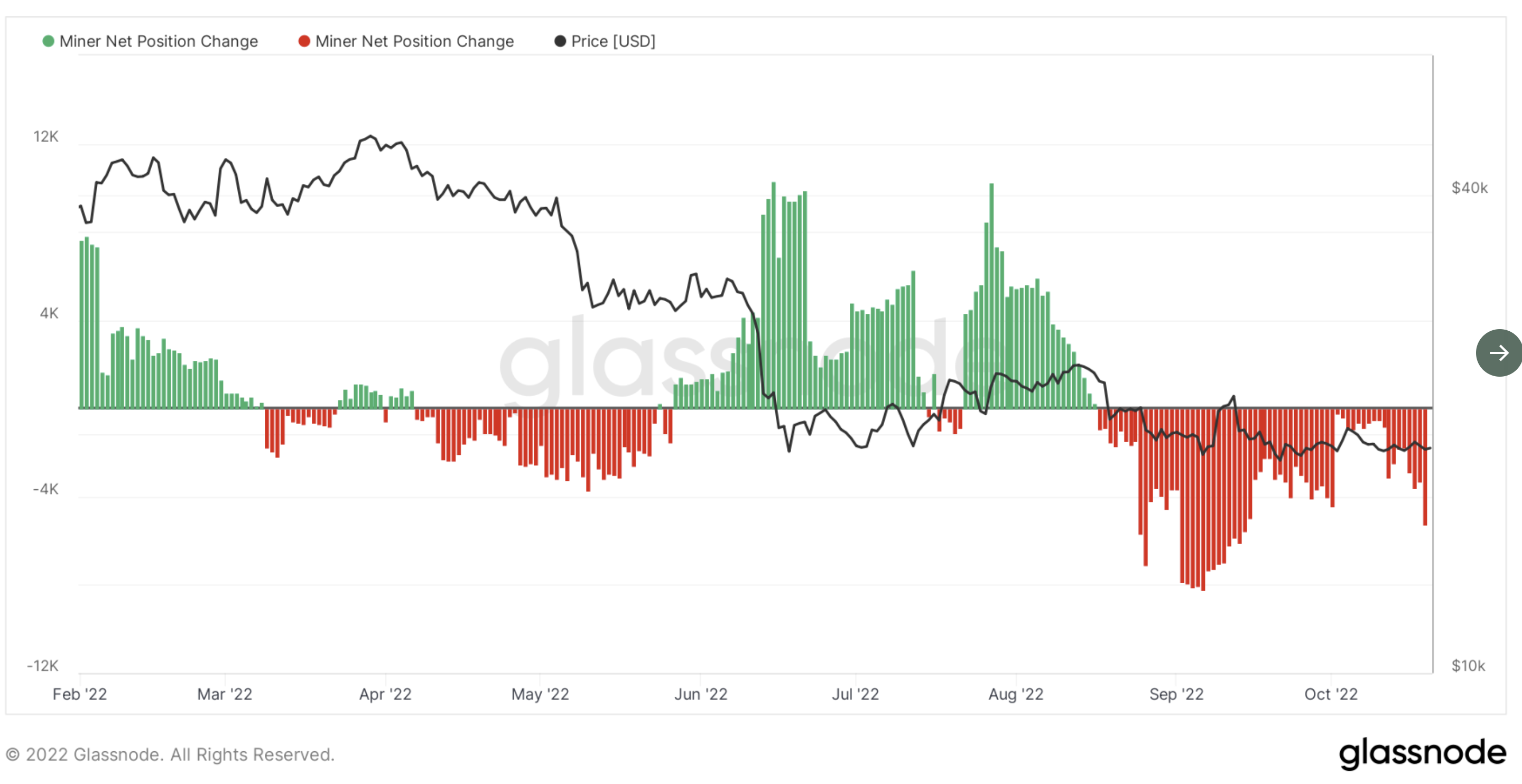

Currently, the change in the miner’s net position continues to indicate that the industry is exerting selling pressure on the market. The statistic shows that the total number of Bitcoins sold by miners was higher than the number held each day in October.

From a technical point of view, BTC appears to be “ready to hit long ground” soon. For now, the price needs to bottom out and hold the level at $19.9K.