As Bitcoin And as Ethereum continues to dominate the cryptocurrency market, traders and investors are closely watching its price movements. Over the weekend, both Bitcoin and Ethereum were trading within a narrow range, causing some concern among traders.

As Bitcoin And as Ethereum continues to dominate the cryptocurrency market, traders and investors are closely watching its price movements. Over the weekend, both Bitcoin and Ethereum were trading within a narrow range, causing some concern among traders.

As we head into the new week, the question on everyone’s mind is: will BTC and ETH break free of the weekend blues and see a drop in price?

In this update, we’ll take a closer look at the current state of bitcoin and EthereumAnalyze their recent price movements, and provide predictions on whether we can expect to see a breakout in the near future.

Dive Deeper: Cryptocurrency Fundamentals Outlook and Analysis

bitcoin, world largest cryptocurrencyThe week is set to end on a positive note as it climbed above the $29,000 mark on Thursday, marking its highest level since June 2021, registering gains of over 3.5%.

However, the current price of bitcoin is $28,565.21 with a 24-hour trading volume of $18,291,181,018. Bitcoin is still up 1.48% over the past 24 hours.

Meanwhile, the second largest cryptocurrency, Ethereum, gained significant traction and traded around $1,830 with an intraday high of $1,846. That’s up nearly 10% in March and has risen 52.8% year-to-date.

However, the current price of Ethereum is $1,824, with a 24-hour trading volume of $8.7 billion. Ethereum is up about 1.50% in the past few hours.

However, the reason for their strong upward rally may be linked to renewed interest in high-risk assets and expectations for the future federal Reserve Ending its rate-hike cycle.

Furthermore, the recent financial crisis and regulatory developments have boosted bitcoin (BTC) by increasing interest and investment in the cryptocurrency, contributing to its recent price increase. on the downside, Regulators Continue to Crack Down on Cryptocurrencies and exchanges, which have hindered the development of bitcoin.

Significantly, the The Commodity Futures Trading Commission recently sued Binance, the world’s largest crypto exchange, and its CEO Changpeng “CZ” Zhao for violating trading and derivatives laws. As a result, this has slowed down further growth in the price of bitcoin.

US Government Planning to Sell Confiscated Bitcoin: Potential Impact on BTC Price

The United States is about to sell more than 41,000 bitcoins seized during the Silk Road case against Ross Ulbricht. This information was revealed in a court filing in the United States, which also stated that the authorities had previously sold approximately 9,861 BTC for more than $215 million. This leaves approximately 41,491 bitcoins to be sold in four more batches this year.

Although the news of such a large influx of bitcoin into the market may have piqued investor interest, its impact on the price of bitcoin remains uncertain. Typically, a significant sell-off is followed by a minor price drop in the market, although this is usually followed by a rapid recovery.

US Inflation and Consumer Sentiment Reports Show Mixed Results, Leaving Bitcoin Price Unfazed

US inflation data released by the Commerce Department reflect that core PCE climbed 4.6% annuallyWhich is lower than expected and lower than last month’s level.

While headline inflation was 5%, this means that the Fed’s tightening actions do affect inflation.

Susan Collins, President of the Federal Reserve Bank of Boston, praised the news But stressed that more work needed to be done. In addition, the University of Michigan’s Consumer Sentiment Index for March came in below estimates, with inflation forecasts for the one-year and five-year periods falling.

These developments imply that the Fed will continue with its tightening efforts, which could affect the price of bitcoin.

According to New York Fed President John Williams, inflation will drop to 3.5%, and GDP will decline somewhat before rebounding in 2024.

bitcoin price

on saturday BTC/USD The pair is trading in a neutral range, maintaining a narrow window between $27,600 and $28,900. It looks like investors are still looking for a solid fundamental reason to exit this particular trading range.

On the upside, a break above the $28,900 triple-top pattern could propel BTC towards the next immediate resistance at $29,600. On the downside, an immediate support for BTC remains at the $27,600 mark.

Key technical indicators such as RSI and MACD are trading above and below the intermediate levels (50 and 0, respectively), indicating a neutral trading bias among investors.

Therefore, a breakout of $27,600 to $28,900 in this trading range will determine further price action.

ethereum price

Similar to bitcoin Ethereum It is currently struggling to overcome the $1,840 resistance and is continuously trading near the $1,700 support.

In the event that the ETH/USD pair successfully overcomes the $1,800 range, it is predicted to face resistance at the $1,900 level.

It is estimated that the support level for the ETH/USD pair will lie at $1,700 or $1,620.

Top 15 Cryptocurrencies to Watch in 2023

Stay up to date with the latest ICO projects and altcoins by regularly checking this carefully selected list of the 15 most promising cryptocurrencies to keep an eye on in 2023.

This list has been compiled by experts from Industry Talk and Cryptonews, so you can be sure that it includes only the best and most promising cryptocurrencies in the market.

Disclaimer: The Industry Talks section features insights by crypto industry players and is not part of the editorial content of 0x0news.com.

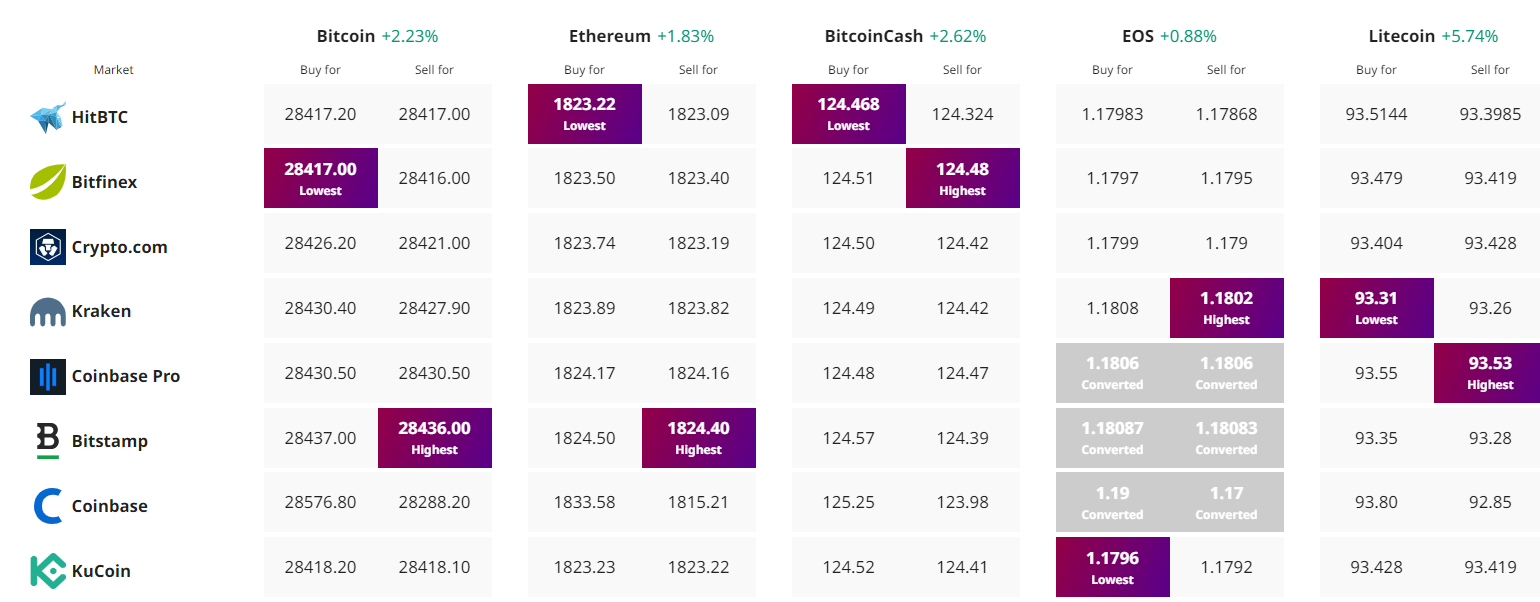

Find the best price to buy/sell cryptocurrency