bitcoin (btc), potentially the most popular cryptocurrency in the world, maintained its winning run and gained some significant traction towards the $28,500 mark. During this, Ethereum (ETH)The second-largest cryptocurrency extended its uptrend and reached an eight-month high of $1,900.

bitcoin (btc), potentially the most popular cryptocurrency in the world, maintained its winning run and gained some significant traction towards the $28,500 mark. During this, Ethereum (ETH)The second-largest cryptocurrency extended its uptrend and reached an eight-month high of $1,900.

However, the sustained bullish rally in the crypto market was mainly influenced by ongoing liquidity issues in the financial sector, which has the potential to impact both traditional and digital asset markets.

Investors will be keeping an eye on any volatility or volatility in this area as it could affect the rest of the financial system.

On the other end, Ethereum’s upcoming Shanghai upgradescheduled for April 12, was seen as another major factor that led to a general uptick in the crypto market.

As such, many investors have been closely analyzing Ethereum’s performance in the run-up to the upgrade, hoping it will spur growth across the entire crypto market.

Investors seem to be optimistic about the cryptocurrency market in April, as historical data suggests that the month has been fruitful for cryptocurrencies such as Bitcoin and Ethereum, with recent growth in the crypto industry and increasing popularity.

It is worth remembering that bitcoin has already gained 23% in March and is up 67% year to date. This is why, investors are excited at the prospect of new all-time highs in the coming weeks.

Bitcoin bids up despite drop in US job vacancies

Bitcoin is on the rise, experiencing a significant surge recently, even amid a larger than expected drop in US job vacancies on Tuesday. However, a recent decrease in US job openings could signal an easing of labor market conditions, which could limit gains in the bitcoin price rally.

According to the Monthly Job Openings and Labor Turnover Survey (JOLTS), US job openings declined by 632,000 to 9.9 million in February, the lowest since May 2021.

This drop in job openings follows a decrease of 1.3 million in the first two months of 2023. Economists had previously predicted 10.4 million job openings, marking a bigger-than-expected decline.

As a result, these data figures suggest a tighter labor market, potentially affecting the macroeconomic outlook and investor sentiment, particularly in cryptocurrency.

Crypto Market Rally Persists – Awaiting Nonfirm Payrolls Data

The global cryptocurrency market has maintained its bullish rally, showing a 1.09 percent increase in 24 hours, with a market cap of $1.20 trillion at the time of writing. As a result, Ethereum (ETH) crossed the $1,900 mark early Wednesday, hitting an eight-month high.

Meanwhile, BTC remained stable around the $28,000 level. Furthermore, several important cryptocurrencies posted gains across the board, including Dogecoin (DOGE), Ripple (XRP), Litecoin (LTC), and Solana (SOL).

As most cryptocurrencies performed well in March, investors are bullish about the market in April, as historical data indicates that April has generally been a good month for Bitcoin (BTC) and Ethereum (ETH).

However, ongoing liquidity issues in the financial sector could affect the digital asset markets, and investors will be closely watching for volatility or instability. This could potentially have ramifications for the wider financial ecosystem.

Bitcoin holdings by digital asset managers show resilience despite bank failures.

BTC holdings by digital asset managers, including trusts and exchange-traded products, initially fell in early March following the collapse of major banks. Subsequently, these managers added approximately 4,000 BTC to their holdings, totaling over 692,000 BTC as of April 2.

Therefore, it indicates that investor interest in cryptocurrencies is back again, as these managers are increasing their holdings despite the recent bank failures.

Thus, increased BTC holdings by digital asset managers may signal greater confidence in the cryptocurrency and affect broader market sentiment, ultimately contributing to positive price momentum for BTC.

bitcoin price

The current price of bitcoin is $28,500, with a 24-hour trading volume of $16.6 billion. Bitcoin has experienced an increase of about 2.5% in the last 24 hours. According to technical analysis, the BTC/USD pair is currently bullish. However, it might face resistance when it reaches the $28,950 level.

If bitcoin manages to break the $28,950 resistance, its price could potentially rise to $29,250 or even $30,500.

Conversely, should a bearish trend emerge, the $26,500 and $25,500 levels are expected to be an important support.

ethereum price

Currently, the current price of Ethereum is $1,909.55 with a 24-hour trading volume of $11.6 Billion. Ethereum has seen an increase of almost 6% in the last 24 hours.

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself informed about the latest ICO projects and altcoins by referring to our handpicked selection of the 15 most promising cryptocurrencies to monitor in 2023, suggested by experts from Industry Talk and Cryptonews.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

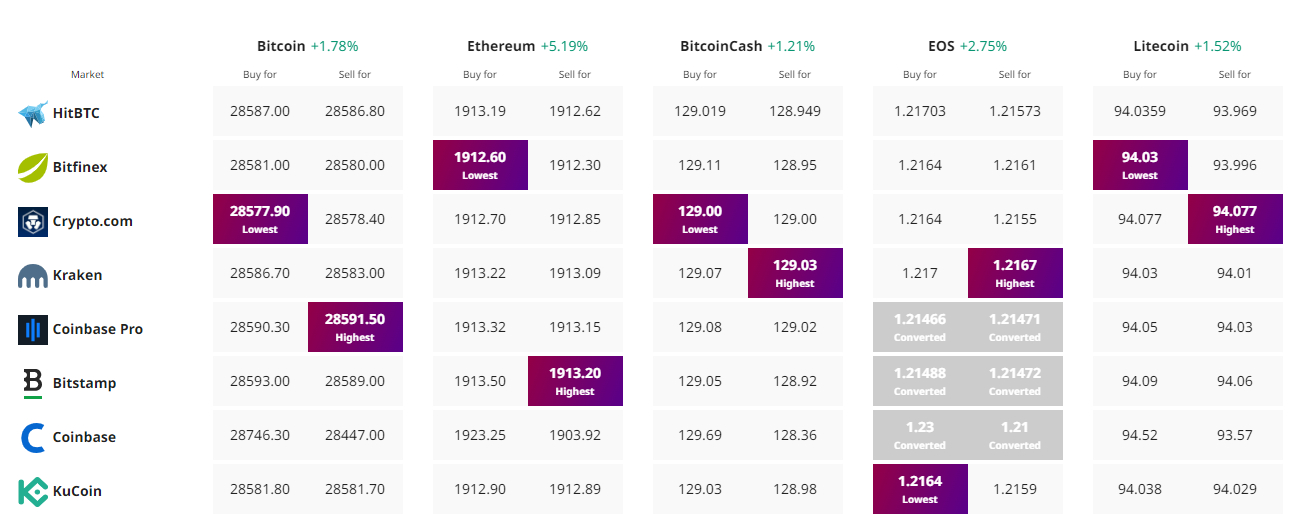

Find the best price to buy/sell cryptocurrency